Sarepta (SRPT) Q3 Loss Narrower Than Expected, Sales Beat

Sarepta Therapeutics, Inc. SRPT reported a loss of 46 cents per share in the third quarter of 2023, narrower than the Zacks Consensus Estimate of a loss of $1.66. In the year-ago period, the company posted a loss of $2.94 per share.

The loss included depreciation and amortization expenses and stock-based compensation expenses. The adjusted earnings per share in the quarter stood at 37 cents against the year-ago period’s adjusted loss of 80 cents per share.

Sarepta recorded total revenues of $331.8 million, up 44% year over year. The year-over-year increase in revenues was driven by sales of Sarepta’s four approved marketed therapies for Duchenne muscular dystrophy (“DMD”).The reported revenues beat the Zacks Consensus Estimate of $286 million.

Quarter in Detail

Sarepta’s commercial portfolio includes three approved RNA-based PMO therapies — Exondys 51, Vyondys 53 and Amondys 45 — and the recently approved Elevidys gene therapy, all targeting DMD indication.

The company’s product revenues were up 49% year over year at $309.3 million, which beat our model estimates of $256.9 million. The upside was driven by an increased demand for its marketed products.

Sarepta generated $240.2 million from the product sales of its three PMO therapies, up 16% year over year.

During the third quarter, Sarepta commercially launched Elevidys (delandistrogene moxeparvovec, or SRP-9001), which recently received accelerated approval from the FDA as the first gene therapy for DMD. The recently launched therapy generated $69.1 million in sales, which beat our model estimates of $15 million.

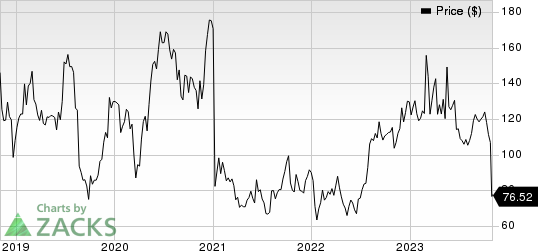

Shares were up 1.9% in after-market trading on Nov 1, likely due to the encouraging Elevidys sales. In the year so far, the stock has plunged 41% compared with the industry’s 24.3% fall.

Image Source: Zacks Investment Research

The company recorded $22.5 million in collaboration revenues, primarily from its licensing agreement with Roche RHHBY. In the year-ago period, management recorded $22.5 million as collaboration revenues, which were also received from Roche.

Sarepta and Roche entered into a licensing agreement in 2019 to develop Elevidys. Per the agreement, Roche has exclusive rights to launch and commercialize Elevidys in ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $163.9 million in the third quarter, down 15% year over year. This downside is attributable to a decline in manufacturing expenses incurred during the quarter, partially offset by an increase in clinical study expenses.

Adjusted selling, general & administrative (SG&A) expenses were $92.8 million, up 39% year over year. The upside was driven primarily by an increase in professional service expenses incurred by the company for Elevidys’ launch.

2023 Guidance

Sarepta reiterated its previously issued product revenue guidance for the three approved PMO drugs, which are expected to generate more than $925 million in 2023.

Though management did not issue guidance on Elevidys sales, it expects overall product revenues (across all four approved products) to exceed $1 billion for the full year substantially.

Pipeline Updates

Last month, Sarepta reported topline data from the phase III EMBARK study, the proposed confirmatory study for full approval of Elevidys in DMD indication. Though data from the study supports the conclusion that treatment with Elevidys modifies the course of DMD indication, the study failed to achieve its primary endpoint. However, treatment with Elevidys achieved statistical significance on all pre-specified key secondary endpoints across all age groups.

Management claims to have shared these results with the FDA, who have confirmed that they are open to such label expansion if supported by a review of the data and that they intend to proceed rapidly with consideration of the submission. Sarepta intends to submit a regulatory filing with the FDA soon.

To satisfy regulatory requirements for Elevidys’ approval outside the United States, Sarepta is also evaluating the safety and efficacy of Elevidys in the ongoing phase III ENVISION study in non-ambulatory and ambulatory DMD patients.

Sarepta Therapeutics, Inc. Price

Sarepta Therapeutics, Inc. price | Sarepta Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Sarepta currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector are Dynavax Technologies DVAX and Ligand Pharmaceuticals LGND, each carrying a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Ligand Pharmaceuticals’ 2023 earnings per share have increased from $5.09 to $5.10. During the same period, earnings estimates for 2024 rose from $4.56 to $4.59. Shares of Ligand lost 20.2% in the year-to-date period.

Ligand beat earnings estimates in three of the last four quarters while missing the mark on one occasion. The company has delivered an earnings surprise of 52.47% on average. In the last reported quarter, Ligand’s earnings beat estimates by 86.84%.

In the past 30 days, Dynavax’s loss per share estimates for 2023 have narrowed from 23 cents to 22 cents for 2023 in the past 30 days. During the same period, earnings estimates for 2024 rose from 3 cents to 8 cents. Shares of DVAX have gained 32.5% in the year so far.

Dynavax beat estimates in two of the trailing four quarters and missed in the remaining two, witnessing an average earnings surprise of 25.78%. In the last reported quarter, Dynavax’s earnings beat estimates by 133.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report