Sallie Mae (SLM) Q2 Earnings Miss Estimate, NII Surpasses

Sallie Mae SLM, formally known as SLM Corporation, reported second-quarter 2023 earnings per share of $1.10, missing the Zacks Consensus Estimate of $1.14. The bottom line compared unfavorably with the prior-year quarter’s earnings of $1.29.

A rise in non-interest expenses and lower non-interest income impeded the results. Nonetheless, lower provisions for credit losses, an increase in the net interest income (NII) and robust loan originations were positives.

The company’s GAAP net income was $265 million, down 22.5% from the previous-year quarter.Our estimate for the same was $257.8 million.

NII Improves, Expenses Climb

NII in the second quarter was $386.6 million, up 6.6% year over year. Also, the reported figure surpassed the Zacks Consensus Estimate of $370.2 million.

The net interest margin (NIM) expanded 23 basis points to 5.52%.

The company’s non-interest income of $144 million declined 44.2% from the prior-year quarter. This was mainly attributable to net losses on securities and a substantial decline in net gain on the sale of loans.Our estimate for the same was pegged at $148.1 million.

Sallie Mae's non-interest expenses increased 16.4% to $156 million. The increase mainly resulted from higher compensation and benefits, and FDIC assessment fees.Our estimate for the same was $163 million.

Credit Quality Mixed

The company recorded a provision for credit losses of $18 million compared with $31 million in the prior-year quarter. Our estimate for the same was $13.5 million. Net charge-offs for private education loans were $103 million. Private education loans held-for-investment net charge-offs as a percentage of average private education loans held for investment in repayment (annualized) was 2.69%, up from 2.56% year over year.

Balance Sheet Position Deteriorates

As of Jun 30, 2023, deposits of Sallie Mae were $20.36 billion, down 6.6% on a sequential basis. Private education loan held for investment was $18.64 billion, down 9% on a sequential basis.

In the quarter, the company witnessed private education loan originations of $651 million, increasing 6% from the year-ago quarter.

Share Repurchase Update

In the second quarter, the company repurchased 16 million common stocks for $257 million under its existing share repurchase program expiring on Jan 25, 2024.

2023 Outlook

The company expects core earnings per share (on a non-GAAP basis) of $2.50-$2.70.

It anticipates total loan portfolio net charge-offs of $345-$385 million.

Private education loan originations are projected to grow 5-6% year over year.

The company’s non-interest expenses are expected to be $610-$620 million.

Conclusion

The overall financial performance of the company seems decent. Improvements in NIM and NII are positives. However, a rise in expenses and a deterioration in fee income are major near-term headwinds.

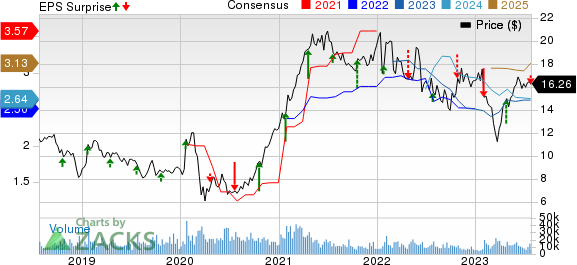

SLM Corporation Price, Consensus and EPS Surprise

SLM Corporation price-consensus-eps-surprise-chart | SLM Corporation Quote

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Consumer Loan Providers

Navient Corporation NAVI reported second-quarter 2023 adjusted earnings per share of 70 cents, missing the Zacks Consensus Estimate of 76 cents. The reported figure compares unfavorably with the year-ago quarter’s 92 cents.

A fall in core NII and total other income, and higher expenses affected NAVI’s results. Nonetheless, a decline in provisions acted as a tailwind.

Capital One’s COF second-quarter 2023 earnings of $3.52 per share surpassed the Zacks Consensus Estimate of $3.31. The bottom line tanked 29% from the year-ago quarter.

The results of COF were aided by an increase in NII and fee income. However, despite higher rates, the net interest margin declined year over year. Also, higher expenses, along with a significant rise in provisions, were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report