Sarah Ketterer Adjusts Portfolio, Exits iShares MSCI EAFE ETF with Notable Impact

Insights from Causeway Capital Management's Latest 13F Filing

Sarah Ketterer (Trades, Portfolio), the CEO of Causeway Capital Management, has a reputation for her meticulous approach to value investing in global equities. With a focus on international, global, and emerging markets, Ketterer's investment strategy is grounded in rigorous quantitative and value-oriented analysis. Her recent 13F filing for the fourth quarter of 2023 reveals a series of strategic moves, reflecting her commitment to seeking out stocks with the highest expected risk-adjusted return. Ketterer's expertise, honed through years of experience, including her tenure at Hotchkis & Wiley and her education at Stanford University and Dartmouth College, continues to guide her investment decisions.

Summary of New Buys

Sarah Ketterer (Trades, Portfolio) added a total of 10 stocks to her portfolio in the fourth quarter. Noteworthy new acquisitions include:

Analog Devices Inc (NASDAQ:ADI), with 263,109 shares, accounting for 1.33% of the portfolio and a total value of $52.24 million.

Seagate Technology Holdings PLC (NASDAQ:STX), comprising 458,070 shares, representing approximately 1% of the portfolio, with a total value of $39.11 million.

Aptiv PLC (NYSE:APTV), with 363,303 shares, accounting for 0.83% of the portfolio and a total value of $32.60 million.

Key Position Increases

Ketterer also bolstered her stakes in 43 stocks, with significant increases in:

Canadian Pacific Kansas City Ltd (NYSE:CP), with an additional 1,470,042 shares, bringing the total to 5,561,777 shares. This represents a 35.93% increase in share count and a 2.98% impact on the current portfolio, totaling $442.11 million.

JinkoSolar Holding Co Ltd (NYSE:JKS), with an additional 621,339 shares, bringing the total to 826,558. This marks a 302.77% increase in share count, with a total value of $30.53 million.

Summary of Sold Out Positions

Exiting 11 holdings, Ketterer made decisive portfolio adjustments, including:

iShares MSCI EAFE ETF (EFA): All 4,789,941 shares were sold, resulting in an -8.71% impact on the portfolio.

Mondelez International Inc (NASDAQ:MDLZ): The complete liquidation of 772,419 shares caused a -1.41% impact on the portfolio.

Key Position Reductions

Furthermore, Ketterer reduced her position in 31 stocks. The most significant reductions were:

UBS Group AG (NYSE:UBS) by 4,188,922 shares, resulting in a -46.55% decrease in shares and a -2.74% impact on the portfolio. The stock traded at an average price of $26.3 during the quarter and has returned 10.04% over the past three months and -11.36% year-to-date.

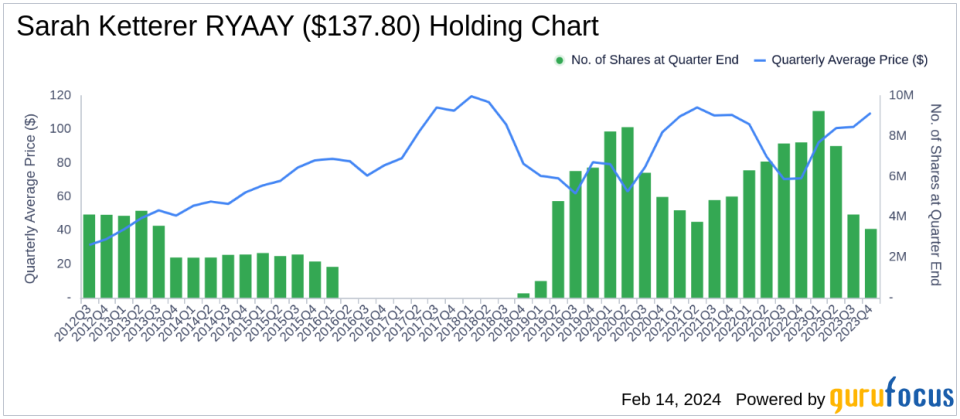

Ryanair Holdings PLC (NASDAQ:RYAAY) by 710,502 shares, resulting in a -17.25% reduction in shares and a -1.82% impact on the portfolio. The stock traded at an average price of $109.81 during the quarter and has returned 25.03% over the past three months and 3.89% year-to-date.

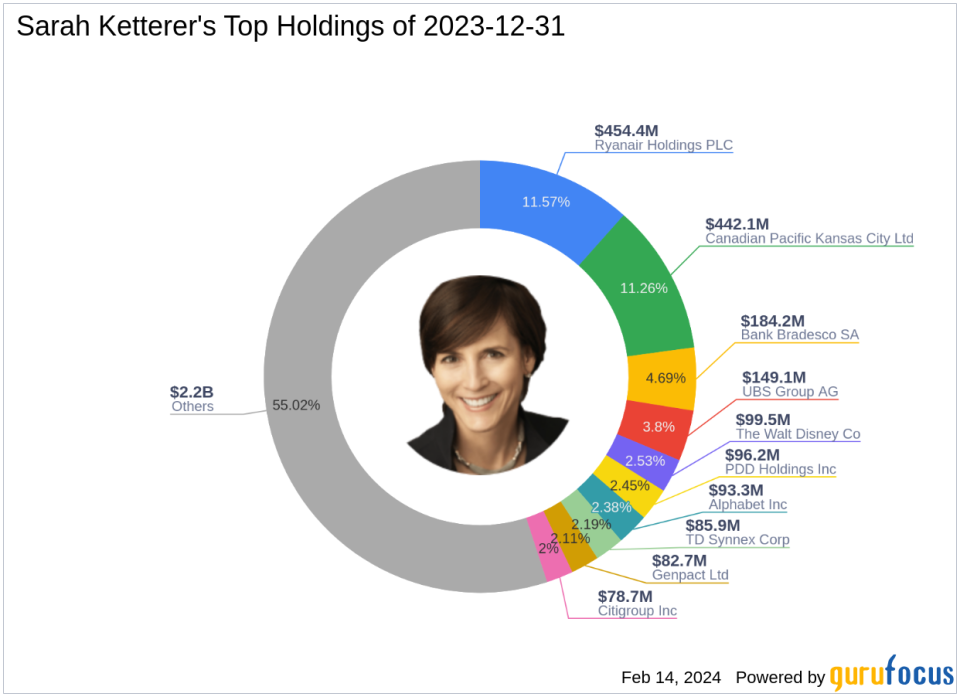

Portfolio Overview

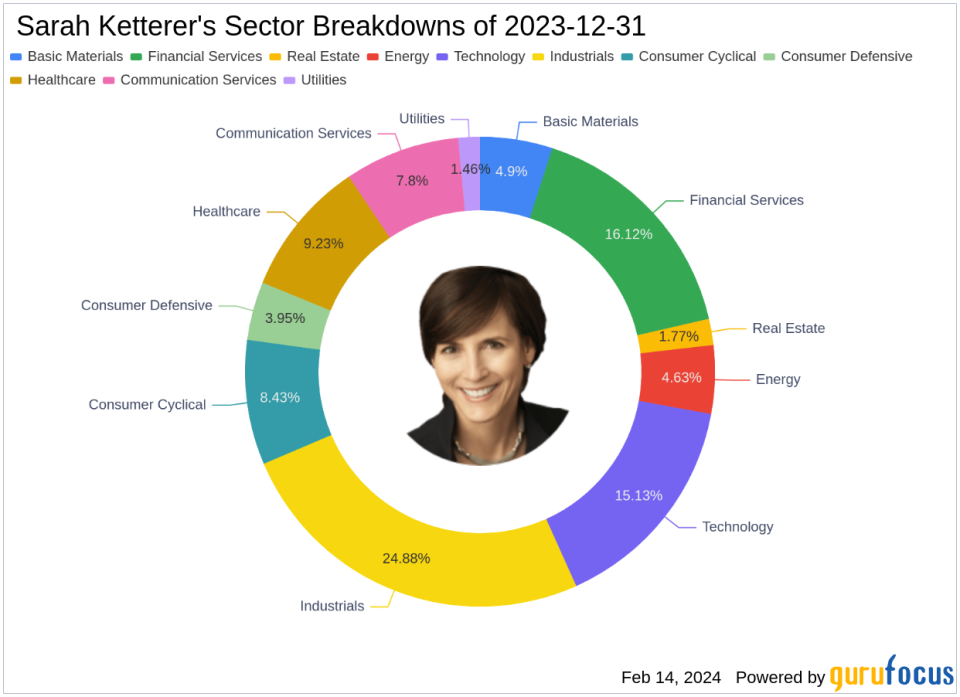

At the end of the fourth quarter of 2023, Sarah Ketterer (Trades, Portfolio)'s portfolio included 89 stocks. The top holdings were 11.57% in Ryanair Holdings PLC (NASDAQ:RYAAY), 11.26% in Canadian Pacific Kansas City Ltd (NYSE:CP), 4.69% in Bank Bradesco SA (NYSE:BBD), 3.8% in UBS Group AG (NYSE:UBS), and 2.53% in The Walt Disney Co (NYSE:DIS). The holdings are mainly concentrated in 11 industries, showcasing a diverse range of sectors from Industrials to Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.