Sage Therapeutics (SAGE) Plunges 46% in a Month: Here's Why

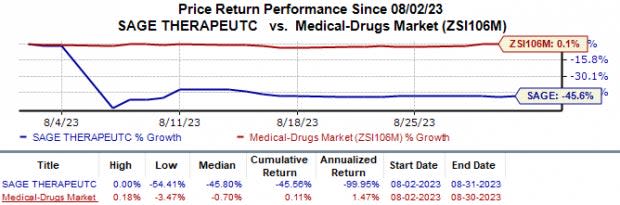

Since the past month, Sage Therapeutics’ SAGE shares have lost 45.6% against the industry’s 0.1% growth.

Image Source: Zacks Investment Research

This downside is mainly attributed to the FDA’s recent decision on the company’s new drug application (“NDA”) for zuranolone in postpartum depression (“PPD”) and major depressive disorder (“MDD”) indications. While the agency approved the drug for treating PPD, it issued a complete response letter (“CRL”) in the MDD indication.

Per the CRL, the FDA stated that the NDA filing did not provide substantial evidence of effectiveness to support the approval of zuranolone. Hence, an additional study or studies will be needed.

Following the approval in PPD, zuranolone is the first and only oral, once-daily, 14-day treatment that can rapidly improve depressive symptoms in women with PPD. The drug, expected to be launched in fourth-quarter 2023, will be marketed under the trade name Zurzuvae.

Though the approval in PPD was positive, MDD is a much larger and more lucrative market opportunity. In addition, the FDA approval for PPD also comes with a back box warning – advising patients not to drive or operate heavy machinery for at least 12 hours after taking Zurzuvae. This is further likely to dampen the drug’s sales prospects. Investors were disappointed with these setbacks, leading to this share price crash.

Sage Therapeutics developed Zurzuvae in collaboration with Biogen BIIB. Currently, Sage and Biogen are evaluating the further course of action.

Following the above setbacks and to support Zurzuvae’s commercial launch, Sage Therapeutics recently announced its decision to implement a strategic reorganization plan. Based on this plan, the company will reduce its workforce by around 40% and focus on the pipeline development of Sage’s lead neuropsychiatric drug candidate, SAGE-718, and lead neurology program, SAGE-324. Like Zurzuvae, SAGE-324 is also being developed in collaboration with Biogen.

The restructuring plan is designed to help SAGE save around $240 million a year, allowing it to extend its cash runway into 2026.

PPD is a major depressive episode following childbirth, although symptoms can start during pregnancy. Prior to Zurzuvae's approval, the only approved medication for PPD patients was Zulresso, also marketed by Sage Therapeutics. Zulresso was also the first FDA-approved treatment specifically for PPD.

Unlike Zurzuvae, which is an oral drug, Zulresso is administered intravenously. Hence, Zurzuvae is likely to carry an edge in sales over Zulresso. Also, the sales performance of Zulresso has been relatively lackluster due to the time taken for intravenous administration. Since the only FDA-approved treatment specifically for PPD is an approved intravenous drug, patients often use anti-depressant drugs, which can take weeks to be effective and also carry several side effects.

The approval of Zurzuvae, which can be administered orally and requires a 14-day treatment course, will likely help Sage Therapeutics acquire a more significant market share in the PPD patient population than it ever did with Zulresso.

Sage Therapeutics, Inc. Price

Sage Therapeutics, Inc. price | Sage Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Sage Therapeutics currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP and Annovis Bio ANVS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for ANI Pharmaceuticals’ 2023 earnings per share have risen from $3.39 to $3.73. During the same period, the earnings estimates per share for 2024 have improved from $4.12 to $4.35. Year to date, shares of ANIP have surged 60.1%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, witnessing an earnings surprise of 91.56% on average. In the last reported quarter, ANI Pharmaceuticals’ earnings beat estimates by 100.00%.

In the past 30 days, estimates for Annovis Bio’s 2023 loss per share have narrowed from $4.89 to $4.38. During the same period, the loss estimates per share for 2024 have improved from $3.18 to $2.77. Year to date, shares of ANVS have lost 7.7%.

Earnings of Annovis Bio beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 13.40% on average. In the last reported quarter, Annovis’ earnings beat estimates by 6.14%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report