The Saracen Mineral Holdings (ASX:SAR) Share Price Has Soared 1179%, Reaching For The Stratosphere

Saracen Mineral Holdings Limited (ASX:SAR) shareholders might be concerned after seeing the share price drop 19% in the last month. But over five years returns have been remarkably great. Indeed, the share price is up a whopping 1179% in that time. So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for Saracen Mineral Holdings

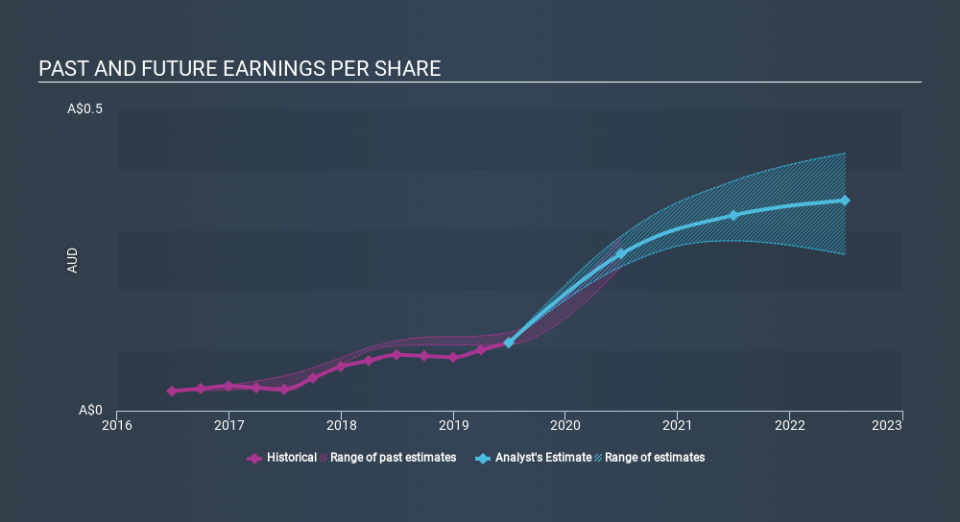

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Saracen Mineral Holdings managed to grow its earnings per share at 65% a year. That makes the EPS growth particularly close to the yearly share price growth of 66%. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Saracen Mineral Holdings has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Saracen Mineral Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Saracen Mineral Holdings's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Saracen Mineral Holdings's TSR, at 1204% is higher than its share price return of 1179%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Saracen Mineral Holdings provided a TSR of 23% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 67% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.