Schneider (SNDR) Q3 Earnings Miss Estimates, EPS View Down

Schneider National Inc. (SNDR) reported third-quarter 2023 earnings per share (EPS) of 20 cents, which missed the Zacks Consensus Estimate of 38 cents and declined 71.4% from the year-ago quarter’s levels. Operating revenues of $1,352 million lagged the Zacks Consensus Estimate of $1,396.5 million and fell 19.3% year over year. Revenues (excluding fuel surcharge) decreased 18% to $1,179.4 million.

Income from operations (adjusted) fell 67% from the prior-year quarter’s level to $47.6 million. The adjusted operating ratio was 96%.

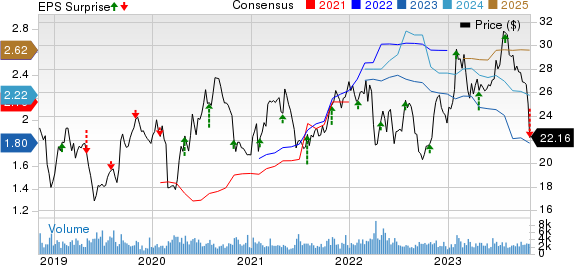

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) for the third quarter of 2023 fell 6% year over year to $535.3 million. The downside was due to unfavorable pricing in the network, partially offset by the impact of organic dedicated growth and M&M Transport revenues. Truckload revenue per truck per week was $3,909, down 6% year over year.

Truckload income from operations decreased 24.5% year over year to $71 million in the third quarter of 2023. The downfall was owing to lower prices in the network, higher fuel and other inflationary costs, bad debt, and friction costs related to dedicated new business implementations. Truckload segment operating ratio rose to 95.4% in the third quarter of 2023 from 85.4% in the year-ago period.

Intermodal revenues (excluding fuel surcharge) were $263 million, down 21% year over year, due to lower volume and revenue per order. Intermodal income from operations was $11.1 million, down 64% year over year, owing to negative pricing and volume pressures, partially offset by lower rail and dray-related costs. Intermodal operating ratio rose to 95.8% in the third quarter of 2023 from 90.7% in the year-ago period.

Logistics revenues (excluding fuel surcharge) for the third quarter of 2023 came in at $326 million, down 30% year over year owing to decreased revenue per order, which continues to be unfavorably impacted by lower market prices, and lower brokerage volumes, which decreased 11% year over year. Logistics income from operations was $8.5 million, down 70% year over year, owing to lower volumes and net revenue per order and decreased port dray earnings. Logistics operating ratio rose to 97.4% in the third quarter of 2023 from 94.0% in the third quarter of 2022.

Liquidity

Schneider exited the third quarter with cash and cash equivalents of $58.5 million compared with $249.2 million at the end of June 2023. Long-term debt was $218.5 million at the end of the third quarter compared with $142.2 million at the second-quarter end.

2023 Outlook

Schneider now anticipates 2023 adjusted EPS in the range of $1.40-$1.45 (prior view: $1.75-$1.90). The Zacks Consensus Estimate is currently pegged at $1.80.

The company now expects net capital expenditures between $550 million and $575 million (prior view: $525-$575 million). The full-year effective tax rate is expected to be around 24.5%.

Currently, Schneider carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL)reported third-quarter 2023 EPS (excluding 31 cents from nonrecurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air-travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air-travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report