Schrödinger (NASDAQ:SDGR) shareholder returns have been notable, earning 68% in 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the Schrödinger, Inc. (NASDAQ:SDGR) share price is 68% higher than it was a year ago, much better than the market return of around 13% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! On the other hand, longer term shareholders have had a tougher run, with the stock falling 41% in three years.

Since the stock has added US$210m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Schrödinger

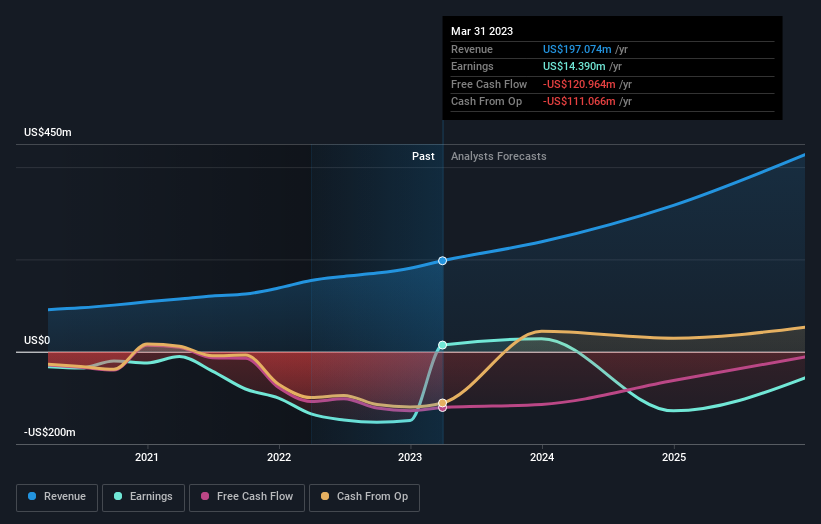

Given that Schrödinger only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Schrödinger saw its revenue grow by 28%. That's a fairly respectable growth rate. Buyers pushed the share price 68% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Schrödinger stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Pleasingly, Schrödinger's total shareholder return last year was 68%. That certainly beats the loss of about 12% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Schrödinger better, we need to consider many other factors. Even so, be aware that Schrödinger is showing 3 warning signs in our investment analysis , and 2 of those make us uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here