Sage's (SAGE) Huntington's Disease Drug Gets FDA's Orphan Tag

Sage Therapeutics SAGE announced that the FDA has granted orphan drug designation to its lead neuropsychiatric candidate, SAGE-718, for treating Huntington’s disease (“HD”), a rare neurodegenerative disease.

An orphan drug designation is granted by the FDA to the candidates developed to treat, diagnose or prevent a rare disease or condition. This FDA designation makes the sponsor eligible for seven years of market exclusivity, following the potential approval and tax credit for qualified clinical studies.

An inherited disorder, HD causes nerve cells (neurons) in brain parts to gradually break down and die. Cognitive impairment is one of the most under-recognized aspects of HD.An estimated one in 40,000 people across the United States is affected by this disorder each year.

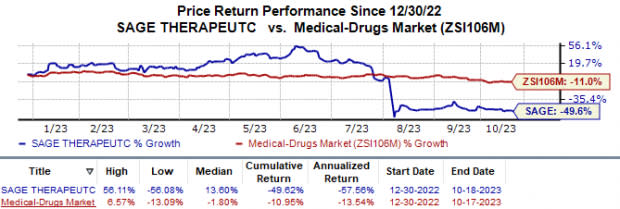

In the year so far, shares of Sage have plunged 49.6% compared to the industry’s 11.0% fall.

Image Source: Zacks Investment Research

Currently, no treatment options are available to improve HD's cognitive effects. An investigational oral therapy, SAGE-718, is being developed for cognitive disorders associated with NMDA receptor dysfunction. The candidate has already been granted fast-track designation by the FDA and orphan drug designation by the EMA as a potential treatment for HD.

SAGE-718 is being evaluated as a potential treatment for patients with HD-related cognition dysfunction across three ongoing clinical studies – two phase II studies (DIMENSION and SURVEYOR) and a phase III study (PURVIEW). The candidate is also being evaluated in separate mid-stage studies for treating cognitive issues associated with Parkinson’s and Alzheimer’s diseases.

The above news comes a couple of months after the FDA decided on zuranolone in postpartum depression (“PPD”) and major depressive disorder (“MDD”) indications. While the agency approved the drug for treating PPD, it issued a complete response letter (“CRL”) in the MDD indication. The drug will be marketed in PPD indication under the trade name Zurzuvae.

Per the CRL, the FDA stated that the NDA filing did not provide substantial evidence of effectiveness to support the approval of zuranolone. Hence, an additional study or studies will be needed.

Sage Therapeutics has developed Zurzuvae in collaboration with Biogen BIIB. Currently, Sage and Biogen are evaluating the further course of action.

Following the above setbacks and to support Zurzuvae’s commercial launch, Sage Therapeutics implemented a strategic reorganization plan. Based on this plan, the company will reduce its workforce by around 40%, focus on the pipeline development of SAGE-718 and lead the neurology program, SAGE-324. Like Zurzuvae, SAGE-324 is also being developed in collaboration with Biogen.

The restructuring plan is designed to help Sage Therapeutics save around $240 million a year, allowing it to extend its cash runway into 2026.

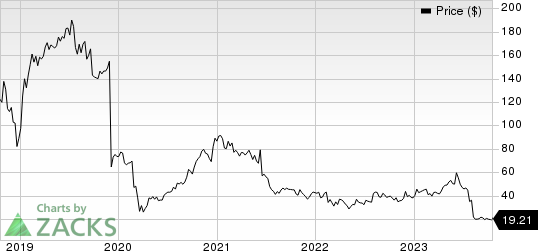

Sage Therapeutics, Inc. Price

Sage Therapeutics, Inc. price | Sage Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Sage currently carries a Zacks Rank #3 (Hold).A couple of better-ranked stocks include Deciphera Pharmaceuticals DCPH and Jazz Pharmaceuticals JAZZ, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Deciphera Pharmaceuticals’ 2023 loss per share have narrowed from $2.38 to $2.36. Year to date, Deciphera’s stock has plunged 35.5%.

Deciphera’s earnings surpassed estimates in two of the last four quarters, met the mark on one occasion and missed on another. The company witnessed an earnings surprise of 1.58% on average. In the last reported quarter, Deciphera’s earnings beat estimates by 8.06%.

In the past 60 days, estimates for Jazz Pharmaceuticals’ 2023 and 2024 earnings per share have increased from $18.49 to $18.64 and $20.31 to $20.59, respectively. Year to date, JAZZ’s stock has dipped 16.7%.

Jazz Pharmaceuticals’ earnings outpaced estimates in two of the trailing four quarters while missing the mark on the other two occasions, witnessing a negative surprise of 27.59%, on average. In the last reported quarter, Jazz Pharmaceuticals’ earnings beat estimates by 1.12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

Deciphera Pharmaceuticals, Inc. (DCPH) : Free Stock Analysis Report