Sally Beauty (SBH) Unveils Collaboration With XMONDO Color

Sally Beauty Holdings, Inc. SBH has entered into an exclusive retail partnership with XMONDO Color, a hair color line under the XMONDO Hair brand founded by the hairstylist and social media sensation, Brad Mondo. The collaboration signifies a major step in the beauty industry and demonstrates Sally Beauty's commitment to providing customers with innovative and sought-after brands.

This partnership designates Sally Beauty as the first and exclusive in-store distributor for XMONDO Color products. The XMONDO Color lineup includes seven Color Depositing Masks in vibrant shades like Super Red and Super Purple, as well as a Clear Glossing Treatment. XMONDO Color aligns with the trend by offering color-care products that prioritize hydration and the revitalization of damaged hair.

The entire XMONDO Color collection stands out for its commitment to being vegan, gluten-free, cruelty-free, sulfate-free and paraben-free. These products are available for purchase on SallyBeauty.com will be available in Sally Beauty stores across the United States and Canada, beginning Sep 1, 2023.

Image Source: Zacks Investment Research

What’s More?

Sally Beauty is deeply dedicated to driving growth through a customer-centric approach, employing inventive marketing tactics, distinctive product offerings and meticulously planned strategic initiatives to expand its customer base. The company leads with a comprehensive selection of more than 1,300 hair color shades accessible both online and in physical stores.

The company's robust e-commerce strategy further attests to its competitiveness in the digital domain. With a strong emphasis on seamless omnichannel integration and significant investments in the digital sphere, Sally Beauty witnessed a 3% surge in global e-commerce sales, amounting to $83 million, constituting 8.9% of consolidated net sales in the third quarter of fiscal 2023.

In the third quarter of fiscal 2023, Sally Beauty introduced Happy Beauty Co., an innovative retail concept designed to deliver an immersive beauty encounter at an affordable price point. Also, the company effectively leveraged customer loyalty to bolster its bottom line.

Wrapping Up

Sally Beauty witnessed a soft adjusted gross margin in the third quarter due to the lower margin at Beauty Systems Group. This resulted from an unfavorable sales mix shift between segment stores and the expanded Regis partnership, as well as a shift in some distribution center costs from SG&A expenses to the gross margin.

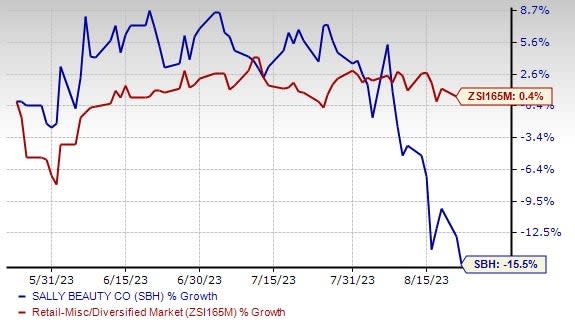

Shares of this Zacks Rank #3 (Hold) company have declined 15.5% in the past three months against the industry’s growth of 0.4%.

However, a focus on key strategic initiatives and customer-centric moves like the abovementioned alliance with XMONDO Color is likely to work well for Sally Beauty.

Three Solid Picks

Here we have highlighted three better-ranked stocks, namely Skechers U.S.A., Inc. SKX, Five Below, Inc. FIVE and Crocs, Inc. CROX.

Skechers designs, develops, markets and distributes footwear. It currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 28.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Skechers’ current financial-year sales and earnings suggests growth of 8.5% and 41.2%, respectively, from the year-ago reported figures. SKX has a trailing four-quarter earnings surprise of 39.1%, on average.

Five Below is a specialty value chain retailer that provides a wide range of premium quality and trendy merchandise. The company currently has a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 22.1%.

The Zacks Consensus Estimate for Five Below’s current fiscal-year sales and earnings suggests growth of 15.7% and 19.2%, respectively, from the year-ago reported numbers. FIVE has a trailing four-quarter earnings surprise of 27.9%, on average.

Crocs is one of the leading footwear brands with a focus on comfort and style. It currently has a Zacks Rank #2. CROX delivered an earnings surprise of 20.5% in the last reported quarter.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 12.9% and 11.2%, respectively, from the year-ago reported numbers. CROX has a trailing four-quarter earnings surprise of 19.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report