Schneider National Inc (SNDR) Faces Headwinds Amid Challenging Freight Environment

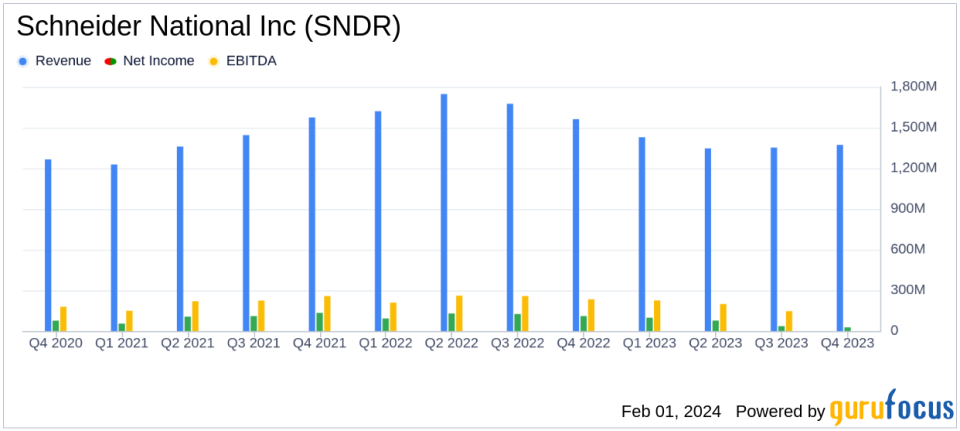

Operating Revenues: $1.4 billion in Q4 2023, down 12% from $1.6 billion in Q4 2022.

Income from Operations: $31.3 million in Q4 2023, a significant decrease from $143.3 million in Q4 2022.

Net Income: $27.4 million in Q4 2023, a 75% drop from $110.1 million in Q4 2022.

Diluted Earnings Per Share (EPS): $0.15 in Q4 2023, compared to $0.62 in Q4 2022.

Adjusted Diluted EPS: $0.16 in Q4 2023, reflecting a 75% decrease year-over-year.

Full Year 2024 Guidance: Adjusted Diluted EPS of $1.15 - $1.30 and Net Capital Expenditures of $400.0 - $450.0 million.

On February 1, 2024, Schneider National Inc (NYSE:SNDR), one of North America's largest surface transportation and logistics solutions providers, released its 8-K filing, disclosing the fourth quarter and full-year results for the period ended December 31, 2023. The company, which operates through segments such as Truckload, Intermodal, and Logistics, reported a decline in operating revenues and net income, reflecting the ongoing challenges in the freight market.

Financial Performance Overview

SNDR's operating revenues for the fourth quarter stood at $1.4 billion, a 12% decrease from the previous year, primarily due to the persistent challenges of the current freight environment. Income from operations plummeted by 78% to $31.3 million, and net income saw a 75% decline to $27.4 million. The diluted earnings per share were $0.15, compared to $0.62 in the same quarter of the previous year. Adjusted diluted earnings per share also fell to $0.16.

The company's financial health is further evidenced by its balance sheet, which showed $302.1 million in total debt and finance lease obligations, up from $215.1 million at the end of 2022. Cash and cash equivalents decreased to $102.4 million from $385.7 million year-over-year. Schneider also returned $63.6 million to shareholders in the form of dividends throughout the year.

Segment Performance and Strategic Initiatives

The Truckload segment reported a slight increase in revenues, but income from operations dropped by 73% due to lower network pricing and increased claims costs. The Intermodal segment experienced a 17% decrease in revenues and an 88% decrease in income from operations, attributed to lower pricing and volumes. The Logistics segment faced a 20% revenue decline and a 75% decrease in income from operations, driven by lower net revenue per order and increased claims costs.

Despite the challenging environment, SNDR made key strategic moves, including expanding its dedicated fleet by 750 trucks and forming new rail partnerships. President and CEO Mark Rourke acknowledged the efforts of the company's professional drivers and associates and emphasized the focus on positioning the business for an anticipated freight recovery and executing strategic growth objectives.

Outlook and Commentary

Executive Vice President and CFO Darrell Campbell provided insights into the company's outlook, stating,

While the continuing impacts of the freight downcycle were felt across our portfolio in 2023, we believe the signs of stabilization seen in the fourth quarter of 2023 may be indicative of a broader freight market rebalancing ahead of us in 2024."

He also noted the uncertainty of the recovery's shape and the expectation of it being weighted towards the second half of the year.

For the full year 2024, SNDR provided guidance for adjusted diluted earnings per share of $1.15 to $1.30 and net capital expenditures of $400 to $450 million, reflecting the company's strategic priorities and market expectations.

Investors and stakeholders can access the earnings conference call replay or the live webcast on the Investor Relations section of Schneider's website for further details.

As Schneider National Inc (NYSE:SNDR) navigates a transition year, the company's resilience and strategic adjustments will be key to overcoming the current industry headwinds and capitalizing on the eventual market recovery.

Explore the complete 8-K earnings release (here) from Schneider National Inc for further details.

This article first appeared on GuruFocus.