Sally Beauty Holdings Inc (SBH) Faces Sales Dip Amid Strategic Progress in Q1 Fiscal 2024

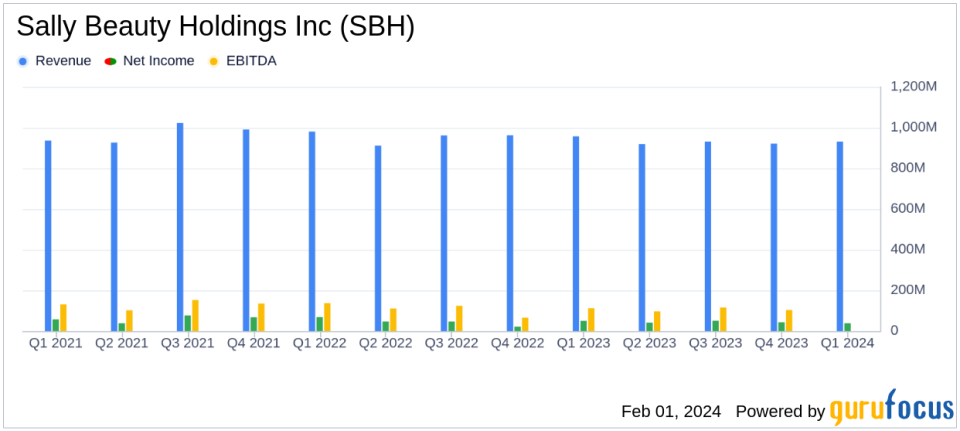

Net Sales: $931 million, a decrease of 2.7% year-over-year.

Comparable Sales: Declined by 0.8%, with global e-commerce sales at $91 million.

Gross Margin: GAAP gross margin at 50.2%, a decrease from the previous year.

Operating Earnings: GAAP operating earnings of $69 million, with an operating margin of 7.4%.

Net Earnings: GAAP diluted net earnings per share of $0.35, adjusted at $0.39.

Cash Flow: Generated $51 million from operations and executed $20 million in share repurchases.

Guidance: Full year fiscal 2024 guidance maintained, with net sales expected to be approximately flat compared to the prior year.

On February 1, 2024, Sally Beauty Holdings Inc (NYSE:SBH) released its 8-K filing, detailing the financial outcomes for the first quarter ended December 31, 2023. The professional beauty-products retailer, operating across various international markets, reported consolidated net sales of $931 million, marking a 2.7% decrease compared to the prior year. This decline was primarily attributed to store closures in December 2022 and was partially offset by favorable foreign currency translation impacts.

Performance Overview

Sally Beauty Holdings Inc (NYSE:SBH) faced a challenging quarter with a slight decline in consolidated comparable sales by 0.8%. The company cited lower traffic and inflationary pressures affecting consumer behavior as key factors. Despite these challenges, SBH's global e-commerce sales remained robust, contributing 9.8% to net sales. The company's GAAP gross margin also experienced a decrease to 50.2%, down 80 basis points from the previous year, due to an unfavorable sales mix shift and fixed cost absorption, somewhat mitigated by supply chain efficiencies.

SG&A expenses increased marginally by $6.6 million, driven by higher labor and rent costs associated with strategic initiatives. GAAP operating earnings and margin saw a decline to $69.1 million and 7.4%, respectively. Net earnings for the quarter stood at $38.4 million, or $0.35 per diluted share, a decrease from the prior year's $50.3 million, or $0.46 per diluted share. Adjusted net earnings were reported at $42.0 million, or $0.39 per diluted share.

Financial Health and Shareholder Returns

The balance sheet of SBH reflected cash and cash equivalents of $121 million, with a net debt leverage ratio of 2.2x. Inventory levels rose by 2.1% compared to the previous year. The company continued to return value to shareholders, repurchasing 1.9 million shares at a cost of $20 million during the quarter.

President and CEO Denise Paulonis commented on the company's strategic initiatives, emphasizing the focus on customer centricity and innovation. She noted the solid cash flow from operations, which facilitated the share repurchase program, as a positive outcome of the quarter.

"We are pleased with our start to the year, delivering results in line with our expectations while continuing to make solid progress on our strategic initiatives to drive top line growth and improve profitability over the long-term," said Denise Paulonis.

Segment Performance and Future Outlook

The Sally Beauty Supply segment experienced a 4.8% decrease in net sales, primarily due to store optimization efforts. The Beauty Systems Group segment remained stable, with a slight increase in comparable sales driven by expanded distribution and improving salon demand trends.

Looking ahead, SBH maintains its full fiscal year 2024 guidance, expecting net sales and comparable sales to be approximately flat compared to the prior year. The company anticipates a gross margin above 50% and an adjusted operating margin of at least 9.0%. Operating cash flow is projected to be at least $260 million, with capital expenditures around $100 million.

For more detailed insights and analysis on Sally Beauty Holdings Inc (NYSE:SBH)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Sally Beauty Holdings Inc for further details.

This article first appeared on GuruFocus.