Saba Capital Management, L.P. Increases Stake in Nuveen Real Asset Income and Growth Fund

On August 10, 2023, Saba Capital Management, L.P., a New York-based investment firm, added 756,874 shares of Nuveen Real Asset Income and Growth Fund (NYSE:JRI) to its portfolio. This article provides an in-depth analysis of this transaction, the profiles of the involved parties, and the potential implications for value investors.

Details of the Transaction

The transaction took place on August 10, 2023, with Saba Capital Management acquiring the shares at a price of $11.39 each. This addition increased the firm's total holdings in JRI to 1,396,535 shares, representing 0.3% of its portfolio and 5.09% of JRI's total shares. The transaction had a 0.16% impact on Saba Capital Management's portfolio.

Profile of Saba Capital Management, L.P.

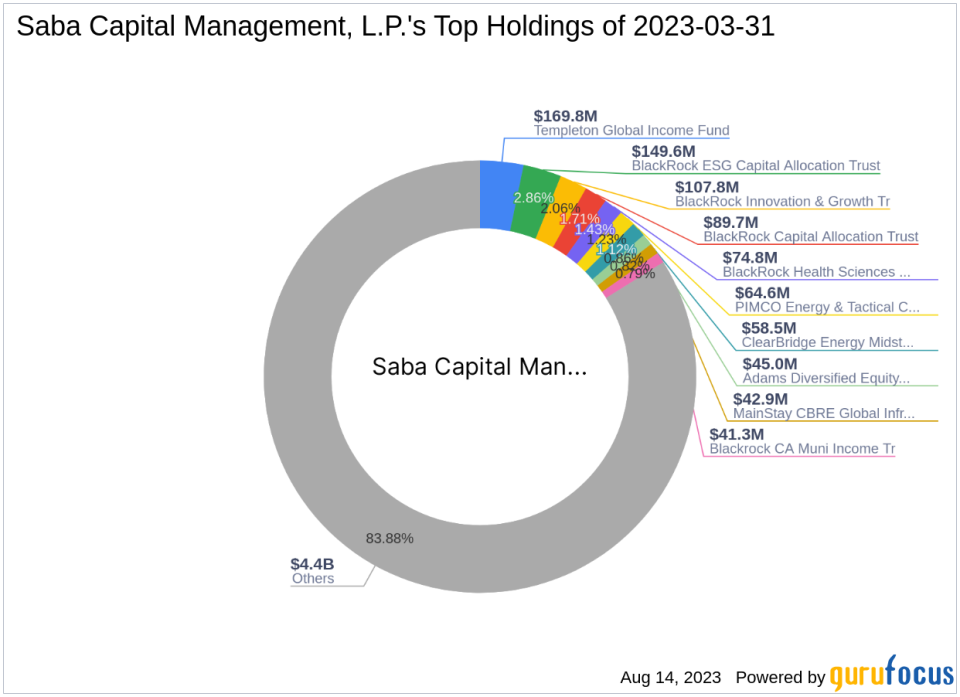

Saba Capital Management, L.P. is an investment firm located at 405 Lexington Avenue, New York. The firm manages a portfolio of 762 stocks, with a total equity of $5.24 billion. Its top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm primarily invests in the Financial Services and Technology sectors.

Overview of Nuveen Real Asset Income and Growth Fund

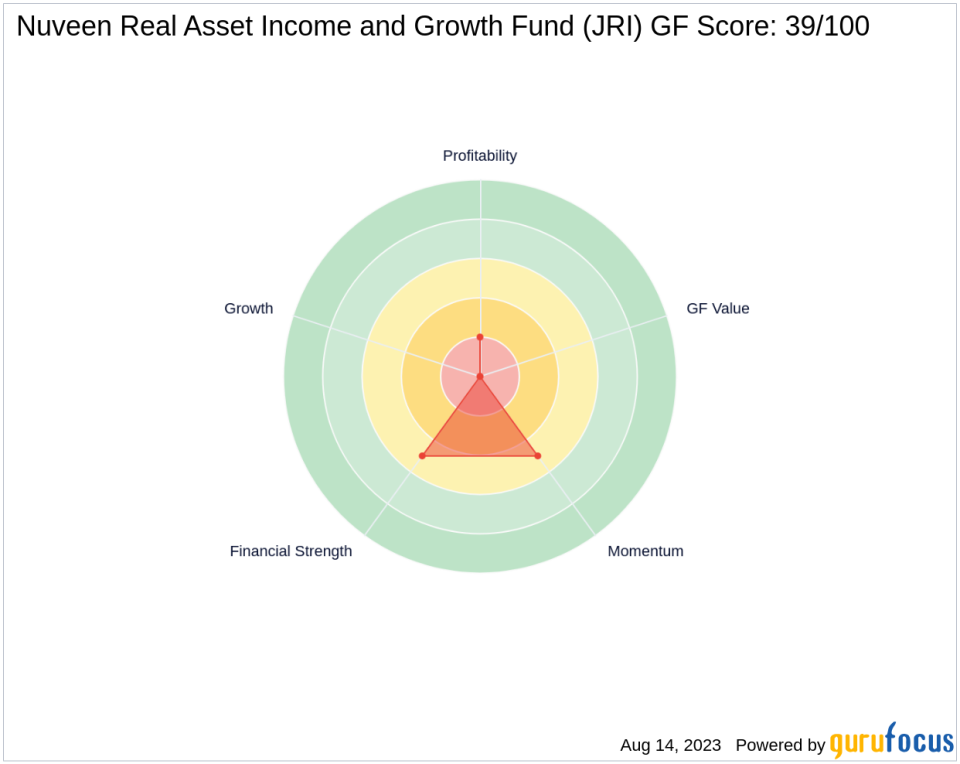

Nuveen Real Asset Income and Growth Fund (NYSE:JRI) is a US-based closed-end fund. The fund aims to provide a high level of current income and long-term capital appreciation by investing in equity and debt securities issued by real asset-related companies worldwide. As of August 14, 2023, the company has a market capitalization of $309.678 million and a stock price of $11.28. The company's GF Score is 39/100, indicating poor future performance potential.

Analysis of the Stock's Performance

Since the transaction, JRI's stock price has decreased by 0.97%. The stock has also experienced a year-to-date price change ratio of -4.81% and a price change ratio of -36.34% since its Initial Public Offering (IPO). These figures suggest a downward trend in the stock's performance.

Evaluation of the Stock's Financial Health

JRI's financial health is evaluated based on several metrics. The company's Financial Strength is ranked 5/10, its Profitability Rank is 2/10, and its Growth Rank is 0/10. The company's Piotroski F-Score is 4, indicating a poor financial situation. Its Altman Z score and cash to debt ratio are not applicable due to insufficient data.

The Stock's Industry Performance

JRI operates in the Asset Management industry. Its Return on Equity (ROE) and Return on Assets (ROA) ranks within the industry are 1398 and 1365, respectively. These ranks, coupled with a negative ROE of -17.65% and a negative ROA of -12.01%, suggest that JRI's performance is lagging within its industry.

Conclusion

In conclusion, Saba Capital Management's recent acquisition of JRI shares represents a significant addition to its portfolio. However, given JRI's poor financial health and performance metrics, the transaction's potential implications for value investors remain uncertain. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.