Schneider (SNDR) Stock Down 2.3% Despite Q2 Earnings Beat

Schneider National, Inc. (SNDR) stock declined 2.3% since its second-quarter 2023 earnings release on Aug 3. Quarterly earnings per share (EPS) of 45 cents beat the Zacks Consensus Estimate by a penny but declined 38% from the year-ago quarter’s levels. Operating revenues of $1,346.5 million lagged the Zacks Consensus Estimate of $1,459 million and fell 23% year over year. Revenues (excluding fuel surcharge) decreased 20% to $1,190.9 million.

Income from operations (adjusted) fell 39% from the prior-year quarter’s level to $106.7 million. The adjusted operating ratio was 91%.

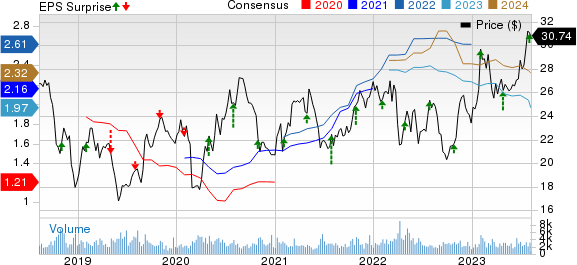

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) for the second quarter of 2023 fell 7% year over year to $532.7 million. The downside was owing to lower network prices driven by market conditions. Truckload revenue per truck per week was $4,005, down 6% year over year.

Truckload income from operations decreased 20% year over year to $64.8 million in the second quarter of 2023. The downfall was owing to pricing pressures in network and higher driver and other inflationary costs, partially offset by higher gains on the sale of equipment. The Truckload segment operating ratio rose to 87.8% in the second quarter of 2023 from 85.9% in the prior-year quarter.

Intermodal revenues (excluding fuel surcharge) were $261 million, down 22% year over year, due to lower volume and revenue per order. Intermodal income from operations was $23.7 million, down 44% year over year. Intermodal operating ratio rose to 90.9% in the reported quarter from 87.4% in second-quarter 2022.

Logistics revenues (excluding fuel surcharge) for the second quarter of 2023 came in at $343.4 million, down 34% year over year, owing to a decline in revenue per order impacted by lower spot prices and a 10% decrease in brokerage volume. Logistics income from operations was $12.8 million, down 73% year over year, owing to lower volumes, decreased net revenue per order, and reduced earnings from port dray activity. Logistics operating ratio rose to 96.3% in the second quarter of 2023 compared with 90.9% in the year-ago reported quarter.

Liquidity

Schneider exited the second quarter with cash and cash equivalents of $249.2 million compared with $389.8 million at the end of March 2023. Long-term debt was $142.2 million at the second-quarter end compared with $141.2 million at March 2023-end.

2023 Outlook

Schneider now anticipates 2023 adjusted EPS in the range of $1.75-$1.90 (prior view: $2.00-$2.20). The Zacks Consensus Estimate is currently pegged at $1.97.

The company continues to expect net capital expenditures between $525 million and $575 million. The full-year effective tax rate is expected to be around 24.5%.

Currently, Schneider carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT second-quarter 2023 EPS of $1.81 missed the Zacks Consensus Estimate of $1.97 and declined 25.2% year over year.

JBHT’s total operating revenues of $3,132.6 million also lagged the Zacks Consensus Estimate of $3,347.5 million and fell 18.4% year over year. The downfall was due to a decline in revenue per load of 24% in Integrated Capacity Solutions, 13% in Intermodal, 21% in Truckload and a 4% decline in productivity in Dedicated Capacity Solutions on the back of changes in customer rate, freight mix and lower fuel surcharge revenue.

Total operating revenues, excluding fuel surcharges, decreased 14% year over year.

Delta Air Lines DAL reported better-than-expected revenues and EPS, driven by strong air-travel demand. DAL’s second-quarter 2023 EPS (excluding 16 cents from non-recurring items) of $2.68 comfortably beat the Zacks Consensus Estimate of $2.42. DAL reported EPS of $1.44 a year ago, dull compared to the current scenario, as air-travel demand was not so buoyant then.

DAL’s total revenues of $15,578 million beat the Zacks Consensus Estimate of $14,991.6 million. Total revenues increased 12.69% on a year-over-year basis, driven by higher air-travel demand.

United Airlines Holdings, Inc. (UAL)reported second-quarter 2023 EPS of $5.03, which outpaced the Zacks Consensus Estimate of $3.99 and improved more than 100% year over year.

Operating revenues of $14,178 million beat the Zacks Consensus Estimate of $13,927.1 million. UAL’s revenues increased 17.1% year over year due to upbeat air-travel demand. The year-over-year increase in the top line was driven by a 20.1% rise in passenger revenues (accounting for 91.7% of the top line) to $13,002 million. Nearly 42 million passengers traveled on UAL flights in the second quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report