Sallie Mae's (SLM) Q4 Earnings Lag Estimates, Expenses Rise

Sallie Mae’s SLM, formally SLM Corporation, fourth-quarter 2023 core earnings per share of 72 cents missed the Zacks Consensus Estimate of 87 cents. The bottom line, however, compared favorably with the prior-year quarter’s loss of 33 cents.

A rise in non-interest expenses impeded the results. Nonetheless, lower provisions for credit losses, an increase in the net interest income (NII), robust loan originations and higher non-interest income were positives.

The company’s GAAP net income was $168 million against a net loss of $77 million in the prior-year quarter.

For 2023, core earnings of $2.41 per share lagged the consensus estimate but grew 36.9% year over year. Net income (GAAP) was $581 million, up 23.9%.

NII Improves, Expenses Climb

Fourth-quarter NII was $385.9 million, up 1.2% year over year. Also, the reported figure surpassed the Zacks Consensus Estimate of $379.2 million.

For 2023, NII rose 4.9% to $1.56 billion. The figure met the consensus estimate.

The quarterly net interest margin (NIM) was stable at 5.37%.

Non-interest income was $57.1 million against a non-interest loss of $40.6 million in the prior-year quarter. This was mainly attributable to improvement in all non-interest income components.

Non-interest expenses jumped 44.3% to $202.1 million. The surge mainly resulted from higher acquired intangible assets impairment and amortization expenses.

Credit Quality Improves

Provision for credit losses of $16 million, down substantially from $297 million in the prior-year quarter. The decline was owing to negative provisions due to the $1.1 billion private education loan sale during the reported quarter.

Net charge-offs for private education loans were $92.6 million, down 20.4%. Private education loans held for investment net charge-offs as a percentage of average private education loans held for investment in repayment (annualized) was 2.43%, down 72 basis points year over year.

Balance Sheet Position Strengthens

As of Dec 31, 2023, deposits were $21.65 billion, up almost 1% on a year-over-year basis. Private education loans held for investment were $19.77 billion, up 4%.

In the reported quarter, the company witnessed private education loan originations of $839 million, increasing 2% from the year-ago quarter.

Share Repurchase Update

In the fourth quarter, SLM repurchased 6 million shares for $92 million under its 2022 share buyback program.

Concurrently, the company announced a new share repurchase program, under which it is authorized to buy back $650 million worth of shares. The program is effective Jan 26, 2024, and is set to expire on Feb 6, 2026.

2024 Outlook

The company expects core earnings per share (on a non-GAAP basis) of $2.60-$2.70.

It anticipates total loan portfolio net charge-offs of $340-$370 million.

Private education loan originations are projected to grow 7-8% year over year.

The company’s non-interest expenses are expected to be $635-$655 million.

Conclusion

The overall financial performance of the company seems decent. Improvements in NIM and NII, as well as higher fee income, are positives. However, a rise in expenses is a major near-term headwind.

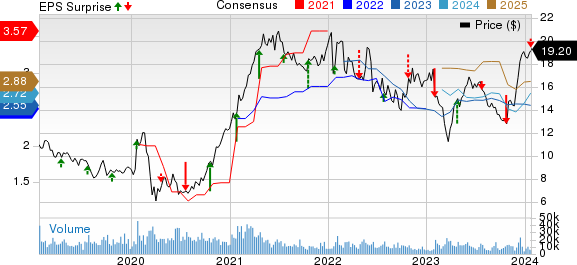

SLM Corporation Price, Consensus and EPS Surprise

SLM Corporation price-consensus-eps-surprise-chart | SLM Corporation Quote

Currently, SLM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Release Date Other Consumer Loan Providers

Ally Financial’s ALLY fourth-quarter and 2023 adjusted earnings of 45 cents per share surpassed the Zacks Consensus Estimate by a penny. However, the bottom line reflects a decline of 58.3% from the year-ago quarter.

ALLY’s results were primarily aided by an improvement in other revenues. However, a decline in net financing revenues and higher expenses and provisions were the undermining factors.

Navient Corporation NAVI is slated to announce fourth-quarter and full-year 2023 numbers on Jan 31.

Over the past 30 days, the Zacks Consensus Estimate for NAVI’s quarterly earnings has remained unchanged at 77 cents. This implies a 1.3% rise from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report