Sandy Spring Bancorp (NASDAQ:SASR) Is Paying Out A Dividend Of $0.34

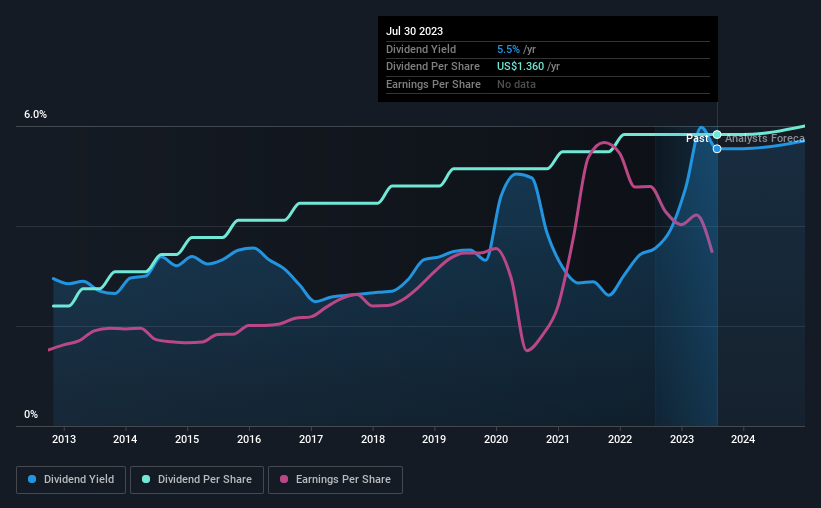

Sandy Spring Bancorp, Inc. (NASDAQ:SASR) will pay a dividend of $0.34 on the 16th of August. Based on this payment, the dividend yield on the company's stock will be 5.5%, which is an attractive boost to shareholder returns.

See our latest analysis for Sandy Spring Bancorp

Sandy Spring Bancorp's Payment Expected To Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained.

Sandy Spring Bancorp has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 43%, which means that Sandy Spring Bancorp would be able to pay its last dividend without pressure on the balance sheet.

Over the next year, EPS is forecast to fall by 9.2%. But if the dividend continues along recent trends, we estimate the future payout ratio could be 51%, which we would consider to be quite comfortable looking forward, with most of the company's earnings left over to grow the business in the future.

Sandy Spring Bancorp Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of $0.56 in 2013 to the most recent total annual payment of $1.36. This means that it has been growing its distributions at 9.3% per annum over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Has Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Sandy Spring Bancorp has seen EPS rising for the last five years, at 6.6% per annum. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

We Really Like Sandy Spring Bancorp's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The earnings easily cover the company's distributions, and the company is generating plenty of cash. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Sandy Spring Bancorp that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here