Schlumberger Ltd (SLB) Posts Strong Fourth-Quarter and Full-Year 2023 Results; Increases ...

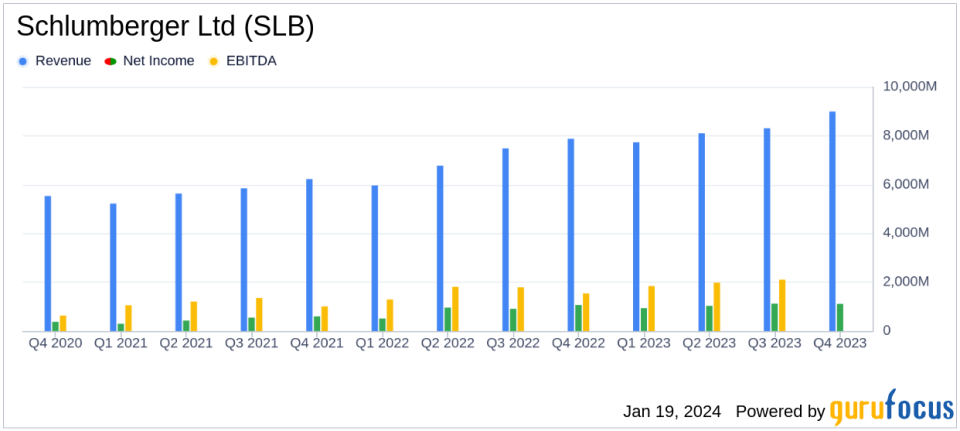

Revenue Growth: Fourth-quarter revenue increased by 14% year-on-year to $8.99 billion, and full-year revenue grew by 18% to $33.14 billion.

Net Income: Fourth-quarter GAAP net income rose by 4% to $1.11 billion, while full-year GAAP net income increased by 22% to $4.20 billion.

Earnings Per Share (EPS): Diluted EPS for the fourth quarter was $0.77, marking a 4% increase year-on-year, with full-year diluted EPS up by 22% to $2.91.

Adjusted EBITDA: Adjusted EBITDA for the fourth quarter reached $2.28 billion, a 19% increase year-on-year, and $8.11 billion for the full year, up by 25%.

Dividend Increase: SLB announced a 10% increase in its quarterly dividend, reflecting confidence in the company's financial strength and cash flow.

Share Repurchases: The company repurchased 1.8 million shares at an average price of $54.46 per share for a total of $100 million during the quarter.

International Growth: International revenue grew by 18% in the fourth quarter and 20% for the full year, outpacing North America.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 19, 2024, Schlumberger Ltd (NYSE:SLB), the world's largest oilfield service firm, released its 8-K filing, detailing a robust financial performance for both the fourth quarter and the full year of 2023. The company, known for its expertise in reservoir performance, well construction, production enhancement, and digital solutions, has demonstrated resilience and growth despite market challenges.

Financial Performance and Challenges

SLB's fourth-quarter revenue saw an 8% sequential increase and a 14% rise compared to the same quarter in the previous year, reaching nearly $9 billion. The full-year revenue also saw a significant jump of 18% to over $33 billion. The company's net income for the fourth quarter slightly dipped by 1% sequentially but increased by 4% year-on-year. For the full year, net income attributable to SLB rose by a notable 22%. These figures underscore SLB's ability to navigate the complex oil and gas industry landscape, capitalizing on international growth and integrating acquisitions such as the Aker subsea business.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the 10% increase in the quarterly dividend and the share repurchases, signal a strong balance sheet and cash flow confidence. In the oil and gas industry, where capital discipline and shareholder returns are paramount, these actions reflect SLB's commitment to delivering value to its investors. Additionally, the company's international revenue growth, especially in the Middle East and Asia, highlights its strategic positioning and operational excellence in key markets.

Key Financial Metrics

SLB's adjusted EBITDA margins reached a cycle high, with the fourth quarter at 25.3% and the full year at 24.5%, indicating improved profitability. The pretax segment operating income for the fourth quarter increased by 20% year-on-year, with a margin of 20.8%. The full-year pretax segment operating income also saw a 30% increase, with a margin of 19.7%. These metrics are crucial as they reflect the company's operational efficiency and its ability to convert revenue into profit.

Commentary from CEO Olivier Le Peuch

"We have concluded a remarkable year marked by widespread revenue growth, margin expansion, and exceptional free cash flow... These results showcase our continued ability to deliver superior earnings, generate impressive cash flows, and maintain a strong balance sheet."

Le Peuch's comments emphasize the company's robust performance and strategic initiatives that have led to durable growth and resilience in a competitive market.

Analysis of SLB's Performance

SLB's performance in 2023 reflects a company adept at leveraging its technological leadership and global footprint to drive growth. The increase in international revenue, particularly in the Middle East and Asia, demonstrates the company's successful expansion in high-growth markets. The growth in adjusted EBITDA and pretax operating income highlights operational excellence and the effective integration of acquisitions. The increase in the quarterly dividend and share repurchases further underscore SLB's financial health and commitment to shareholder returns.

For a more detailed breakdown of Schlumberger Ltd's financials and strategic outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Schlumberger Ltd for further details.

This article first appeared on GuruFocus.