Sana Bio (SANA) Stock Rallies 105% in 3 Months: Here's Why

Sana Biotechnology SANA, a gene-editing company, creates and delivers engineered cells as medicines for patients. The company recently secured three investigational new drug (IND) application clearances from the FDA in 2023.

Sana Bio received its first IND clearance in January 2023 for its investigational hypoimmune-modified, CD19-targeted allogeneic CAR T therapy, SC291, to begin clinical development for the treatment of patients with B-cell malignancies. Following the IND clearance, an early-stage ARDENT study of SC291 was initiated for this indication.

Sana Bio received the remaining two IND clearances from the FDA in the fourth quarter of 2023, one for SC291 again to treat autoimmune diseases and the other for its hypoimmune-modified, CD22-directed allogeneic CAR T therapy, SC262, to treat patients with relapsed or refractory B-cell malignancies.

Shares of SANA have skyrocketed 104.7% over the past three months compared with the industry’s 13.3% rise. This significant surge in the stock price was mainly driven by the two IND clearances secured by the company around the end of 2023.

Image Source: Zacks Investment Research

In November 2023, Sana Bio received the FDA’s nod to begin an early-stage clinical study of SC291 in patients with multiple B-cell mediated autoimmune diseases, including lupus nephritis, extrarenal lupus and antineutrophil cytoplasmic antibody-associated vasculitis.

The company is currently gearing up to start treating patients in a phase I study of SC291 for autoimmune indications in the near term. Initial data readout from the study regarding safety and efficacy across multiple diseases is expected in 2024.

Sana Bio recently announced that it has received the third IND clearance, paving the path to initiate an early-stage study of SC262 in patients with relapsed or refractory B-cell malignancies. The study will initially enroll patients who have received prior CD19-directed CAR T therapy.

Per the company, all currently approved autologous CAR T therapies for B-cell lymphoma and B-cell acute lymphoblastic leukemia target the CD19 protein. However, it has been observed that incomplete responses or relapses occur in approximately 60% of CD19 CAR T-treated patients. This represents a significant unmet medical need.

Sana Bio claims that CD22, albeit a similar kind of protein, is a better alternative in addressing failure to achieve durable complete responses with CD19-directed CAR T therapy. CD22-directed CAR T therapies have proven their efficacy in multiple academic clinical studies, demonstrating durable complete responses in many patients in the relapse setting following treatment with a CD19-directed CAR T therapy.

Initial proof-of-concept data from the impending phase I study of SC262 is expected later this year.

Sana Bio is also collaborating with Uppsala University Hospital in Sweden to develop the latter’s investigational allogeneic, primary islet cell therapy, UP421, which is engineered with its hypoimmune technology for type I diabetes.

In November 2023, Sana Bio announced that the Swedish regulatory body authorized the initiation of an investigator-sponsored, first-in-human study of UP421 to treat patients with type I diabetes. Top-line data is expected to be reported later this year.

In December 2023, SANA announced positive initial clinical data from the first patient treated at the lowest dose in the ongoing phase I ARDENT clinical study of SC291. Per the company, treatment with SC291 appeared safe and well-tolerated, evaded immune detection and induced a partial response in the chronic lymphocytic leukemia patient (CLL).

The phase I ARDENT study is evaluating the safety and tolerability of SC291 in patients with CLL and non-Hodgkin lymphoma. Treatment in the dose-escalation portion of the study is ongoing, with more data expected later this year.

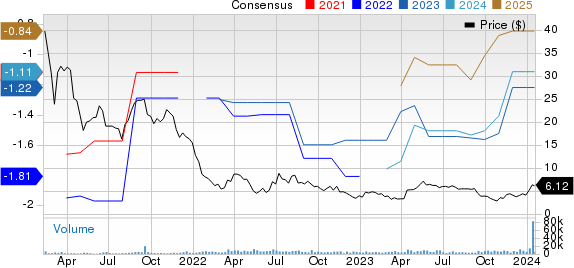

Sana Biotechnology, Inc. Price and Consensus

Sana Biotechnology, Inc. price-consensus-chart | Sana Biotechnology, Inc. Quote

Zacks Rank and Other Stocks to Consider

Sana Bio currently carries a Zacks Rank #2 (Buy).

Some other top-ranked drug/biotech stocks worth mentioning are Puma Biotechnology, Inc. PBYI, ADMA Biologics ADMA and Acadia Pharmaceuticals ACAD. While PBYI sports a Zacks Rank #1 (Strong Buy), ADMA and ACAD carry a Zacks Rank #2 each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Puma Biotech’s 2023 earnings per share (EPS) has increased from 72 cents to 73 cents. During the same time frame, the consensus estimate for Puma Biotech’s 2024 EPS has increased from 64 cents to 69 cents. Over the past three months, shares of PBYI have gained 111%.

PBYI beat estimates in three of the last four quarters while missing on one occasion, delivering a four-quarter average earnings surprise of 76.55%.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has narrowed from 3 cents to 2 cents. The consensus estimate for ADMA Biologics’ 2024 EPS is pegged at 22 cents. Over the past three months, shares of ADMA have risen 56.5%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 63.57%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has remained constant at 33 cents. During the same time frame, the consensus estimate for Acadia’s 2024 EPS is pegged at $1.04. Over the past three months, shares of ACAD have gained 22%.

ACAD beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Sana Biotechnology, Inc. (SANA) : Free Stock Analysis Report