Sanmina Corp (SANM) Posts Solid Q1 Fiscal 2024 Results Amid Market Challenges

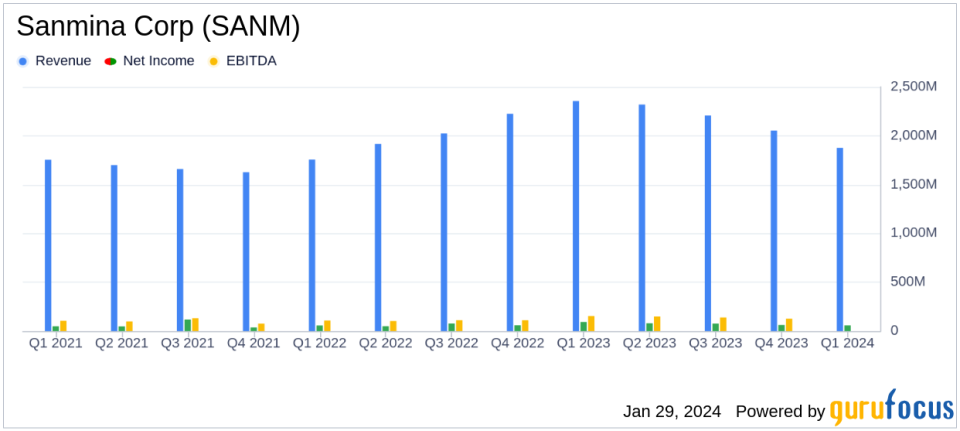

Revenue: Reported $1.87 billion, reflecting the company's robust sales performance.

GAAP Operating Margin: Achieved a GAAP operating margin of 4.7%.

GAAP Diluted EPS: Delivered a GAAP diluted EPS of $0.98.

Non-GAAP Financials: Non-GAAP operating margin stood at 5.5%, with a non-GAAP diluted EPS of $1.30.

Cash Flow and Liquidity: Generated $126 million in cash flow from operations, ending with $632 million in cash and cash equivalents.

Share Repurchases: Repurchased 2.1 million shares for $106 million.

Non-GAAP Pre-tax ROIC: Posted a strong non-GAAP pre-tax Return on Invested Capital (ROIC) of 22.7%.

On January 29, 2024, Sanmina Corp (NASDAQ:SANM), a leading provider of integrated manufacturing solutions, announced its financial results for the first quarter of fiscal year 2024, which ended on December 30, 2023. The company released its 8-K filing, revealing a steady performance despite the challenging market conditions.

Sanmina Corp operates in two business segments: Integrated Manufacturing Solutions, which includes printed circuit board assembly and generates the majority of the firm's revenue, and Components, Products, and Services, which encompasses interconnect systems and mechanical systems. The company has a significant presence in the United States, China, and Mexico, and serves markets such as communications networks, storage, industrial, defense, and aerospace.

Financial Performance and Challenges

Sanmina's revenue for the quarter was $1.87 billion, with a GAAP operating margin of 4.7% and a GAAP diluted EPS of $0.98. The non-GAAP figures were slightly more robust, with an operating margin of 5.5% and a diluted EPS of $1.30. These results are indicative of Sanmina's ability to maintain profitability and manage costs effectively in a competitive hardware industry.

Despite a solid performance, Sanmina faces challenges such as reliance on a small number of customers for a substantial portion of sales and risks arising from international operations. Geopolitical uncertainties, including the war in Ukraine and conflict in the Middle East, could also impact future sales and net income. Chairman and CEO Jure Sola commented on the results:

"Our team did a great job delivering first quarter financial results in line with our outlook. We are confident in our market-focused strategy and continue to position the company for long-term financial success."

Financial Achievements and Importance

The company's financial achievements, particularly the non-GAAP pre-tax ROIC of 22.7%, highlight Sanmina's efficient use of capital in generating profits. The share repurchase program, which saw 2.1 million shares bought back for $106 million, reflects confidence in the company's valuation and a commitment to delivering shareholder value.

Key Financial Metrics

Sanmina's balance sheet remains strong, with a decrease in total current liabilities from the previous quarter and a healthy cash and cash equivalents balance of $631 million. The income statement shows a net income attributable to common shareholders of $57.068 million, down from the previous year but still demonstrating profitability. The cash flow statement reveals a positive cash flow from operations of $126 million, contributing to a free cash flow of $91.809 million for the quarter.

These metrics are crucial for Sanmina as they provide insights into the company's operational efficiency, liquidity, and financial health, which are key considerations for value investors.

Analysis of Company's Performance

Sanmina's performance in Q1 fiscal 2024 reflects a company that is managing its resources effectively amidst market volatility. The company's focus on operational efficiency and shareholder returns, combined with a strategic approach to market challenges, positions it for potential growth as conditions improve.

For the second quarter of fiscal 2024, Sanmina expects revenue to be between $1.825 billion and $1.925 billion, with GAAP diluted earnings per share between $0.95 to $1.05 and non-GAAP diluted earnings per share between $1.20 to $1.30. This outlook suggests a cautious but stable performance as the company navigates the current economic landscape.

Investors and potential GuruFocus.com members interested in the detailed financials can access the full earnings release and additional information on Sanmina's website or listen to the recorded conference call for a deeper dive into the company's financials and strategies.

Sanmina Corp's disciplined approach to cost management and strategic investments, combined with its solid financial performance, make it a company worth watching for value investors seeking opportunities in the hardware sector.

Explore the complete 8-K earnings release (here) from Sanmina Corp for further details.

This article first appeared on GuruFocus.