SBA Communications Corp (SBAC) Reports Q4 2023 Results and Provides 2024 Outlook

Site Leasing Revenue: Increased to $636.1 million in Q4 2023, up 4.3% year-over-year.

Net Income: Grew to $109.5 million, a 6.7% increase from Q4 2022.

AFFO Per Share: Rose by 8.0% to $3.37 in Q4 2023 compared to the same period last year.

Quarterly Dividend: Boosted by approximately 15% to $0.98 per share.

Debt Management: Net debt to Adjusted EBITDA leverage ratio reduced to 6.3x, the lowest in decades.

Portfolio Growth: Acquired 23 sites and built 138 towers in Q4 2023, with 281 sites under contract for future acquisition.

2024 Outlook: Site leasing revenue projected between $2,529.0 million and $2,549.0 million, with AFFO per share estimated at $13.15 to $13.51.

SBA Communications Corp (NASDAQ:SBAC) released its 8-K filing on February 26, 2024, detailing a robust fourth quarter for 2023 and providing a positive outlook for the full year of 2024. The company, a leading independent owner and operator of wireless communications infrastructure, operates nearly 40,000 cell towers across North America, South America, and Africa. With a significant presence in the U.S. and Brazil, SBA Communications functions as a real estate investment trust (REIT), focusing on leasing space on its towers to top mobile carriers.

Financial Performance and Challenges

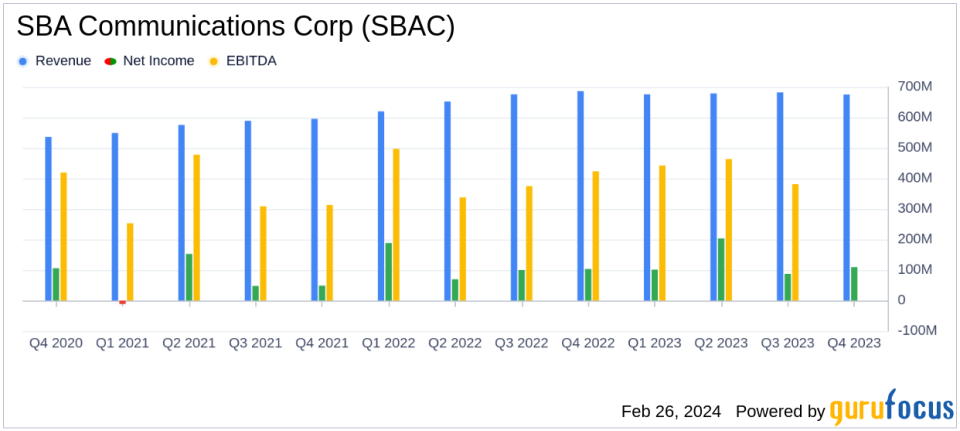

SBA Communications experienced a 4.3% increase in site leasing revenue, reaching $636.1 million in the fourth quarter of 2023. The company's net income also saw an uptick, growing by 6.7% to $109.5 million. Adjusted EBITDA and AFFO improved by 4.3% and 7.3%, respectively, with AFFO per share increasing by 8.0% to $3.37. This performance underscores the company's ability to generate growth despite a year marked by higher interest rates and subdued domestic carrier activity.

However, the company faced challenges, including a 49.1% decrease in site development revenue and the impact of foreign exchange rates on its international operations. Despite these hurdles, SBA Communications' strategic focus on debt reduction and capital allocation has positioned it for continued financial health, as evidenced by the lowest net debt to Adjusted EBITDA leverage ratio in decades at 6.3x.

Strategic Financial Management

The company's financial achievements are particularly noteworthy for a REIT like SBA Communications. The increase in the quarterly dividend by approximately 15% to $0.98 per share reflects confidence in the company's steady cash flow and its commitment to delivering shareholder value. The dividend represents less than 30% of the AFFO projected for 2024, leaving substantial capital for potential portfolio growth and stock repurchases.

During the fourth quarter, SBA Communications continued to expand its portfolio, acquiring 23 communication sites and constructing 138 new towers. As of December 31, 2023, the company owned or operated 39,618 communication sites. Additionally, subsequent to the fourth quarter, the company has either purchased or is under contract to purchase 281 communication sites for a total of $87.8 million in cash, expected to be completed by the end of the third quarter of 2024.

"We had a strong finish to 2023, exceeding our outlook for Site Leasing Revenue, Tower Cash Flow, Adjusted EBITDA and AFFO," commented Brendan Cavanagh, President and Chief Executive Officer. "The strength and quality of our core business gives me great confidence about our prospects to create increased value for our shareholders for years into the future."

2024 Outlook and Strategic Initiatives

Looking ahead, SBA Communications provided an optimistic outlook for 2024, with site leasing revenue expected to be between $2,529.0 million and $2,549.0 million. The company anticipates AFFO to range from $1,433.0 million to $1,473.0 million, translating to an AFFO per share of $13.15 to $13.51. These projections are based on current market conditions and do not account for potential acquisitions not yet identified or under contract.

The company's strategic initiatives include refinancing activities to optimize its debt profile and a commitment to capital expenditures that support growth and operational efficiency. With a focus on maintaining a strong balance sheet and leveraging its extensive portfolio of communication sites, SBA Communications is well-positioned to capitalize on the ongoing demand for wireless infrastructure driven by 5G upgrades and other technological advancements.

For detailed financial tables and further information, readers can access the full 8-K filing. SBA Communications' solid performance and strategic direction underscore its potential as an attractive investment for those interested in the REIT sector and wireless communications infrastructure.

Explore the complete 8-K earnings release (here) from SBA Communications Corp for further details.

This article first appeared on GuruFocus.