Sanara MedTech Inc (SMTI) Reports Strong Sales Growth and Reduced Net Loss for Full Year 2023

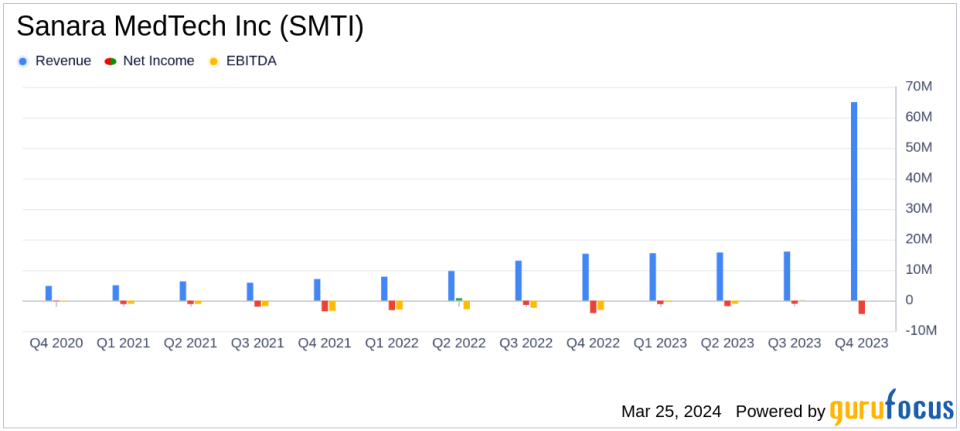

Revenue: $65.0 million in 2023, a 42% increase from $45.8 million in 2022.

Net Loss: Reduced to $4.4 million in 2023 from $8.1 million in 2022.

Adjusted EBITDA: Improved to negative $0.3 million in 2023 from negative $7.5 million in 2022.

Key Products: Sales growth driven by soft tissue repair and bone fusion products.

Strategic Moves: Acquisition of CellerateRX assets and launch of ALLOCYTE Plus and BIASURGE.

Sanara MedTech Inc (NASDAQ:SMTI), a medical technology company specializing in wound and skincare solutions, released its 8-K filing on March 25, 2024, revealing financial results for the fourth quarter and full year ended December 31, 2023. The company, which is known for its surgical wound care products such as CellerateRX Surgical Activated Collagen, and chronic wound care products like HYCOL Hydrolyzed Collagen and BIAKOS Skin and Wound Cleanser, reported a significant increase in sales and a reduction in net loss compared to the previous year.

Financial Performance and Challenges

Sanara's 2023 performance was marked by a notable 42% increase in net revenues, amounting to $65.0 million, up from $45.8 million in 2022. This growth was attributed to the enhanced sales of soft tissue repair and bone fusion products, bolstered by market penetration and geographic expansion. Despite this revenue surge, the company faced increased expenses in selling, general, and administrative (SG&A) costs, as well as research and development (R&D), which contributed to a net loss of $4.4 million. However, this loss was a significant improvement from the $13.9 million loss before income taxes reported in the previous year.

The company's strategic acquisitions, including assets related to CellerateRX, and the launch of new products like ALLOCYTE Plus and BIASURGE, were key factors in driving growth. However, the increased SG&A and R&D expenses highlight the challenges of expanding operations and investing in product development.

Importance of Financial Achievements

For a company in the Medical Devices & Instruments industry, the ability to grow revenue while managing losses is crucial. The substantial increase in sales indicates strong market demand and effective execution of the company's growth strategy. The improvement in Adjusted EBITDA, although still negative, suggests progress towards operational efficiency and potential future profitability.

Income Statement and Balance Sheet Highlights

Sanara's income statement reflects a gross profit of $57.1 million in 2023, up from $39.5 million in 2022. The balance sheet shows an increase in total assets to $73.9 million in 2023 from $61.0 million in 2022, with cash and cash equivalents decreasing to $5.1 million from $9.0 million. The company's shareholder equity also increased to $44.6 million from $41.7 million, indicating a strengthened financial position.

Management Commentary

Zach Fleming, Sanaras CEO, stated, During 2023, the Sanara team achieved several key strategic and operational milestones that position the Company for continued strong growth in 2024. These achievements included the acquisition of key assets related to CellerateRX Surgical Powder and Gel (CellerateRX) and the launch of our new ALLOCYTE Plus Advanced Viable Bone Matrix product (ALLOCYTE Plus) while also commercializing BIASURGE Advanced Surgical Solution (BIASURGE). I am grateful to our entire team for their dedication to advancing our goal of developing and commercializing technologies that improve outcomes and reduce costs throughout the U.S.

Analysis and Future Outlook

Sanara MedTech Inc's strategic initiatives and product launches have set a solid foundation for continued growth. The company's focus on expanding its product portfolio and distribution network is expected to further drive sales and market presence. While increased expenses are a concern, they are indicative of the company's investment in future growth. The improved Adjusted EBITDA suggests that Sanara is moving in the right direction towards achieving operational efficiency and profitability.

For more detailed financial analysis and insights into Sanara MedTech Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Sanara MedTech Inc for further details.

This article first appeared on GuruFocus.