Scholastic Corp (SCHL) Reports Mixed Fiscal 2024 Third Quarter Results Amidst Strategic Investments

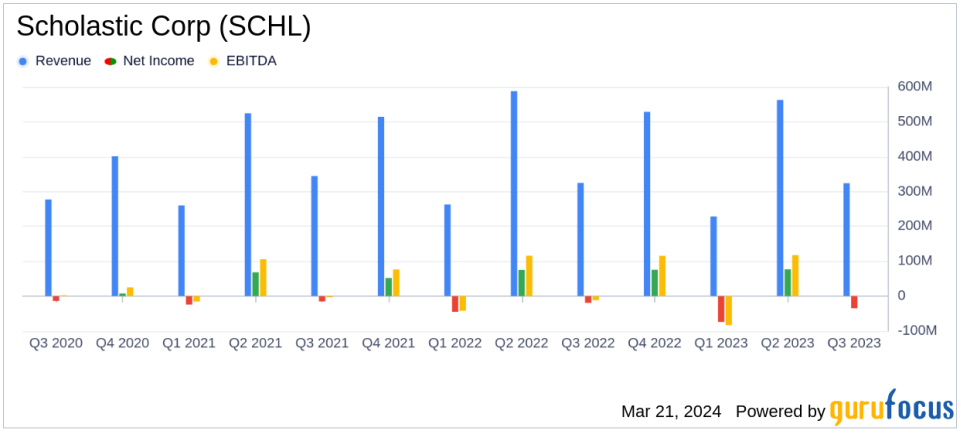

Revenue: Remained nearly flat at $323.7 million compared to $324.9 million in the previous year.

Operating Loss: Increased by 26% to $34.9 million, including one-time items.

Diluted Loss Per Share: Worsened to $0.91 from $0.57 year-over-year.

Adjusted EBITDA: Declined to a loss of $7.2 million, a 33% decrease.

Capital Returns: Over $60 million returned to shareholders through buybacks and dividends.

Strategic Investment: Announced agreement to invest in 9 Story Media Group to expand childrens media footprint.

On March 21, 2024, Scholastic Corp (NASDAQ:SCHL) released its 8-K filing, detailing the company's financial performance for the fiscal third quarter ended February 29, 2024. Scholastic Corp, a leading publisher and distributor of children's books and educational materials, reported a slight decrease in revenues to $323.7 million, down $1.2 million from the prior year's quarter. The company's operating loss widened by 26% to $34.9 million, including one-time items, while diluted loss per share increased significantly from $0.57 to $0.91.

Performance and Challenges

Despite the stable revenues, Scholastic faced challenges in its School Reading Events and Education divisions due to the complex environment in U.S. schools. The company's strategic repositioning of its U.S. Book Clubs led to a revenue decline of approximately $14.4 million. However, strong trade publishing revenues in the U.S., Canada, and the UK, driven by popular book series titles, helped offset these declines. Adjusted EBITDA, a non-GAAP measure, saw a decrease of $1.8 million to a loss of $7.2 million.

Financial Achievements and Strategic Moves

Despite the mixed financial results, Scholastic Corp highlighted its strategic investment in 9 Story Media Group, which is expected to enhance the company's children's media presence and create additional value for shareholders. The company also continued its commitment to returning capital to shareholders, distributing over $60 million through share repurchases and dividends during the quarter.

Key Financial Metrics

Net cash provided by operating activities improved by $5.5 million compared to the prior period, primarily due to lower inventory purchasing and working capital usage. Free cash flow use improved by 40%, reflecting lower working capital usage. The company's net cash position decreased significantly to $78.9 million from $193.6 million, a 59% reduction year-over-year.

"Last quarter Scholastics continued successes in childrens book publishing and entertainment demonstrated our leadership in building beloved childrens franchises and brands," said Peter Warwick, President and Chief Executive Officer of Scholastic Corp.

Analysis of Company's Performance

While Scholastic Corp managed to maintain its revenue stream, the increased operating losses and diluted loss per share indicate pressure on profitability. The company's strategic investments and content creation initiatives, such as the investment in 9 Story Media Group and the success of the Goosebumps TV series, suggest a focus on long-term growth and brand monetization. The commitment to shareholder returns amidst these investments reflects confidence in the company's financial health and future prospects.

For a more detailed analysis and additional information, investors and interested parties are encouraged to review the full earnings report and listen to the earnings call. Scholastic Corp remains focused on its long-term strategy, investing in content and capabilities to drive growth, maintaining a strong balance sheet, and enhancing shareholder value.

For more information on Scholastic Corp's fiscal 2024 third quarter results, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Scholastic Corp for further details.

This article first appeared on GuruFocus.