Sanofi (SNY) Discontinues Tusamitamab Ravtansine Cancer Program

Sanofi SNY announced that it is ending the development of the cancer program called tusamitamab ravtansine based on the outcome of a prespecified interim analysis conducted by an Independent Data Monitoring Committee (IDMC).

The CARMEN-LC03 study investigated tusamitamab ravtansine, a type of an antibody-drug conjugate, as a monotherapy compared to docetaxel in previously treated patients with metastatic non-squamous non-small cell lung cancer whose tumors express high levels of carcinoembryonic antigen-related cell adhesion molecule 5.

The CARMEN-LC03 study had dual primary endpoints – progression-free survival (PFS) and overall survival (OS).

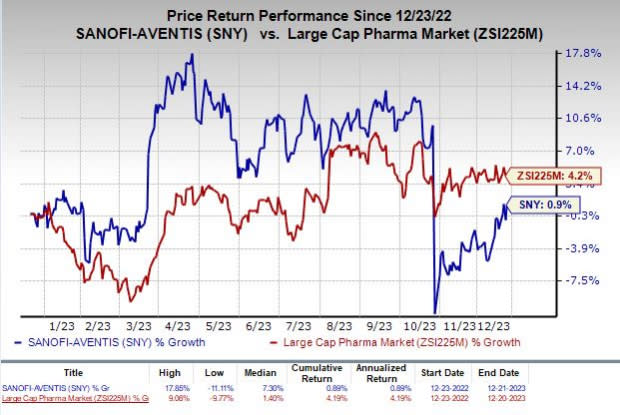

Shares of Sanofi have inched up 0.9% in the past year compared with the industry’s increase of 4.2%.

Image Source: Zacks Investment Research

Per the finding of IDMC, tusamitamab ravtansine failed to meet the dual primary endpoint of improving PFS versus docetaxel in the CARMEN-LC03 study.

Although treatment with tusamitamab ravtansine demonstrated an improved OS trend, Sanofi decided to stop further clinical development of tusamitamab ravtansine based on non-improvement in PFS in the final analysis.

Despite the study data falling short of expectations, management will continue to explore the potential of tusamitamab-based antibody drug conjugates in several other types of cancer indications.

Antibody drug conjugates are being considered a disruptive innovation in the pharmaceutical industry as these allow better treatment of cancer by harnessing the targeting power of antibodies to deliver cytotoxic molecule drugs to tumors.

Zacks Rank & Stocks to Consider

Sanofi currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Taro Pharmaceutical Industries Ltd. TARO, Entrada Therapeutics, Inc. TRDA and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Taro Pharmaceutical’s 2024 earnings per share have improved from 96 cents to $1.10. In the past year, shares of TARO have surged 41.2%.

Earnings of Taro Pharmaceutical beat estimates in two of the last four quarters while missing the same on the remaining two occasions. TARO delivered a four-quarter earnings surprise of 10.06%, on average.

In the past 60 days, estimates for Entrada Therapeutics’ 2024 loss per share have narrowed from $2.35 to $2.04. In the past year, shares of TRDA have decreased 0.7%.

Earnings of Entrada Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. TRDA delivered a four-quarter average earnings surprise of 70.68%.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 56 cents to 64 cents. In the past year, shares of PBYI have lost 4.1%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Taro Pharmaceutical Industries Ltd. (TARO) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Entrada Therapeutics, Inc. (TRDA) : Free Stock Analysis Report