SandRidge Mississippian Trust I (SDT): Does -79.2% EPS Decline Lately Make It An Underperformer?

For long-term investors, assessing earnings trend over time and against industry benchmarks is more beneficial than examining a single earnings announcement at a point in time. Investors may find my commentary, albeit very high-level and brief, on SandRidge Mississippian Trust I (NYSE:SDT) useful as an attempt to give more color around how SandRidge Mississippian Trust I is currently performing. View our latest analysis for SandRidge Mississippian Trust I

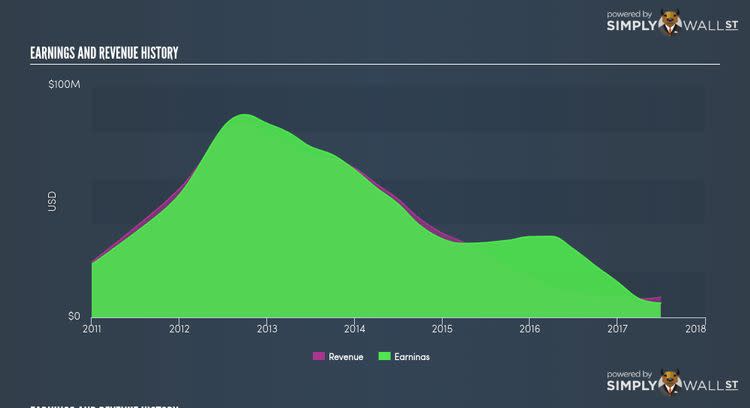

Was SDT weak performance lately part of a long-term decline?

I look at the ‘latest twelve-month’ data, which annualizes the latest 6-month earnings release, or some times, the latest annual report is already the most recent financial data. This blend enables me to analyze various companies on a more comparable basis, using new information. SandRidge Mississippian Trust I’s latest twelve-month earnings is $6M, which, against the prior year’s level, has plunged by a non-trivial -79.17%. Since these values may be fairly short-term thinking, I’ve determined an annualized five-year figure for SDT’s net income, which stands at $44M. This doesn’t look much better, as earnings seem to have gradually been falling over the longer term.

Why could this be happening? Let’s examine what’s going on with margins and whether the entire industry is facing the same headwind. In the last few years, SandRidge Mississippian Trust I has, on average, delivered negative top- and bottom-line growth. As revenues dropped by more, expenses have been lowered in order to maintain margins – not the most sustainable operating activity.

What does this mean?

Though SandRidge Mississippian Trust I’s past data is helpful, it is only one aspect of my investment thesis. Typically companies that experience a drawn out period of decline in earnings are undergoing some sort of reinvestment phase I recommend you continue to research SandRidge Mississippian Trust I to get a more holistic view of the stock by looking at:

1. Financial Health: Is SDT’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

2. Valuation: What is SDT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SDT is currently mispriced by the market.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.