SandRidge Energy Inc (SD) Announces 2023 Earnings and Dividend Increase

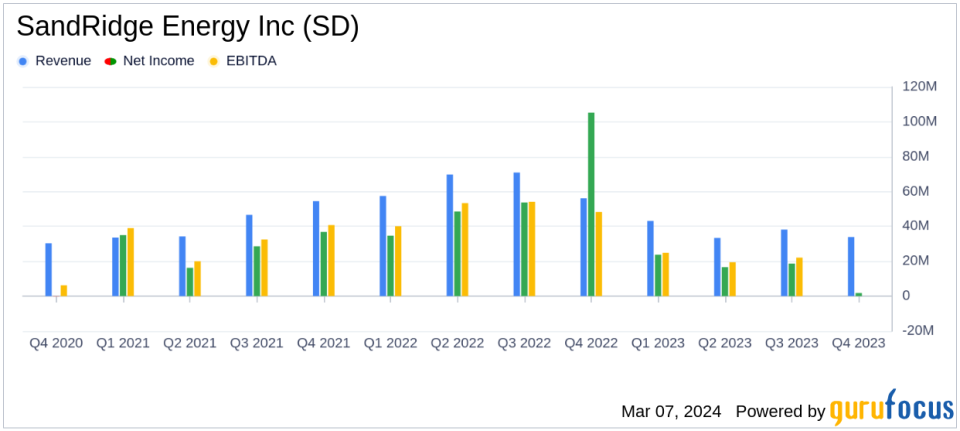

Net Income: Reported $60.9 million, or $1.65 per basic share for 2023.

Adjusted EBITDA: Generated $93.2 million in 2023.

Free Cash Flow: Approximately $89.2 million, representing a 96% conversion rate relative to adjusted EBITDA.

Production: Averaged 16.9 MBoed in 2023, with a 10% increase in oil production year-over-year.

Dividend: Declared a $0.11 per share cash dividend, a 10% increase from the previous quarter.

Proved Reserves: Decreased to 55.7 MMBoe at the end of 2023, primarily due to lower SEC commodity prices.

2024 Guidance: Capital expenditure plans of $8 - $11 million in production optimization.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On March 6, 2024, SandRidge Energy Inc (NYSE:SD) released its 8-K filing, detailing its financial and operational results for the quarter and fiscal year ended December 31, 2023. SandRidge, a U.S.-based oil and natural gas company, is engaged in the exploration, development, and production of crude oil, natural gas, and natural gas liquids. The company's business activities span Exploration and Production, Drilling and Oil Field Services, and Midstream Gas Services.

Fiscal Year 2023 Performance

SandRidge reported a net income of $60.9 million, or $1.65 per basic share for the full year of 2023. The adjusted net income was $69.0 million, or $1.87 per basic share, reflecting a solid financial performance. The company's profitability was supported by robust free cash flow generation of approximately $89.2 million, which represents a high conversion rate relative to the adjusted EBITDA of $93.2 million.

Production for the year averaged 16.9 MBoed, benefiting from the company's Production Optimization Program and the successful completion of its high-return drilling and completion program. This strategic focus led to an approximate 10% increase in oil production compared to the previous year, underscoring the company's operational efficiency and its ability to adapt to market conditions.

Financial Highlights and Challenges

Despite the positive income and cash flow, SandRidge faced challenges in 2023, including a decrease in proved reserves from 74.3 MMBoe at the end of 2022 to 55.7 MMBoe at the end of 2023. This decline was primarily attributed to lower year-end SEC commodity prices for oil and natural gas, which resulted in a decrease of 17.5 MMBoe, as well as production during the year.

Operating costs, including lease operating expenses (LOE) and general and administrative expenses (G&A), showed mixed trends. LOE for the full year was $41.9 million, or $6.80 per Boe, slightly higher than the previous year's $41.3 million, or $6.39 per Boe. G&A expenses also increased to $10.7 million from $9.4 million in the prior year.

Liquidity and Dividend Program

As of December 31, 2023, SandRidge had a strong liquidity position with $253.9 million in cash and cash equivalents, including restricted cash. The company has no outstanding term or revolving debt obligations, which is a testament to its prudent financial management and capital discipline.

The Board of Directors declared a $0.11 per share cash dividend payable on March 29, 2024, to shareholders of record on March 15, 2024. This represents a 10% increase from the previous ongoing quarterly dividend and aligns with the company's commitment to returning value to shareholders.

2024 Outlook and Guidance

For 2024, SandRidge plans to spend $8 - $11 million in production optimization capital and anticipates total production to be between 4.7 - 5.9 MMBoe. The company remains vigilant in ensuring prudent capital allocation and adapting to changing market conditions.

SandRidge's focus on growing the cash value and generation capability of its asset base, while exercising prudent capital allocations, positions it to navigate the dynamic energy market effectively. The company's commitment to environmental, social, and governance (ESG) principles, including no routine flaring of produced natural gas and transporting over 95% of produced water via pipeline, further strengthens its market position.

Value investors and potential GuruFocus.com members may find SandRidge's disciplined approach to capital management, consistent dividend payments, and strategic operational focus appealing as they consider the company's performance and prospects.

For more detailed information, investors are encouraged to review the full 8-K filing and consider the company's financial position and future guidance in their investment decisions.

Explore the complete 8-K earnings release (here) from SandRidge Energy Inc for further details.

This article first appeared on GuruFocus.