Sage Therapeutics (SAGE) Depression Drug Meets Goal, Stock Down

Sage Therapeutics SAGE along with partner Biogen BIIB announced that a phase III study on their experimental drug zuranolone in adult patients with major depressive disorder (MDD) met its primary and key secondary endpoints.

The CORAL study (n=440) compared zuranolone 50 mg co-initiated with standard-of-care antidepressant versus standard of care antidepressant co-initiated with placebo.

The study met its primary endpoint as zuranolone 50 mg co-initiated with standard of care antidepressant demonstrated a rapid and statistically significant reduction in depressive symptoms at Day 3 compared to standard of care antidepressant co-initiated with placebo, as assessed by the 17-item Hamilton Rating Scale for Depression (HAMD-17) total score.

The study also demonstrated that zuranolone 50 mg co-initiated with standard-of-care antidepressant led to a statistically significant improvement in depressive symptoms over the 2-week treatment period compared to standard-of-care antidepressant co-initiated with placebo, thereby meeting the study’s key secondary endpoint.

The data from the CORAL study shows that adding zuranolone to conventional antidepressant medicines may offer more rapid relief from depressive symptoms than the current standard of care.

For other secondary endpoints, a statistically significant reduction in HAMD-17 score was observed in the zuranolone co-initiated with the standard-of-care antidepressant arm compared to standard-of-care antidepressant co-initiated with placebo arm at Days 8 and 12.

However, numerical superiority was observed at Day 15 while no statistical difference was observed at Day 42.

Sage Therapeutics’ stock plunged 17.5% after the CORAL study data were announced on continued investor skepticism that zuranolone might not be as effective over the long term, raising questions about whether it can be approved. The stock has declined 15.6% in the year so far compared with the industry’s 10.9% decline.

Image Source: Zacks Investment Research

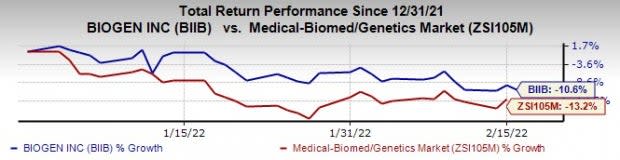

Biogen’s stock declined 1.3% on Wednesday. Biogen’s stock has declined 10.6% in the year so far compared with the industry’s 13.2% fall.

Image Source: Zacks Investment Research

Zuranolone has been evaluated in six late-stage studies. Data from these studies have shown that an improvement in depressive symptoms is observed as early as day 3. In addition, data from all these studies have shown that zuranolone has consistent safety and tolerability profile with no observed evidence of weight gain, sexual dysfunction, euphoria or increased suicidal ideation.

Sage Therapeutics and Biogen plan to begin a rolling submission for a new drug application for zuranolone in MDD in early 2022 with the filing expected to be completed in the second half of the year.

Biogen and Sage Therapeutics signed a joint development/commercialization agreement for zuranolone in 2020. Apart from MDD, zuranolone is being evaluated in the NEST clinical program for treating postpartum depression (PPD).

Zacks Rank and Stocks to Consider

Both Sage Therapeutics and Biogen have a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked drug/biotech stocks are GlaxoSmithKline GSK.and Vertex Pharmaceuticals Incorporated VRTX, both with a Zacks Rank of 2 (Buy).

Vertex Pharmaceuticals’ stock has risen 12.4% in the past year. Estimates for Vertex Pharmaceuticals’ 2022 earnings have gone up from $13.32 to $14.33 per share while those for 2023 have increased from $13.85 to $15.31 per share over the past 60 days.

Vertex Pharmaceuticals’ earnings performance has been strong with the company beating earnings expectations in each of the last four quarters. Vertex Pharmaceuticals has a four-quarter earnings surprise of 10.01%, on average.

Glaxo’s stock has risen 29.9% in the past year. Estimates for Glaxo’s 2022 earnings have gone up from $3.25 to $3.30 over the past 60 days.

Glaxo’s earnings performance has been rather strong with the company beating earnings expectations in three of the last four quarters while meeting estimates in one. Glaxo has a four-quarter earnings surprise of 20.52%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research