ScanSource (NASDAQ:SCSC) shareholders have endured a 39% loss from investing in the stock five years ago

The legendary Jack Bogle helped popularize passive investing, which allows investors to match market returns. You can get far superior returns with a well chosen portfolio of stocks, but some stocks are going to fall short. Those who held ScanSource, Inc. (NASDAQ:SCSC) shares for the last five years have lost -39%, falling well short of the market decline of 38%. And some of the more recent buyers are probably worried, too, with the stock falling 26% in the last year. The falls have accelerated recently, with the share price down 12% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 18% in the same timeframe.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for ScanSource

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, ScanSource actually managed to increase EPS by an average of 5.2% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

It could be that the revenue decline of 3.2% per year is viewed as evidence that ScanSource is shrinking. This has probably encouraged some shareholders to sell down the stock.

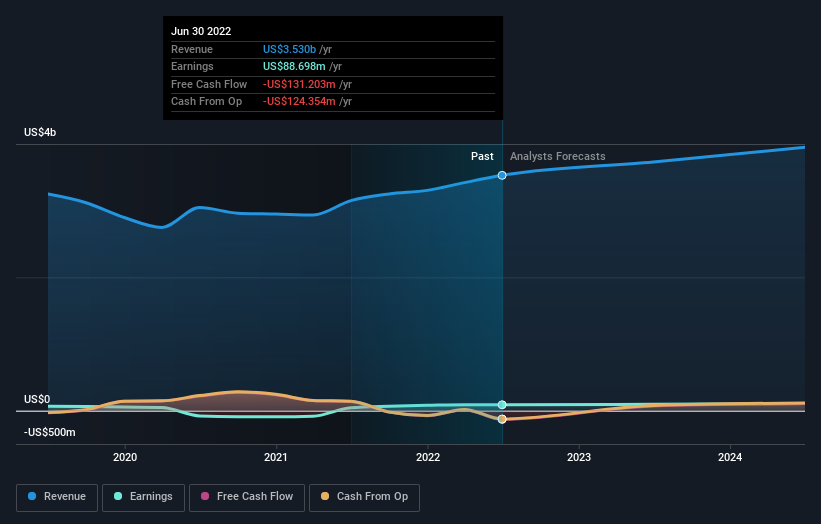

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that ScanSource has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While it's never nice to take a loss, ScanSource shareholders can take comfort that their trailing twelve month loss of 26% wasn't as bad as the market loss of around 44%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 7% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ScanSource you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here