ScanSource Inc (SCSC) Reports Mixed Q2 Results with Strong Cash Flow Amid Sales Decline

Net Sales: Reported a decrease of 12.5% year-over-year to $884.8 million.

Gross Profit: Declined by 12.6% to $100.7 million with a stable gross profit margin of 11.39%.

Operating Income: Dropped by 32.0% to $26.8 million compared to the prior year.

GAAP Net Income: Increased by 27.2% to $32.7 million, with diluted EPS up by 27.7% to $1.29.

Operating Cash Flow: Demonstrated a strong performance with $63.2 million, a significant improvement from the prior year.

Adjusted EBITDA: Decreased by 21.2% to $38.5 million, with a margin of 4.35%.

Free Cash Flow: Showed a robust figure of $60.7 million, marking a notable recovery.

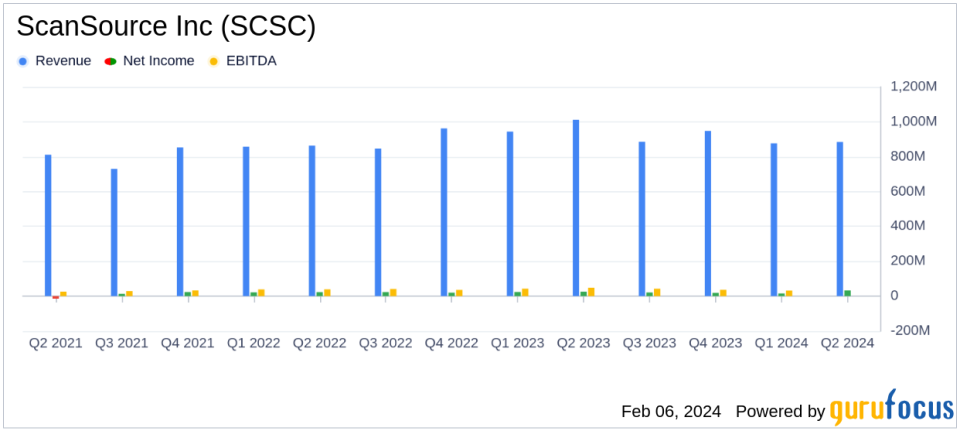

On February 6, 2024, ScanSource Inc (NASDAQ:SCSC), a leading hybrid distributor connecting devices to the cloud, released its 8-K filing, detailing the financial results for the second quarter ended December 31, 2023. The company, which provides value-added services for technology manufacturers and sells to resellers in specialty technology markets, saw a decrease in net sales by 12.5% year-over-year to $884.8 million. This decline was attributed to soft demand in barcode, mobility, and point of sale, partially offset by growth in networking and Cisco products.

Despite the drop in sales, ScanSource reported a 27.2% increase in GAAP net income to $32.7 million, or $1.29 per diluted share, compared to $25.7 million, or $1.01 per diluted share, for the prior-year quarter. This increase was supported by a decrease in interest expense due to lower borrowings and a significant gain on the sale of a business. The company's gross profit margin remained relatively stable at 11.39%, only a slight decrease from the 11.41% reported in the previous year.

Financial Position and Cash Flow

ScanSource's financial position showed strength in cash flow, with operating cash flow reaching $63.2 million, a substantial improvement from the negative cash flow in the prior year. Free cash flow was also strong at $60.7 million. The company's balance sheet reflects a healthy liquidity position with $44.9 million in cash and cash equivalents as of December 31, 2023.

Challenges and Outlook

Despite the positive aspects of the financial report, ScanSource faced challenges, including a decrease in net sales and operating income, which fell by 32.0% to $26.8 million. Adjusted EBITDA also saw a decline of 21.2% to $38.5 million, with the margin contracting by 48 basis points to 4.35%. These challenges reflect the difficult industry demand cycles that the company is navigating.

"Strong cash flow and Intelisys recurring revenue growth are the highlights for our second quarter results," said Mike Baur, Chair and CEO, ScanSource, Inc. "Our teams are navigating well through the challenging industry demand cycles."

Looking ahead, ScanSource has updated its annual financial outlook for fiscal year 2024. The company now expects net sales of at least $3.5 billion, down from the previously guided $3.8 billion, and adjusted EBITDA of at least $155 million, reduced from the prior estimate of $170 million. However, the forecast for free cash flow remains unchanged at at least $200 million.

Overall, ScanSource's second quarter results present a mixed picture, with strong cash flow performance and growth in certain areas being offset by declines in net sales and operating income. The company's updated outlook reflects a cautious approach in the face of ongoing industry challenges.

For more detailed information, investors and interested parties can access the earnings infographic and webcast details on ScanSource's website, and a replay of the earnings call will be available for 60 days.

Explore the complete 8-K earnings release (here) from ScanSource Inc for further details.

This article first appeared on GuruFocus.