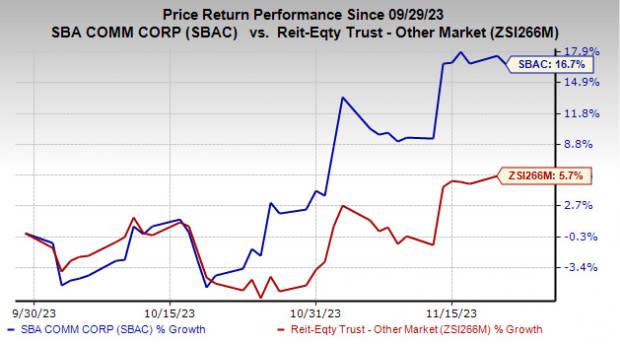

SBA Communications (SBAC) Soars 16.7% QTD: Will the Trend Last?

Shares of SBA Communications SBAC have rallied 16.7% quarter to date compared with the industry’s rise of 5.7%.

High capital spending by wireless carriers for network expansion amid accelerated 4G and 5G network deployment efforts has benefitted this Boca Raton, FL-based communication tower real estate investment trust (REIT) over the past few quarters. Also, its portfolio expansion efforts and healthy balance sheet strength paid off well.

Earlier this month, SBAC reported third-quarter 2023 adjusted funds from operations (AFFO) per share of $3.34, beating the Zacks Consensus Estimate of $3.23. The quarterly results were backed by a year-over-year rise in site-leasing revenues on healthy leasing activity amid elevated tower space demand.

Image Source: Zacks Investment Research

Let us now find out the factors behind the surge in the stock price and check whether this trend will last.

The advancement in mobile technology, such as 4G and 5G networks, and the proliferation of bandwidth-intensive applications have driven growth in mobile data use globally. This has led wireless service providers and carriers to expand their networks and deploy additional equipment for existing networks to enhance network coverage and capacity to meet the rising consumer demand, poising SBA Communications well for growth.

SBAC, currently carrying a Zacks Rank #3 (Hold), has a resilient and stable site-leasing business model and generates most of its revenues from long-term (typically five to 10 years) tower leases with built-in rent escalators. This assures stable site-leasing revenues growth for SBA Communication over the long term.

SBA Communications’ site-leasing revenue growth is likely to be robust in the upcoming period, with wireless service providers continuing to lease additional antenna space on the company’s towers amid the increase in network use, data transfer, network expansion and network coverage requirements. We expect its 2023 site-leasing revenues to increase 7.7% year over year.

The company’s portfolio expansion efforts into domestic and select international markets with high-growth characteristics position it well to take advantage of secular trends in mobile data use and wireless spending growth worldwide. In the third quarter of 2023, the company acquired 45 communication sites for a total cash consideration of $7.2 million. It also built 64 towers during this period.

Subsequent to the end of the third quarter, SBAC purchased or is under contract to buy 215 communication sites for a total consideration of $74 million in cash. The company expects to conclude these buyouts by the second quarter of 2024.

SBA Communications maintains a healthy balance sheet position. It exited the third quarter of 2023 with $228.9 million of cash and cash equivalents, short-term restricted cash, and short-term investments.

The company’s net debt-to-annualized adjusted EBITDA was 6.4X as of Sep 30, 2023, improving sequentially from 6.6X. As of Nov 2, 2023, it had only $285 million outstanding under its $1.5-billion revolving credit facility. With ample financial flexibility, SBAC is well-positioned to capitalize on long-term growth opportunities.

Further, the company’s current cash flow growth is projected at 14.77% compared with the average of 8.10% estimated for the industry.

Solid dividend payouts are arguably the biggest enticement for REIT shareholders and SBA Communications has been committed to the same. Notably, it increased its dividend four times in the last five years, and the five-year annualized dividend growth rate is 23.56%. Such efforts enhance shareholders’ wealth and boost investors’ confidence in the stock. Check SBA Communications’ dividend history here

The company raised its outlook for 2023 AFFO per share to $12.91-$13.13 from the prior guided range of $12.80-$13.16.

Analysts, too, seem bullish on the company. The Zacks Consensus Estimate for SBAC’s current-year FFO per share has been raised marginally in the past month to $12.97, indicating a favorable outlook.

Nonetheless, an increase in customer concentration, ongoing consolidation in the wireless industry and high interest rates pose near-term concerns for the company.

Stocks to Consider

Some better-ranked stocks from the REIT sector are Welltower WELL, EastGroup Properties EGP and Stag Industrial STAG, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s current-year FFO per share has moved marginally northward over the past month to $3.58.

The Zacks Consensus Estimate for EastGroup Properties’ 2023 FFO per share has moved marginally upward in the past month to $7.69.

The Zacks Consensus Estimate for Stag Industrial’s ongoing year’s FFO per share has been raised 1.3% upward over the past month to $2.28.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report