SBA Communications' (SBAC) Q3 AFFO Beat, '23 View Raised

SBA Communications Corporation SBAC reported third-quarter 2023 adjusted funds from operations (AFFO) per share of $3.34, beating the Zacks Consensus Estimate of $3.23. The figure also reflects a rise of 7.4% from the prior-year quarter.

SBAC’s site-leasing revenues improved year over year on healthy leasing activity amid elevated tower space demand. Moreover, it has continued to benefit from the addition of sites to its portfolio. The company also raised its 2023 outlook.

Quarterly total revenues increased 1% year over year to $682.5 million. The figure also beat the Zacks Consensus Estimate of $678 million.

Jeffrey Stoops, the president and CEO of the company, said, “We posted strong financial results for the third quarter, exceeding estimates and our own expectations. Customer activity varied by region, with US customers less active in the aggregate with their wireless networks year over year, and international customers more active than we expected. Despite higher interest expense, we generated solid AFFO in the quarter, providing ample cash for discretionary spending and strong dividend coverage. Long-term, the quality of our assets and our operational execution position us well to capitalize on the continuing growth in wireless data consumption and the resulting necessary investment of our carrier customers into the development and expansion of their 5G networks.

Quarter in Detail

Site-leasing revenues were up 8.5% year over year to $637.4 million, which surpassed our expectation of $624.6 million. Quarterly Site-leasing revenues consisted of domestic site-leasing revenues of $468.4 million and international site-leasing revenues of $169.1 million. The domestic cash site-leasing revenues came in at $461 million, growing 5.4% year over year. International cash site leasing revenues came in at $169.4 million, jumping 22.4% year over year.

However, site development revenues decreased 48.9% year over year to $45.1 million. Our expectation for the same was $50.9 million.

The site-leasing operating profit was $519.2 million, marking an increase of 9.2% year over year. Moreover, 97.4% of SBAC’s total operating profit in the quarter came from site leasing.

The overall operating income improved 2.3% to $248.6 million.

The adjusted EBITDA totaled $482.1 million, up 7.9%, while the adjusted EBITDA margin increased to 71.4% from 67.3% in the prior-year quarter.

Portfolio Activity

In the third quarter, SBAC acquired 45 communication sites for a total cash consideration of $40.8 million. The company also built 86 towers during this period. It owned or operated 39,546 communication sites as of Sep 30, 2023, of which 17,469 were in the United States and its territories and 22,077 internationally.

SBA Communications also spent $15.1 million to purchase land and easements and extend lease terms. Total cash capital expenditure was $114.5 million in the reported quarter, of which $99.8 million represented discretionary and $14.7 million was non-discretionary.

Subsequent to the quarter end, SBAC purchased or is under contract to buy 215 communication sites for a total consideration of $74 million in cash. It expects to complete the acquisition by the end of the second quarter of 2024.

Cash Flow & Liquidity

In the third quarter, SBA Communications generated nearly $313.7 million of net cash from operating activities compared with the year-ago quarter’s $332.5 million.

As of Sep 30, 2023, it had $228.9 million in cash and cash equivalents, short-term restricted cash and short-term investments, down from $273.6 million recorded as of Jun 30, 2023. SBAC ended the quarter with a net debt-to-annualized adjusted EBITDA of 6.4X.

As of Nov 2, 2023, the company had $285 million outstanding under the $1.5 billion revolving credit facility.

During and following the third quarter of 2023, SBAC repurchased 0.5 million shares of its Class A common stock for $100.0 million. As of Nov 2, 2023, it had $404.7 million of authorization remaining under its $1 billion stock repurchase plan.

Dividend Update

Concurrent with the earnings release, SBAC announced a cash dividend of 85 cents on its Class A common stock. The dividend will be paid out on Dec 14 to shareholders of record as of Nov 16, 2023.

2023 Guidance Raised

SBAC now expects AFFO per share in the range of $12.91-$13.13, up from the prior guided range of $12.80-$13.16. The Zacks Consensus Estimate for the same is currently pegged at $12.91, which is within the guided range.

Further, the adjusted EBITDA has been raised from $1,878-$1,898 million to $1,886-$1,896 million.

Site-leasing revenues are now projected to be $2,510-$2,520 million, revised upward from $2,502-$2,522 million. However, Site-development revenues are expected to be between $195 million and $205 million, down from the prior guided range of $205-$225 million.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

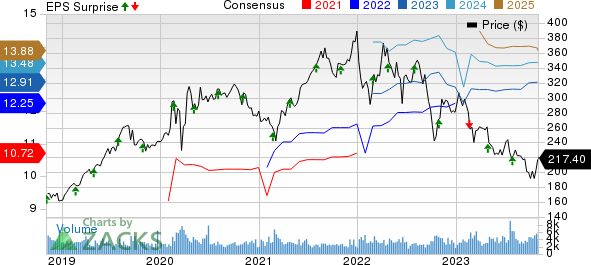

SBA Communications Corporation Price, Consensus and EPS Surprise

SBA Communications Corporation price-consensus-eps-surprise-chart | SBA Communications Corporation Quote

Performance of Other REITs

Crown Castle Inc. CCI reported a third-quarter 2023 AFFO per share of $1.77, which lagged the Zacks Consensus Estimate by a whisker. The reported figure declined 4.3% from the year-ago quarter.

CCI’s results reflect lower-than-anticipated revenues. Higher interest expense and lower contribution from adjusted EBITDA were undermining factors. While CCI maintained its outlook for 2023, it issued 2024 AFFO per share guidance below the consensus mark.

Prologis, Inc. PLD reported third-quarter 2023 core funds from operations (FFO) per share of $1.30, beating the Zacks Consensus Estimate of $1.26. The figure, however, declined 24.9% from the year-ago quarter.

The results of this industrial REIT reflect healthy rent growth. However, lower occupancy and higher interest expenses were undermining factors. PLD also raised the midpoint of its 2023 core FFO per share guidance by a cent.

Digital Realty Trust DLR reported a third-quarter 2023 core FFO per share of $1.62, in line with the Zacks Consensus Estimate.

Results reflected better-than-anticipated revenues, aided by strong enterprise leasing activity. The company registered operating revenues of $1.402 billion in the third quarter, surpassing the Zacks Consensus Estimate marginally. DLR also reported "same-capital" cash net operating income growth of 9.4% in the third quarter.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Crown Castle Inc. (CCI) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report