Sarepta (SRPT) to Report Q4 Earnings: Will It Beat Estimates?

We expect Sarepta Therapeutics SRPT to beat expectations when it reports fourth-quarter and full-year 2023 results. In the last reported quarter, the company delivered an earnings surprise of 72.29%.

Factors to Note

Sarepta generates the majority of its revenues from the sales of its four approved marketed therapies, all targeting Duchenne muscular dystrophy (DMD), which is the most common form of muscular dystrophy. Out of these four therapies, three of them (namely Exondys 51, Vyondys 53 and Amondys 45) utilize the PMO technology, while the fourth one is a one-shot gene therapy.

Investor focus will likely be on the product sales for the gene therapy, marketed under the trade name Elevidys, which was granted accelerated approval by the FDA last June to treat ambulatory pediatric patients aged between four and five years with DMD. It is also the first one-shot gene therapy for DMD.

Last month, Sarepta reported encouraging preliminary/unaudited results for the fourth quarter and full-year 2023. Per management, Elevidys’ sales are expected to be around $131.3 million for the fourth quarter, bringing the total sales figure to around $200.4 million for the full year. This is an encouraging figure for a treatment that was commercially launched in the third quarter of 2023.

Sarepta also submitted an efficacy supplement to the biologics license application (BLA) seeking to expand Elevidys’ label. The purpose of the efficacy supplement is two-fold — not only does it seek to convert Elevidys accelerated approval to a full one, it also seeks approval to expand the therapy’s label to treat all DMD patients, irrespective of age and ambulation status. Last week, this efficacy supplement was accepted by the FDA for review last week and also granted priority review status. A final decision from the agency is expected by Jun 21, 2024.

Elevidys is yet to be launched outside of the United States. To satisfy regulatory requirements for the therapy’s approval outside the country, Sarepta is also evaluating the safety and efficacy of Elevidys in the ongoing phase III ENVISION study in non-ambulatory and ambulatory DMD patients. Investors would likely seek updates on this study from management.

Elevidys has been developed by the company in collaboration with Roche RHHBY. Sarepta and Roche entered into a licensing agreement in 2019 to develop and commercialize Elevidys jointly. Per the agreement, Roche has exclusive rights to launch and commercialize the gene therapy in ex-U.S. markets. As part of the agreement, Sarepta will record collaboration revenues on the ex-U.S. sales made by Roche.

Earnings Surprise History

The company’s surprise history has been impressive, with earnings beating estimates in each of the trailing four quarters. The average surprise is 48.67%.

Sarepta Therapeutics, Inc. Price and EPS Surprise

Sarepta Therapeutics, Inc. price-eps-surprise | Sarepta Therapeutics, Inc. Quote

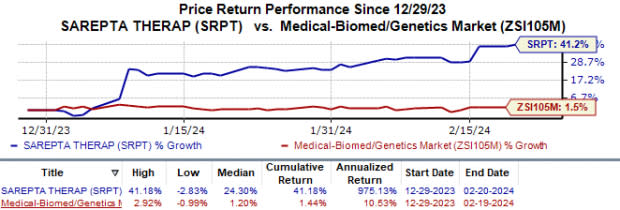

Sarepta’s shares have surged 41.2% year to date compared with the industry’s 1.4% growth.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for Sarepta this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Sarepta’s Earnings ESP is +877.29% as the Most Accurate Estimate of 19 cents is higher than the Zacks Consensus Estimate of a loss of 2 cents.

Zacks Rank: Sarepta has a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are some biotech stocks that have the right combination of elements to beat on earnings this time around:

Arcutis Biotherapeutics ARQT has an Earnings ESP of +25.58% and a Zacks Rank #3.

Arcutis’ stock has surged 193.5% year to date. Arcutis beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, ARQT delivered an earnings surprise of 9.23% in the last four quarters. Arcutis Biotherapeutics is scheduled to release its fourth-quarter results on Feb 27, before market open.

Cullinan Oncology CGEM has an Earnings ESP of +1.04% and a Zacks Rank #2.

Cullinan Oncology’s stock has risen 70.8% year to date. Cullinan beat earnings estimates in two of the last four quarters and missed the mark on one occasion while meeting the mark on another. On average, CGEM witnessed a negative earnings surprise of 10.66% in the last four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

Cullinan Oncology Inc. (CGEM) : Free Stock Analysis Report