Salesforce's Full-Year Results Strengthen Its Long-Term Outlook

My analysis of Salesforce Inc. (NYSE:CRM) indicates strong long-term returns to come for shareholders and the recent full-year results show significant strengths in the short term, too. I estimate, based on the operational value of the company, tied closely with my high expectations of exponential adoption of artificial intelligence within enterprises in the next few decades, that Salesforce will provide significant alpha as an investment over the long term, even amidst reasonable valuation concerns.

Financial results

On Feb. 28, Salesforce released its fiscal fourth quarter and full year 2024 results. For the three months ended Jan. 31, on a GAAP basis, it beat the consensus earnings per share estimate for the quarter by 19 cents, reporting $1.47. It also reported fourth-quarter revenue of $9.29 billion, which is 11% year-over-year growth.

The company also noted full-year revenue of $34.90 billion, up 11% year over year, and full-year operating cash flow of $10.20 billion, up 44% year over year. It initiated a quarterly dividend of 40 cents per share of outstanding common stock and announced its share repurchase program authorization increased by $10 billion.

For 2025, Salesforce issued revenue guidance of $37.7 billion to $38 billion, up 8% to 9% year over year. Its operating margin is expected to rise from 14.40% in 2024 to 20.40% in 2025. It also initiated operating cash flow growth guidance of 21% to 24% year over year.

Long-term operational outlook

I am a long-term investor focused on holding periods of 10 years or more, which I think gives an adequate amount of time for the market to weigh the true value of a company. Technology stocks, in my opinion, are highly subject to speculation and associated volatility as a result. However, over extended holding periods, really exceptional businesses in the technology industry tend to outperform benchmarks like the S&P 500 significantly. My research indicates Salesforce is one such company. As such, I will be holding it for a very long time and am comfortable weathering any short-term volatility as a result of a premium valuation as I believe this will get canceled out in decades of growth and market expansion.

Chairman and CEO Marc Benioff said in the recent earnings release:

"With our trusted, unified Einstein 1 Platform, we're incredibly well positioned to build on our success and capitalize on the massive surge in tech spending expected over the coming years, delivering an unprecedented level of intelligence to our customers as AI transforms every company and industry."

Salesforce's Einstein 1 Platform is a comprehensive solution for businesses to improve data aggregation, efficiency and security in operations. It offers open application programming interfaces and an ecosystem of partners on AppExchange. The platform is coding-language-agnostic, which means it supports fully customizable app development in any preferred programming language. Apps can be deployed to connect to almost every data source.

Einstein 1 helps to unify data across an organization, and it offers low-code services to make the synthesis and collaboration of data sets for automation, content generation and predictions easier for users. Additionally, the platform uses its Data Cloud to harmonize data to create a unified view of a single customer, further helping drive personalization, customer satisfaction and brand loyalty. The Einstein Copilot is also a conversational AI assistant that is aimed at improving productivity and assisting users with workflow, including natural language queries.

Salesforce has significant growth and market dominance, which has led it to be considered the top customer relationship management provider for the 10th consecutive year by the International Data Corp.. As of Salesforce's press release in April, the IDC estimated it had a 22.1% market share, compared to Microsoft's (NASDAQ:MSFT) 5.7%, Oracle's (NYSE:ORCL) 4.7%, SAP's (NYSE:SAP) 3.8% and Adobe's (NASDAQ:ADBE) 3.5%.

My research shows Salesforce is the number one investment in AI-assisted business management at this time. As such, I think it will continue to outperform the S&P 500 benchmark significantly over the next decade and beyond. This is further evidenced by a 2023 report by MarketResearch, which estimates the generative AI in CRM market will grow at a compound annual rate of 20.80% from 2023 to 2032.

Value analysis

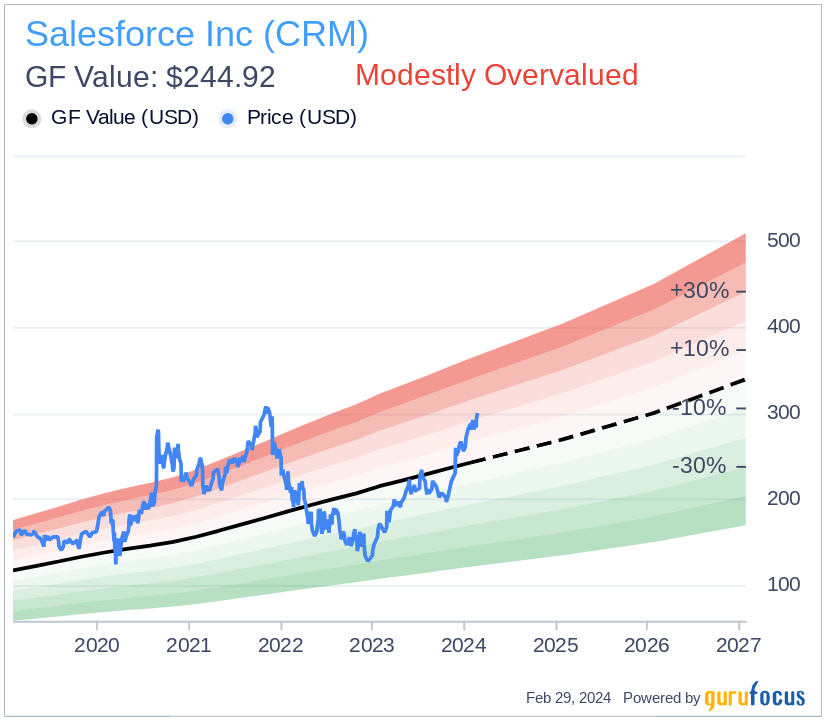

There is a significant chance Salesforce stock is slightly overvalued at this time, as illustrated by the GF Value chart.

However, as far as technology companies go, I estimate Salesforce is still selling at a tolerable valuation. I bought my stake earlier in the year when the GF Value chart indicated a fair valuation. However, as with most technology stocks, I do expect bouts of short-term volatility as a result of valuation and potential future earnings misses. However, I estimate this will be significantly counterbalanced by high growth over the long term.

The company's trailing 12-month price-earnings ratio is approximately 114, but its forward price-earnings ratio comes down to a much more attractive 31. Additionally, its price-earnings ratio without non-recurring items is 45. Therefore, I do not think this is the worst time to buy the stock. Indeed, the valuation could be better, but over the long term, any short-term depreciation could be relatively irrelevant. Compared to competitors, Salesforce's forward price-earnings ratio of 31 looks reasonable, considering Microsoft's ratio of 35, Oracle's ratio of 18, SAP's ratio of 38 and Adobe's ratio of 31.

Global growth risk

At this time, Salesforce has a highly Westernized customer base, with 63% of its operating revenue coming from the United States and 22.8% coming from Europe. With only 9.4% coming from Asia Pacific, there is some risk the company may be outcompeted by Chinese companies in the Asian markets. For example, Alibaba (NYSE:BABA) has a significant stake in the CRM and cloud computing markets. Still, Salesforce has strategically partnered with Alibaba, giving it the exclusive rights to offer its suite of services in China. However, this does not stop new startups in China from potentially innovating and capturing a market that is relatively small for Salesforce in comparison to its American presence.

Conclusion

I expect to increase my stake in Salesforce over time, and I consider it an exceptional business with a relatively wide moat in AI CRM. I believe its growth over the next several decades could far exceed other technology peers as I estimate that we are at the advent of an exponential increase in the adoption of AI in workplaces, which should have a positive feedback loop effect to come. My analyst rating for the stock at the moment is a buy, and it would be a strong buy if the price were slightly more favorable.

This article first appeared on GuruFocus.