Sales And Marketing Software Stocks Q2 Recap: Benchmarking ON24 (NYSE:ONTF)

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the sales and marketing software stocks have fared in Q2, starting with ON24 (NYSE:ONTF).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.32%, while on average next quarter revenue guidance was 0.51% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and while some of the sales and marketing software stocks have fared somewhat better than others, they have not been spared, with share prices declining 6.85% since the previous earnings results, on average.

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

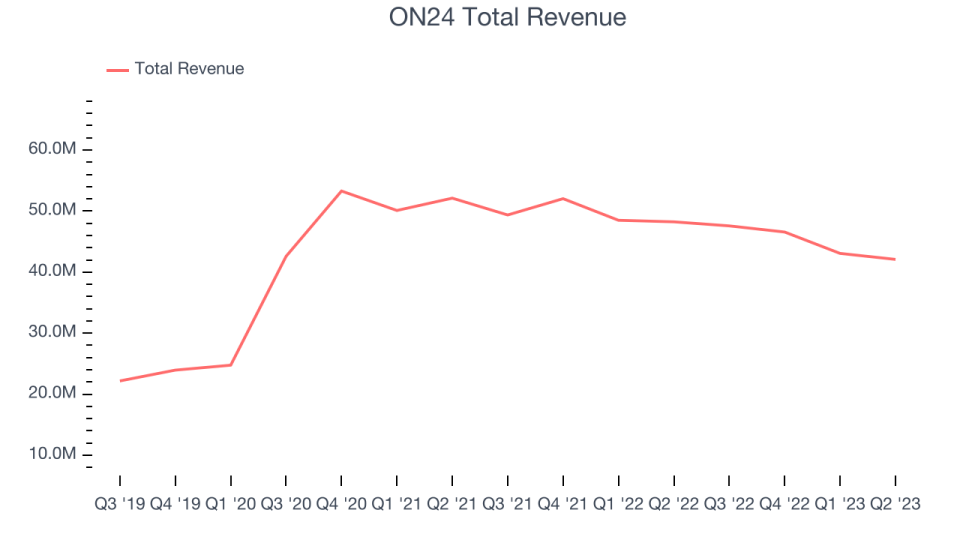

ON24 reported revenues of $42.1 million, down 12.8% year on year, beating analyst expectations by 1.54%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

ON24 delivered the slowest revenue growth of the whole group. The stock is down 17.1% since the results and currently trades at $6.59.

Read our full report on ON24 here, it's free.

Best Q2: AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

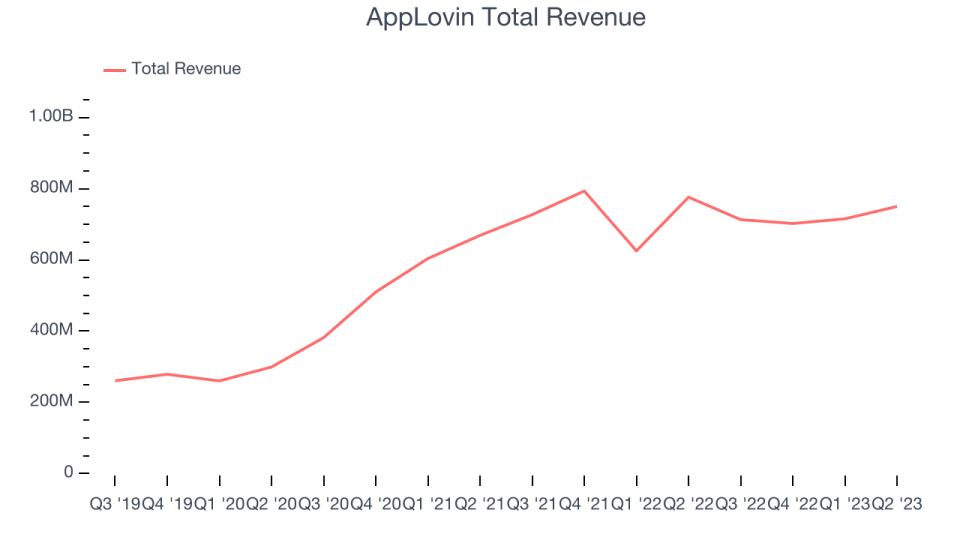

AppLovin reported revenues of $750.2 million, down 3.36% year on year, beating analyst expectations by 3.57%. It was an impressive quarter for the company, with optimistic revenue guidance for the next quarter and a significant improvement in its gross margin.

The stock is up 34.3% since the results and currently trades at $39.5.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it's free.

Weakest Q2: GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.05 billion, up 3.21% year on year, missing analyst expectations by 0.61%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

The stock is down 2.97% since the results and currently trades at $73.47.

Read our full analysis of GoDaddy's results here.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $529.1 million, up 25.5% year on year, beating analyst expectations by 4.68%. It was a strong quarter for the company, with a decent beat of analysts' revenue estimates but decelerating customer growth. In addition, full-year revenue and non-GAAP operating profit guidance (both of which were raised from previous) came in higher than Wall Street's expectations.

The company added 7,626 customers to a total of 184,924. The stock is down 16.4% since the results and currently trades at $463.08.

Read our full, actionable report on HubSpot here, it's free.

PubMatic (NASDAQ:PUBM)

Founded in 2006, as an online ad platform focused on ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $63.3 million, flat year on year, beating analyst expectations by 5.92%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and its net revenue retention rate in jeopardy.

The stock is down 35.7% since the results and currently trades at $11.92.

Read our full, actionable report on PubMatic here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned