SAIC and Rogue Space Systems Team Up for In-Space Services

Science Applications International Corporation SAIC recently announced that it has inked a strategic partnership with the Laconia, NH-based defense and space manufacturing start-up, Rogue Space Systems Corporation, to deliver solutions that provide In-Orbit Service Assembly and Manufacturing (ISAM), asset inspection and Space Situational Awareness (SSA) services.

Teaming up with Rogue Space Systems, SAIC will develop small satellites that will rapidly provide in-space services. The Reston-based information technology services provider will integrate the start-up’s Orbots, which are orbital space robots, to impart ISAM and SSA services to public and commercial organizations. Additionally, it will identify business development opportunities for Rogue Space Systems.

With the rapidly growing space technologies and human endeavors in geostationary and non-geostationary orbit satellites, there has been an increase in demand for satellite services and space-based activities. The latest contract will aid the start-up to accelerate its presence in the ISAM market.

Rogue Space Systems, the first-generation manufacturer of orbital robots, was formed in 2020. It designs satellite vehicles, robots and subsystems to offer in-space services to satellite operators, manufacturers and insurers.

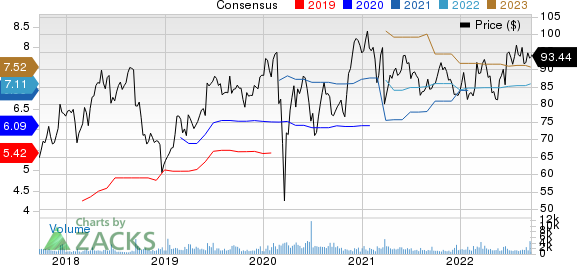

Science Applications International Corporation Price and Consensus

Science Applications International Corporation price-consensus-chart | Science Applications International Corporation Quote

Science Applications is currently focusing on the federal government marketplace and capturing more market share. It intends to drive operational excellence by intensively focusing on its organic and inorganic growth strategy, and strengthening existing customer relationships while building newer ones. Increased federal spending is anticipated to accelerate the pace of contract awards, which, in turn, will be beneficial for SAIC’s top-line growth.

During second-quarter fiscal 2023, SAIC reported revenues of $1.83 billion, mainly driven by contributions from the newly acquired Halfaker business and the ramp-up of new and existing contracts.

The Zacks Consensus Estimate for SAIC’s third-quarter fiscal 2023 revenues is pegged at $1.86 billion compared with the year-ago quarter’s $1.90 billion.

Zacks Rank & Stocks to Consider

Science Applications currently carries a Zacks Rank #3 (Hold). Shares of SAIC have climbed 11.2% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Clearfield CLFD, Silicon Laboratories SLAB and EPAM Systems EPAM. While Clearfield and Silicon Laboratories flaunt a Zacks Rank #1 (Strong Buy), EPAM carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Clearfield's fourth-quarter fiscal 2022 earnings has been revised 10 cents north to 80 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved 36 cents north to $3.13 per share in the past 60 days.

Clearfield’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 33.9%. Shares of CLFD have improved 110% in the past year.

The Zacks Consensus Estimate for Silicon Laboratories’ third-quarter 2022 earnings has increased 36% to $1.13 per share over the past 60 days. For 2022, earnings estimates have moved 20.5% up to $4.41 per share in the past 60 days.

Silicon Laboratories’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.6%. Shares of SLAB have declined 13.3% in the past year.

The Zacks Consensus Estimate for EPAM Systems' third-quarter 2022 earnings has been revised 7 cents northward to $2.52 per share over the past seven days. For 2022, earnings estimates have moved 15 cents north to $9.96 per share in the past seven days.

EPAM's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 23%. Shares of the company have declined 37.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research