Scholastic (NASDAQ:SCHL) Misses Q1 Sales Targets, Stock Drops

Educational publishing and media company Scholastic (NASDAQ:SCHL) fell short of analysts' expectations in Q1 CY2024, with revenue flat year on year at $323.7 million. It made a GAAP loss of $0.91 per share, down from its loss of $0.57 per share in the same quarter last year.

Is now the time to buy Scholastic? Find out by accessing our full research report, it's free.

Scholastic (SCHL) Q1 CY2024 Highlights:

Revenue: $323.7 million vs analyst estimates of $329.2 million (1.7% miss)

EPS: -$0.91 vs analyst expectations of -$0.80 (13.7% miss)

Gross Margin (GAAP): 54.1%, up from 50.4% in the same quarter last year

Free Cash Flow was -$7.1 million, down from $88.6 million in the previous quarter

Market Capitalization: $1.12 billion

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Scholastic's revenue declined over the last five years, dropping 1.7% annually.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Scholastic's annualized revenue growth of 3.6% over the last two years is a reversal from its five-year trend, suggesting some bright spots.

This quarter, Scholastic missed Wall Street's estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $323.7 million of revenue. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

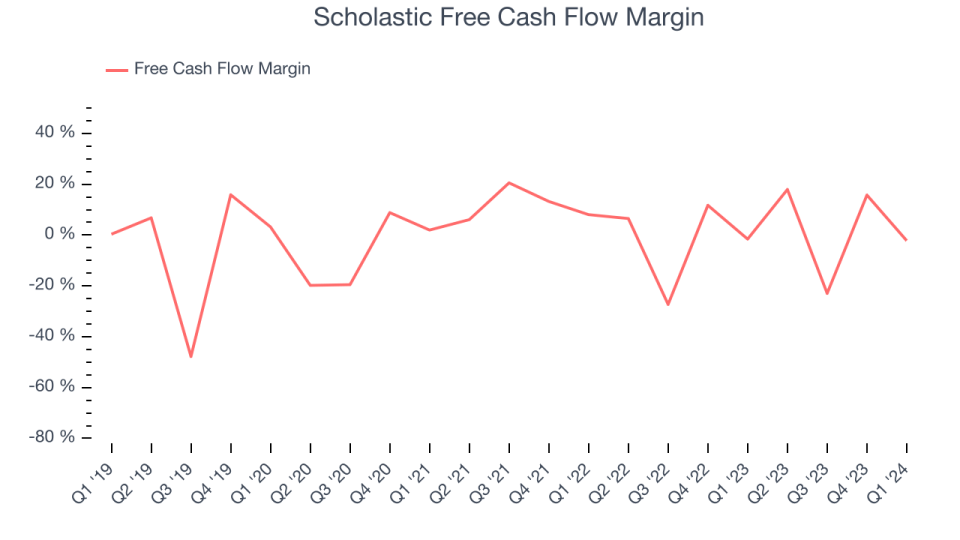

Over the last two years, Scholastic has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.5%, subpar for a consumer discretionary business.

Scholastic burned through $7.1 million of cash in Q1, equivalent to a negative 2.2% margin, reducing its cash burn by 39.2% year on year.

Key Takeaways from Scholastic's Q1 Results

We struggled to find many strong positives in these results. Its EPS missed and its revenue fell short of Wall Street's estimates, driven by weakness in its Book Clubs segment - revenue was down 52% year on year as the company ran fewer promotional offers.

During the quarter, Scholastic acquired 9 Story Media Group to expand into animated and live-action children's content. The deal was priced at $186 million, or just over 15% of Scholastic's current market capitalization. Only time will tell if this was a good strategic decision.

Overall, this was a mixed quarter for Scholastic. The company is down 7.6% on the results and trades at $35 per share.

Scholastic may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.