Sales Software Stocks Q3 Results: Benchmarking Salesforce (NYSE:CRM)

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the sales software stocks, including Salesforce (NYSE:CRM) and its peers.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

The 4 sales software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 1.8% while next quarter's revenue guidance was in line with consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but sales software stocks held their ground better than others, with the share prices up 17.1% on average since the previous earnings results.

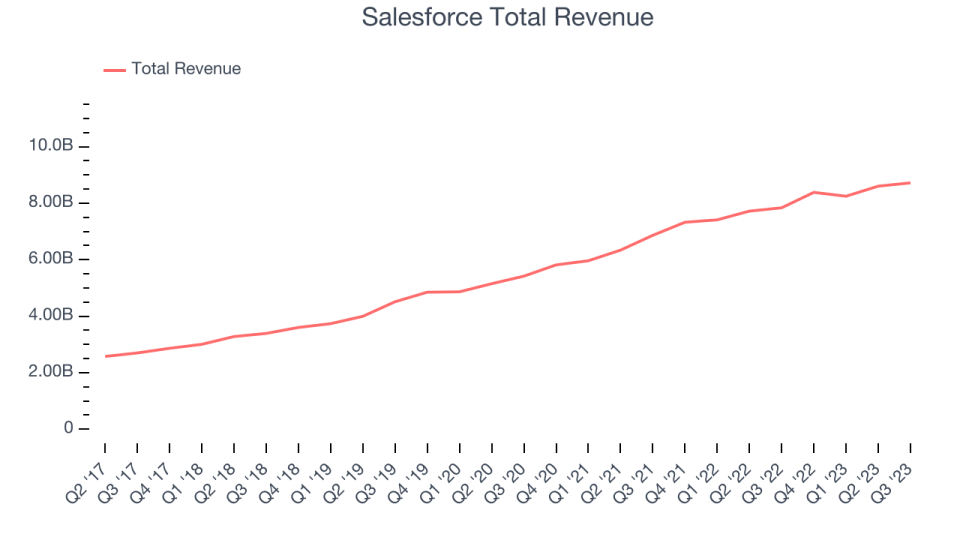

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Salesforce reported revenues of $8.72 billion, up 11.3% year on year, in line with analyst expectations. It was a strong quarter for the company, with revenue beating analysts' expectations by a narrow amount but both current and total RPO (remaining performance obligations, a leading indicator of revenue) beat more convincingly. In addition, non-GAAP operating profit and non-GAAP EPS outperformed expectations.

“We had another strong quarter of executing on our profitable growth plan we set in motion last year, delivering $8.7 billion in revenue and again raising our operating margin guidance for this fiscal year,” said Marc Benioff, Chair and CEO, Salesforce.

Salesforce delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is up 11.4% since the results and currently trades at $256.7.

Is now the time to buy Salesforce? Access our full analysis of the earnings results here, it's free.

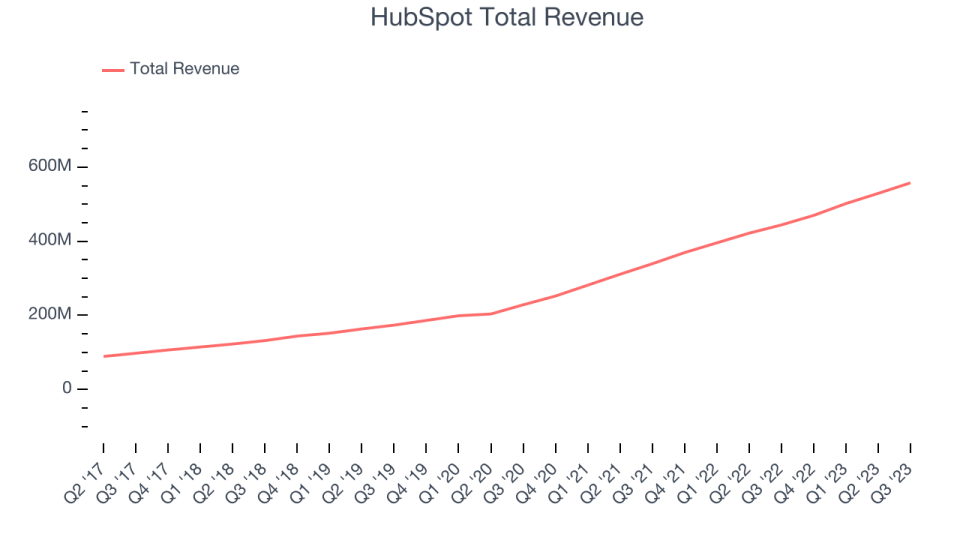

Best Q3: HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

HubSpot reported revenues of $557.6 million, up 25.6% year on year, outperforming analyst expectations by 4.4%. It was a solid quarter for the company, with a decent beat of analysts' revenue estimates and accelerating customer growth.

HubSpot pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The company added 9,174 customers to reach a total of 194,098. The stock is up 25.4% since the results and currently trades at $554.45.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

Weakest Q3: ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $313.8 million, up 9.1% year on year, exceeding analyst expectations by 1.1%. It was a weaker quarter for the company, with decelerating growth in large customers and underwhelming revenue guidance for the next quarter.

ZoomInfo had the slowest revenue growth in the group. The company lost 24 enterprise customers paying more than $100,000 annually and ended up with a total of 1,869. The stock is up 8.9% since the results and currently trades at $16.9.

Read our full analysis of ZoomInfo's results here.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Freshworks reported revenues of $153.6 million, up 19.3% year on year, surpassing analyst expectations by 1.9%. It was a mixed quarter for the company, with decelerating growth in large customers. On the other hand, Freshworks narrowly topped analysts' revenue expectations during the quarter. The company also beat Wall Street's free cash flow estimates and raised its full-year outlook for adjusted operating profit.

The company added 446 enterprise customers paying more than $5,000 annually to reach a total of 19,551. The stock is up 23.1% since the results and currently trades at $22.11.

Read our full, actionable report on Freshworks here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned