Sarah Ketterer's Top 2nd-Quarter Trades

Sarah Ketterer (Trades, Portfolio), the CEO and fundamental portfolio manager of Causeway Capital Management, recently released the firm's portfolio updates for the second quarter of 2020, which ended on June 30.

Causeway Capital Management was founded in 2001 by Ketterer and Harry Hartford. The Los Angeles-based firm chooses stocks from among large and mid-cap companies in developed markets around the world. Their screens use quantitative, value-oriented metrics and a "risk score" to find potential investment opportunities. After screening, the investment team chooses the stocks that have the most favorable risk-adjusted returns, price-earnings ratios and dividend yields.

Based on the above criteria, the firm's biggest buys for the quarter were Jones Lang LaSalle Inc. (NYSE:JLL) and Coca-Cola European Partners PLC (NYSE:CCEP), while its biggest sells were Linde PLC (NYSE:LIN) and Manulife Financial Corp. (NYSE:MFC)

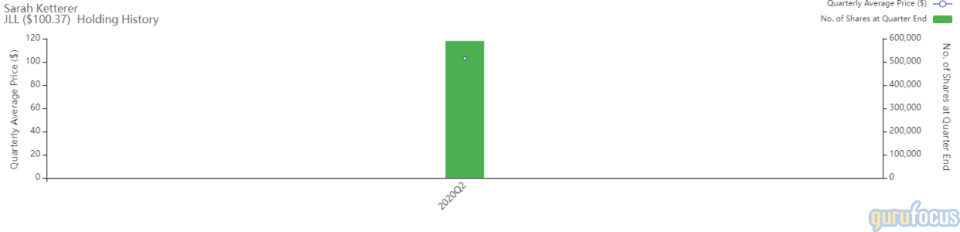

Jones Lang LaSalle

Causeway Capital's biggest new buy for the quarter was Jones Lang LaSalle. The firm established a position of 589,971 shares in the company, impacting the equity portfolio by 1.10%. Shares traded for an average price of $103.08 during the quarter.

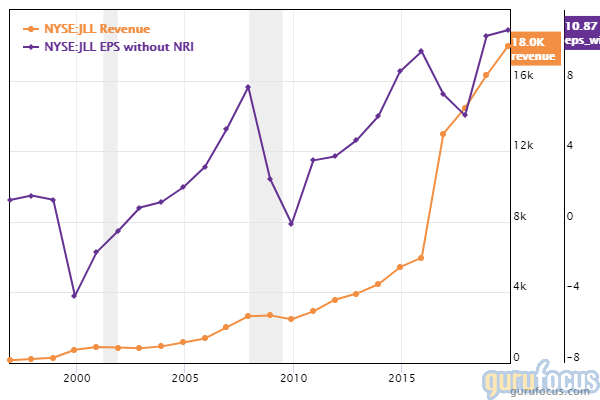

Based in Chicago, Jones Lang LaSalle is a commercial real estate company that also provides a range of investment management services. It buys, builds and invests in a variety of assets ranging from real estate to banking and technology.

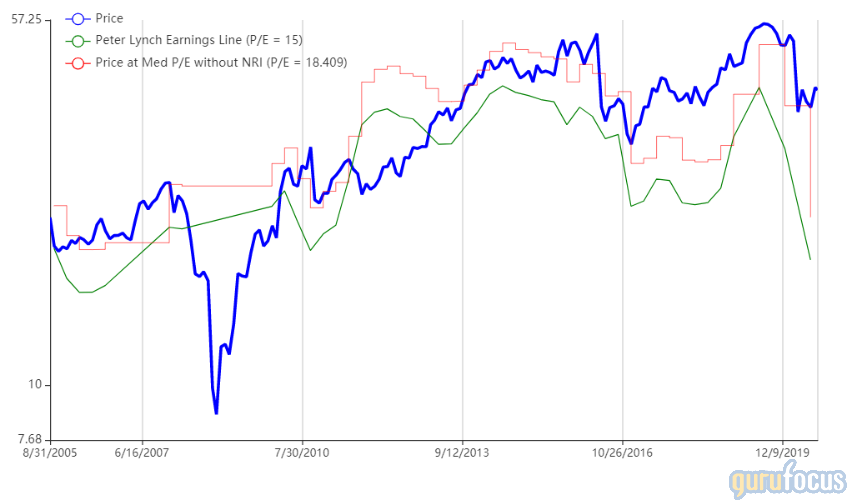

On Aug. 18, shares of Jones Lang LaSalle traded around $98.14 for a market cap of $5.08 billion and a price-earnings ratio of 12.4. According to the Peter Lynch chart, the stock is trading below its fair value.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.13 is lower than 67.21% of competitors, but the Altman Z-Score of 2.39 indicates financial stability. The company has a three-year revenue growth rate of 8.6% and a three-year earnings per share without non-recurring items growth rate of 14.6%.

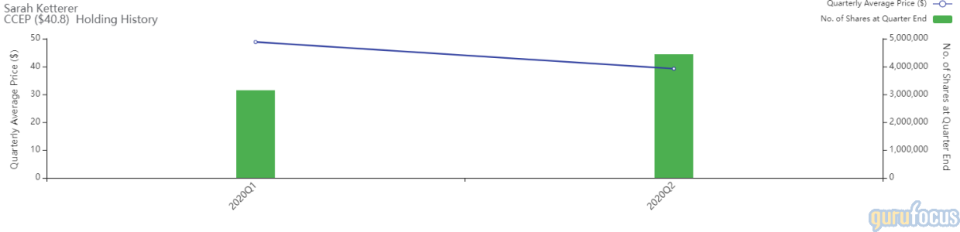

Coca-Cola European Partners

The firm also upped its stake in Coca-Cola European Partners by 1,294,229 shares, increasing the position by 41.11% for a total holding of 4,442,140 shares. The trade had a 0.88% impact on the equity portfolio. During the quarter, shares traded for an average price of $39.22.

Coca-Cola European Partners is a U.K.-based multinational bottling company that produces, distributes and markets Coca-Cola (KO) products primarily in Europe. It is the largest Coca-Cola bottling partner in terms of revenue.

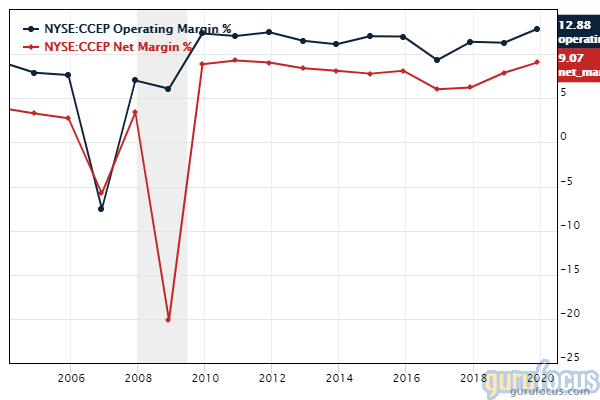

On Aug. 18, shares of Coca-Cola European Partners traded around $40.86 for a market cap of $18.74 billion and a price-earnings ratio of 19.42. According to the Peter Lynch chart, the stock is trading slightly above its fair value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The Altman Z-Score of 1.68 indicates the company could be in danger of bankruptcy without raising additional liquidity, but the interest coverage ratio of 10.26 shows it can pay its short-term debt. The company has improved its margins in recent years, with the operating margin of 12.88% outclassing the industry median of 6.82%.

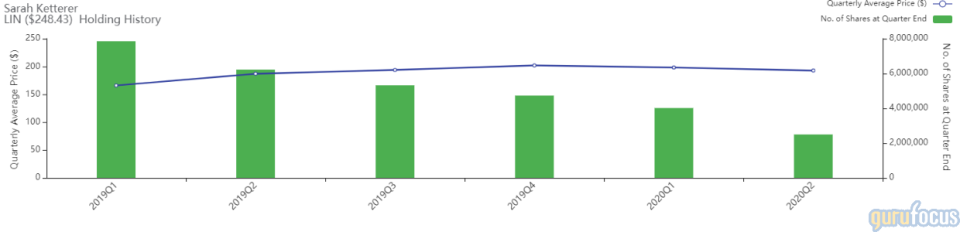

Linde

The firm cut its position in Linde by 1,523,283 shares, or 37.95%, leaving a remaining holding of 2,490,923 shares. The trade had a -4.21% impact on the equity portfolio and brought the position down from the firm's largest holding to its third-largest holding. Shares traded for an average price of $192.72 during the quarter.

Based in Dublin, Ireland, Linde is an industrial chemicals and engineering company. It produces specialty gases, including atmospheric gases such as oxygen and argon and process gasses such as carbon dioxide and acetylene.

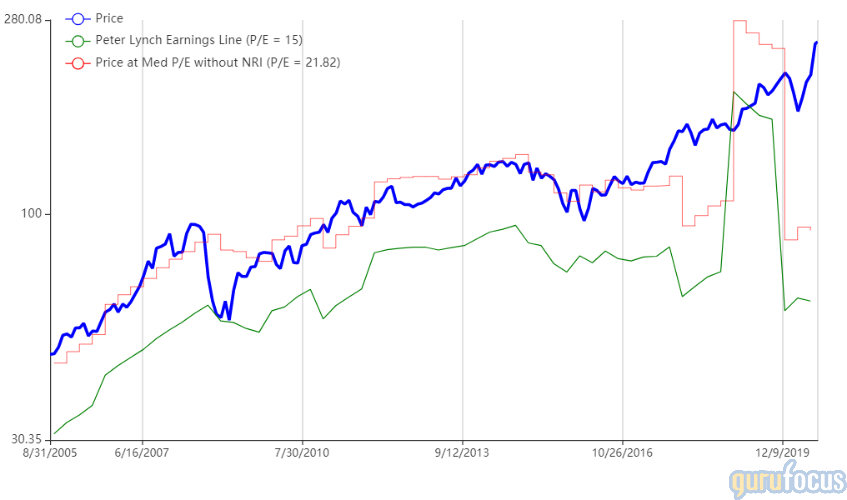

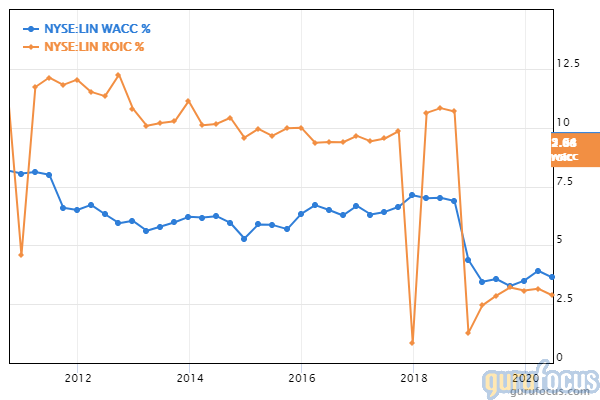

On Aug. 18, shares of Linde traded around $247.32 per share for a market cap of $129.93 billion and a price-earnings ratio of 58.59. According to the Peter Lynch chart, the stock is trading significantly above its fair value.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. The Altman Z-Score of 2.74 and the interest coverage ratio of 13.64 indicate the company is able to comfortably meet debt obligations. The return on invested capital has dropped below the weighted average cost of capital in recent years, meaning the company is losing value for shareholders.

Manulife Financial

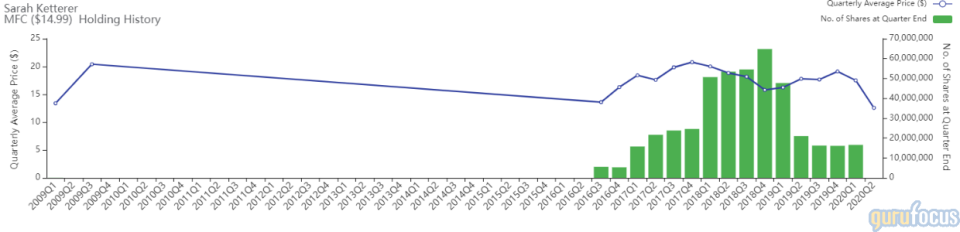

The firm sold out of its 16,584,151-share stake in Manulife Financial, impacting the equity portfolio by -3.32%. During the quarter, shares traded for an average price of $12.57.

Manulife Financial is a multinational insurance company headquartered in Toronto. Operating as Manulife in Canada and Asia and as John Hancock Financial in the U.S., the company provides financial advice, insurance and wealth management solutions.

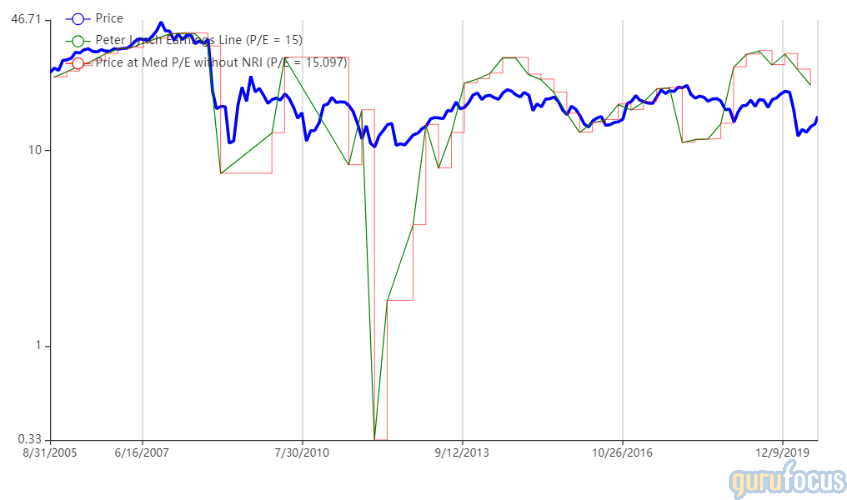

On Aug. 18, shares of Manulife traded around $14.92 for a market cap of $28.79 billion and a price-earnings ratio of 10.14. According to the Peter Lynch chart, the stock is trading below its fair value.

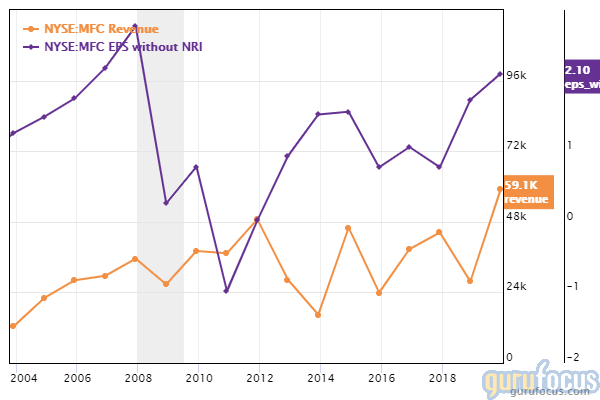

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 5 out of 10. The cash-debt ratio of 1.95 is higher than 52.68% of competitors, though the interest coverage ratio of 4.42 is lower than the industry median of 12.76. The company's earnings have grown since falling in the 2008 recession, with a three-year revenue growth rate of 14.9% and a three-year EPS without NRI growth rate of 25.2%.

Portfolio overview

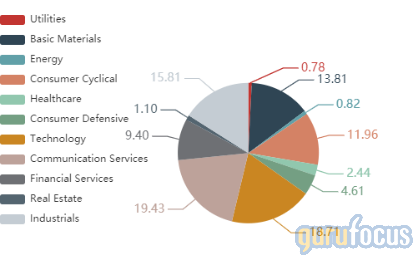

As of the quarter's end, the equity portfolio contained positions in 79 stocks and was valued at $5.55 billion. The firm made eight new buys, sold out of 14 stocks and added to or reduced its positions in several other holdings for a turnover ratio of 5%.

The firm's top holdings were Baidu Inc. (BIDU) with 13.13% of the equity portfolio, Ryanair Holdings PLC (RYAAY) with 10.09% and Linde with 9.51%. In terms of sector weighting, the firm was most invested in communication services, technology and industrials.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Top 3 New Buys of Ron Baron's Firm

Third Avenue's Top 2nd-Quarter Portfolio Updates

Biggest 2nd-Quarter Trades of Jeremy Grantham's Firm

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.