Schnitzer Steel Industries (NASDAQ:RDUS) Will Pay A Dividend Of $0.1875

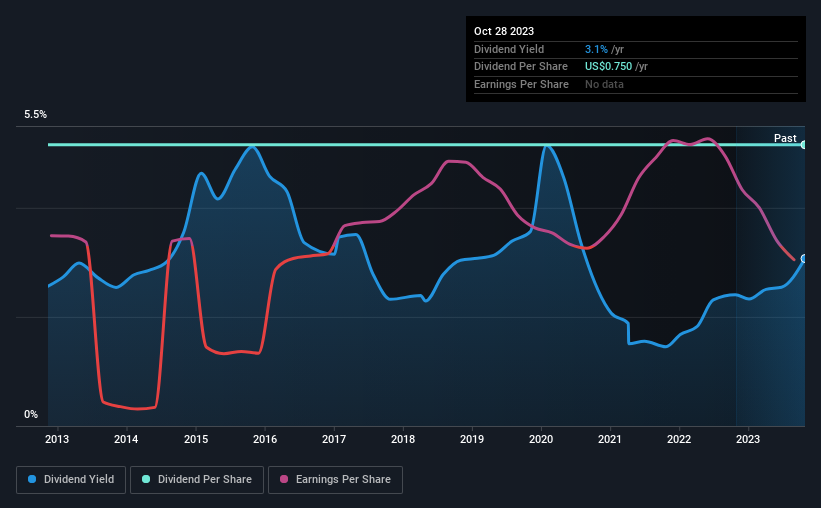

The board of Schnitzer Steel Industries, Inc. (NASDAQ:RDUS) has announced that it will pay a dividend on the 27th of November, with investors receiving $0.1875 per share. This means the dividend yield will be fairly typical at 3.1%.

Check out our latest analysis for Schnitzer Steel Industries

Schnitzer Steel Industries' Distributions May Be Difficult To Sustain

We aren't too impressed by dividend yields unless they can be sustained over time. Schnitzer Steel Industries is unprofitable despite paying a dividend, and it is paying out 210% of its free cash flow. This is quite a strong warning sign that the dividend may not be sustainable.

Over the next year, EPS might fall by 2.3% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Schnitzer Steel Industries Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. There hasn't been much of a change in the dividend over the last 10 years. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. It's not great to see that Schnitzer Steel Industries' earnings per share has fallen at approximately 2.3% per year over the past five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

Schnitzer Steel Industries' Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Schnitzer Steel Industries (2 are a bit concerning!) that you should be aware of before investing. Is Schnitzer Steel Industries not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.