Sarah Ketterer Adjusts Portfolio, Notably Reduces Ryanair Holdings

Insights from Causeway Capital Management's Latest 13F Filing

Sarah Ketterer (Trades, Portfolio), CEO of Causeway Capital Management, has a reputation for her meticulous approach to international and global equity investment. With a career spanning over two decades, Ketterer's expertise lies in identifying undervalued stocks with high dividend yields and lower price/earnings ratios. Her recent 13F filing for Q3 2023 reveals strategic adjustments in her portfolio, reflecting her commitment to risk-adjusted returns.

New Additions to Ketterer's Portfolio

Sarah Ketterer (Trades, Portfolio) has expanded her portfolio with 16 new stocks. Noteworthy additions include:

iShares MSCI EAFE ETF (EFA), with 4,789,941 shares, making up 8.71% of the portfolio and valued at $330.12 million.

Canadian Pacific Kansas City Ltd (NYSE:CP), comprising 4,091,735 shares, or 8.06% of the portfolio, with a total value of $305.51 million.

International Flavors & Fragrances Inc (NYSE:IFF), with 755,351 shares, accounting for 1.36% of the portfolio and valued at $51.49 million.

Significant Increases in Existing Holdings

Additionally, Ketterer has increased her stakes in 40 stocks. Key increases include:

Bank Bradesco SA (NYSE:BBD), with an additional 19,404,902 shares, bringing the total to 64,072,052 shares. This represents a 43.44% increase in share count and a 1.46% impact on the current portfolio, valued at $182.61 million.

Quest Diagnostics Inc (NYSE:DGX), with an additional 181,201 shares, bringing the total to 489,694. This adjustment marks a 58.74% increase in share count, with a total value of $59.67 million.

Exiting Positions

Sarah Ketterer (Trades, Portfolio) has completely exited 8 holdings in the third quarter of 2023, including:

Canadian National Railway Co (NYSE:CNI), selling all 2,887,742 shares, impacting the portfolio by -9.21%.

WestRock Co (NYSE:WRK), liquidating all 2,111,676 shares, with a -1.62% impact on the portfolio.

Notable Reductions in Portfolio

Reductions were also made in 30 stocks, with significant changes in:

Ryanair Holdings PLC (NASDAQ:RYAAY), reduced by 3,388,253 shares, resulting in a -45.14% decrease and a -9.86% portfolio impact. The stock traded at an average price of $101.52 during the quarter and has seen a 7.43% return over the past 3 months and 42.80% year-to-date.

Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), reduced by 912,974 shares, a -64.73% reduction, impacting the portfolio by -2.43%. The stock's average trading price was $94.56 during the quarter, with a 5.53% return over the past 3 months and 31.54% year-to-date.

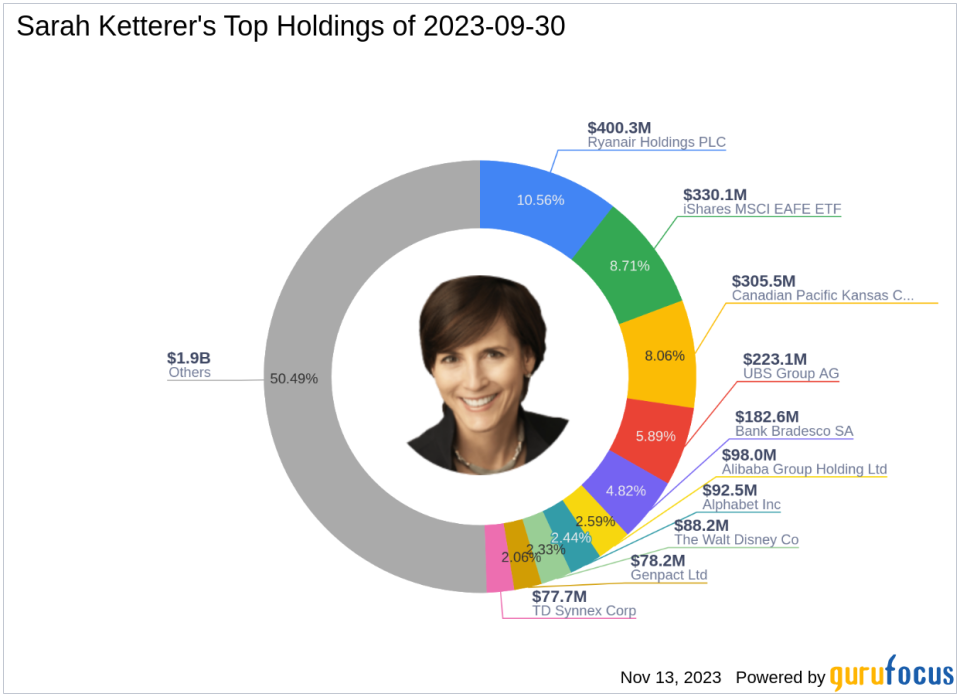

Portfolio Overview

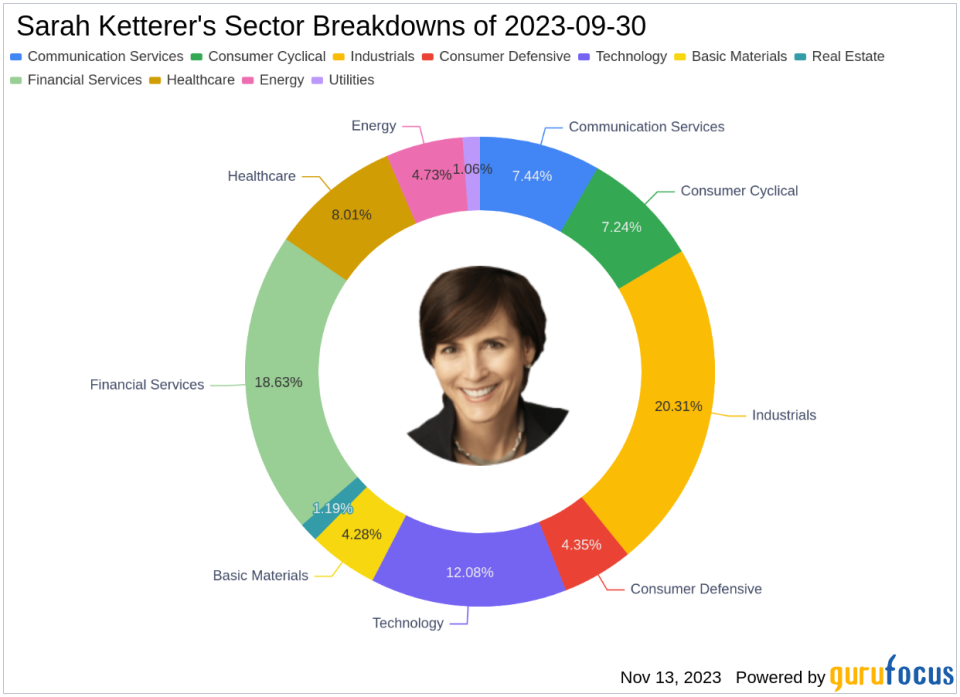

As of Q3 2023, Sarah Ketterer (Trades, Portfolio)'s portfolio consists of 90 stocks. The top holdings include 10.56% in Ryanair Holdings PLC (NASDAQ:RYAAY), 8.71% in iShares MSCI EAFE ETF (EFA), 8.06% in Canadian Pacific Kansas City Ltd (NYSE:CP), 5.89% in UBS Group AG (NYSE:UBS), and 4.82% in Bank Bradesco SA (NYSE:BBD). The investments are diversified across all 11 industries, with a focus on Industrials, Financial Services, and Technology.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.