Salesforce.com, inc.'s (NYSE:CRM) Price is Down but Fundamentals are Strong. Here is what our Intrinsic Value model Reveals About the Stock

This article was originally published on Simply Wall St News

salesforce.com, inc. (NYSE:CRM) is back where it was 12 months ago, and the stock is down 1.28% in that period. Now is a good time to see if there is a fundamental opportunity for investors looking at CRM. We will analyze the value, income and future prospects of the company.

Valuation

Our valuation model estimates that the fair value of the future cash flows for CRM is US$287 per share, which is some 22% undervalued compared to the current US$223 per share.

This should give investors that are interested in CRM a reason to dig deeper and a good foundation of the current strength of the stock. If you want to view our valuation model, you can analyze it HERE.

Fundamentals

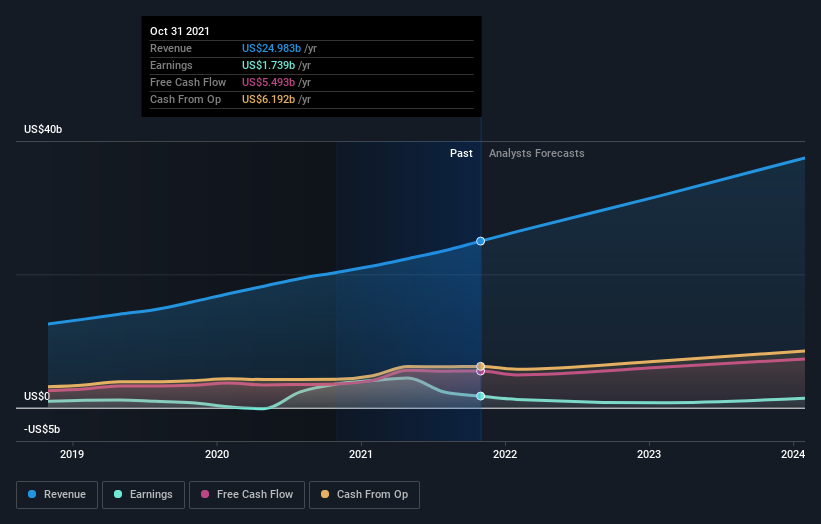

The main value driver for a company is the profitability as denoted by cash flows. Some investors like to look at classic profits or net income, however accountants can modify profitability levels based on the needs of the company. In finance, we are more interested in the free cash flows attributable to investors, and when profits differ from cash flows, we should tend to trust the cash flows as they are harder to massage.

In that regard, we see that CRM has experienced heightened profit during the second half of 2020 and the first half of 2021, but statutory profits fell in the last quarter. This may not represent the true earnings power of the company, and we can see that by looking at the cash flows.

The Free Cash Flows have been consistent and steadily rising, with US$5.5b of FCF in the last twelve months, and a projection of continued and stable FCF for investors in the future.

This is the main reason why the intrinsic value of the company is above the current price and strongly based on fundamentals. We can argue, that the current macroeconomic landscape may provide investors with new opportunities to invest in tech on a long-term basis.

We also thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for salesforce.com

Forecasts

Following the latest results, salesforce.com's 46 analysts are now forecasting revenues of US$31.8b in 2023. This would be a major 27% improvement in sales compared to the last 12 months.

The consensus price target held steady at US$328, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future.

Investors also like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on salesforce.com, with the most bullish analyst valuing it at US$385 and the most bearish at US$242 per share.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of salesforce.com's historical trends, as the 21% annualized revenue growth to the end of 2023 is roughly in line with the 23% annual revenue growth over the past five years.

By comparing this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 14% annually, it's pretty clear that salesforce.com is forecast to grow substantially faster than its industry.

The Bottom Line

Salesforce.com seems to be undervalued by 22% on a fundamental basis, as both the current and future cash flows indicate a stable continuation and growth.

Revenues are also projected to keep growing at a 22%, which is higher than the projected growth for the industry.

Salesforce is still in the high growth phase of its business development, and the validated business model can provide investors with many years of free cash flows.

When analyzing the earning power of the company, investors may want to dig deeper into the cash flows instead of net income, as they arguably provide a better picture of the true profit capacity of the company.

And what about risks? Every company has them, and we've spotted 4 warning signs for salesforce.com you should know about.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.