Is SBA Communications (SBAC) a Value Trap? An In-depth GF Value Analysis

SBA Communications Corp (NASDAQ:SBAC) recently saw a daily gain of 3.94%, with an Earnings Per Share (EPS) of $3.42. However, the question arises: Is this stock a potential value trap? This article offers a comprehensive valuation analysis of SBA Communications (NASDAQ:SBAC) to answer this question. Let's delve into the details.

Understanding SBA Communications Corp (NASDAQ:SBAC)

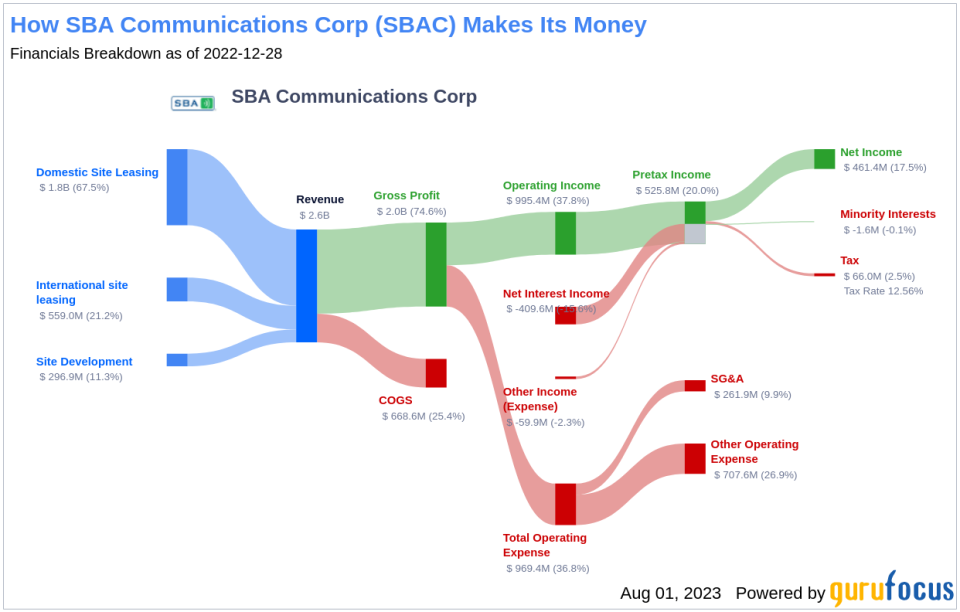

SBA Communications owns and operates almost 40,000 cell towers across North America, South America, and Africa. It leases space on its towers to wireless service providers, supporting their wireless networks. The company has a concentrated customer base, with the top few mobile carriers in each market generating most of its revenue. SBA Communications operates as a real estate investment trust, or REIT. The following income breakdown provides further insight into SBA Communications' financial performance:

Deciphering the GF Value of SBA Communications (NASDAQ:SBAC)

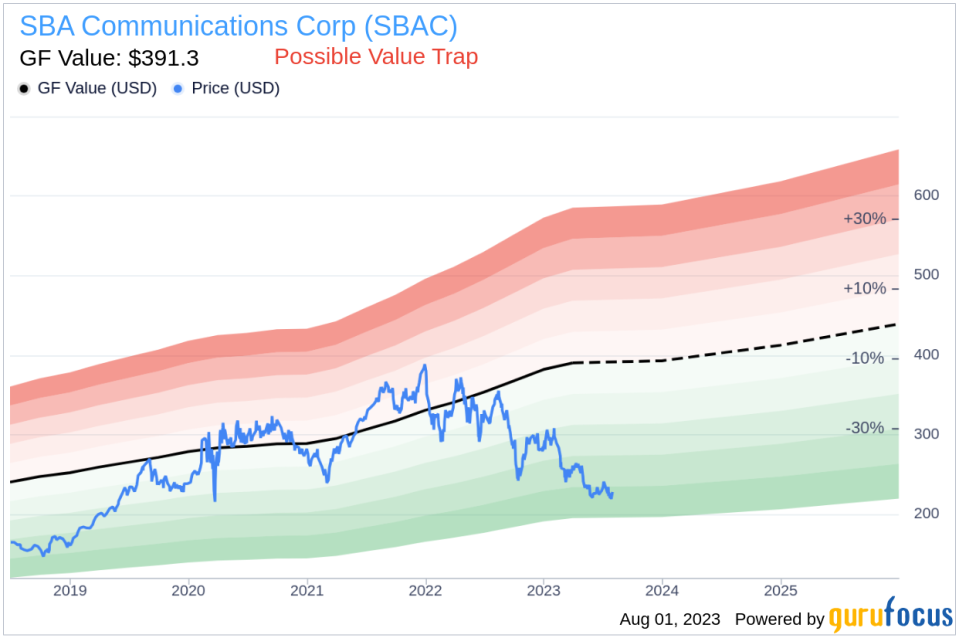

The GF Value is a proprietary measure of a stock's intrinsic value, calculated considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. This value indicates the fair trading value of the stock. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus' valuation method, SBA Communications (NASDAQ:SBAC) appears to be a potential value trap. The GF Value estimates the stock's fair value at $391.3, significantly above its current price of $227.57 per share. This discrepancy indicates a potential value trap, suggesting investors should think twice before investing.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength of SBA Communications

Investors should always assess the financial strength of a company before buying its stock. Companies with poor financial strength pose a higher risk of permanent loss. A great way to understand a company's financial strength is by looking at its cash-to-debt ratio and interest coverage. Unfortunately, SBA Communications has a cash-to-debt ratio of 0.01, worse than 86.03% of companies in the REITs industry. This low ratio indicates poor financial strength, with an overall score of 2 out of 10.

Profitability and Growth of SBA Communications

Consistently profitable companies offer less risk for investors. Higher profit margins usually indicate a better investment compared to a company with lower profit margins. SBA Communications has been profitable 7 over the past 10 years, with an operating margin of 37.99%. This margin ranks worse than 66.92% of companies in the REITs industry. However, the overall profitability of SBA Communications is ranked 9 out of 10, indicating strong profitability.

Growth is a crucial factor in a company's valuation. SBA Communications's 3-year average revenue growth rate outperforms 85.04% of companies in the REITs industry. Its 3-year average EBITDA growth rate is 10.3%, ranking better than 69.64% of companies in the REITs industry. This strong growth suggests value creation for its shareholders.

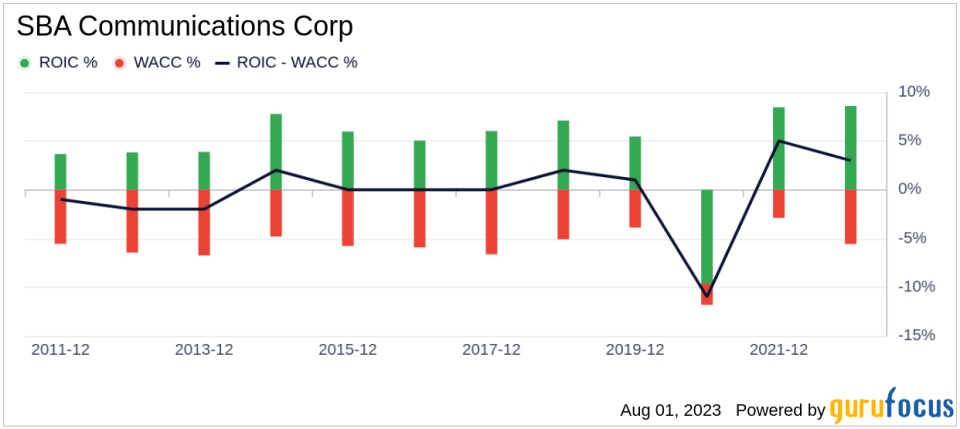

ROIC vs. WACC: A Profitability Evaluation

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, SBA Communications's ROIC was 8.11, while its WACC came in at 6.4, suggesting value creation.

Is SBA Communications a Value Trap?

Despite the promising growth and profitability, SBA Communications appears to be a potential value trap. This assessment is based on the company's low cash-to-debt ratio and the Altman Z-score of 0.42, which places the company's financial health in the distress zone and signals an increased bankruptcy risk. Ideally, an Altman Z-score above 2.99 reflects a safer financial position. To further comprehend the Z-score's role in assessing a company's financial risk, please click here.

Conclusion

In conclusion, despite strong profitability and growth, SBA Communications (NASDAQ:SBAC) gives every indication of being a potential value trap. Its financial condition is poor, which warrants caution. To learn more about SBA Communications stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.