Schneider posts cost-burdened Q3

Schneider National reported a big earnings miss Thursday and cut its outlook for the remainder of the year.

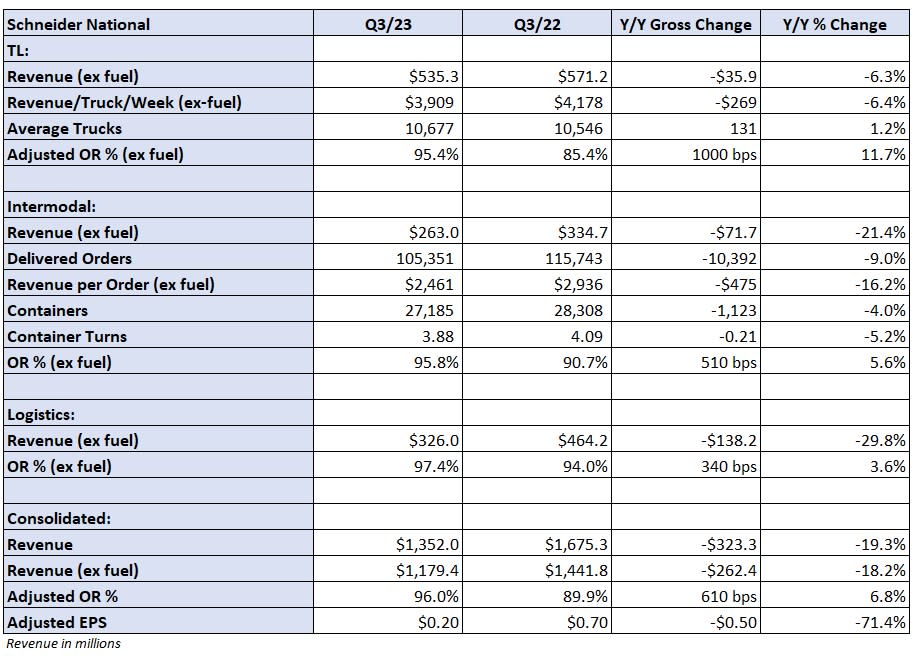

Adjusted earnings per share of 20 cents were below a consensus estimate of 37 cents, a second-quarter result of 45 cents and a year-ago result of 70 cents.

“Our results were driven by ongoing price pressures primarily in our network businesses, as well as other headwinds such as fuel, bad debt, and lower equipment gains,” President and CEO Mark Rourke said in a news release.

Retail diesel prices were off 15% year over year (y/y) in the quarter but increased more than 20% from the beginning to the end of the period, which didn’t allow fuel surcharge mechanisms to keep pace. Combined with an increase in bad debt expense due to customer bankruptcies and lower gains on equipment sales, the total impact was $18 million, or 8 cents per share.

Lower gains from equity investments were a 10 cent headwind y/y. A lower tax rate was a 1 cent tailwind, which was offset by a 1 cent headwind from higher interest expense due to an increase in debt from an acquisition.

Schneider (NYSE: SNDR) cut 2023 EPS guidance to a range of $1.40 to $1.45, a 22% reduction from the August forecast and well below a consensus estimate of $1.78. The company’s initial 2023 EPS guidance was $2.15 to $2.35 in early February.

The company doesn’t expect a lift in volumes in the fourth quarter as seasonal project opportunities failed to materialize. Lower gains on equipment disposals will again be a headwind. However, it expects fuel costs to moderate and noted further rate reduction is unlikely as all of its contracts from the recent bid season have been repriced.

Schneider is expecting 2024 to be a “transition year” with slow and steady improvement in fundamentals.

Truckload revenue fell 6% y/y (up slightly compared to the second quarter) to $535 million. Revenue per truck per week was down 16% y/y in the company’s one-way segment, partially offset by a 2% increase in the dedicated fleet. The metric was off 2% from the second quarter when combining both fleets.

The dedicated fleet’s contribution of total TL revenue increased to 61% from 54% a year ago. In August, Schneider acquired dedicated carrier M&M Transport Services, which was operating 500 trucks at the time.

The TL segment’s adjusted operating ratio deteriorated 1,000 basis points to 95.4% due to lower one-way rates, lagging fuel surcharges, costs to onboard new dedicated customers and an uptick in bad debt expense. The adjusted OR was 760 bps worse than the second quarter.

Management said customer conversations around contract renewals and pricing are getting more constructive. Schneider will continue to reduce its spot market exposure and noted that there is little room left to move lower on contract rates.

“The bites have been taken out of the apple and there’s no apple left,” said retiring CFO Steve Bruffett on a Thursday call with analysts.

Intermodal revenue was down 21% y/y (up 1% from the second quarter) to $263 million. Loads were off 9% y/y and revenue per load was down 16%. Intermodal volumes improved throughout the quarter and through October. Average container turns fell 5% y/y but improved 4% sequentially.

The segment recorded a 95.8% OR, which was 510 bps worse y/y and 490 bps worse sequentially.

Logistics revenue was off 30% y/y (down 5% from the second quarter) to $326 million. Brokerage loads were down 11% y/y with declines in revenue per load closing the gap on the overall revenue decline. The unit’s OR deteriorated 340 bps y/y to 97.4%.

Shares of SNDR were off 10.7% at 11:53 a.m. EDT Thursday compared to the S&P 500, which was up 1.4%.

More FreightWaves articles by Todd Maiden

The post Schneider posts cost-burdened Q3 appeared first on FreightWaves.