Schrodinger Inc (SDGR) Reports Strong Revenue Growth in Q4 and Full-Year 2023

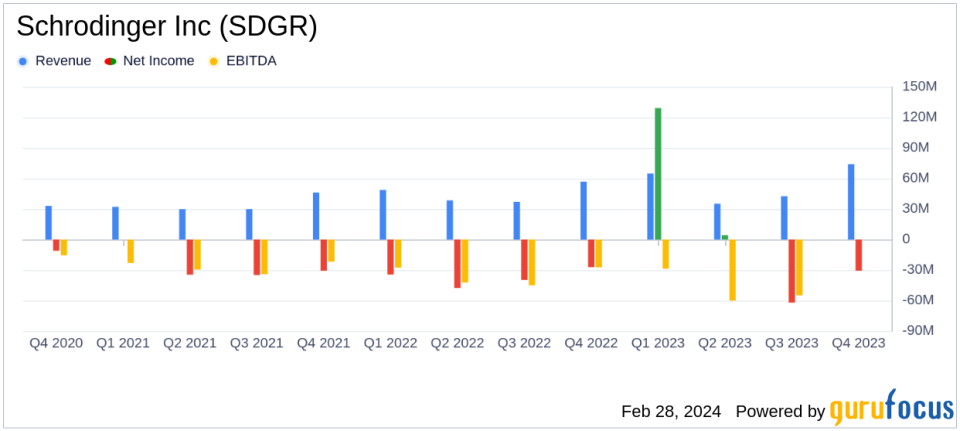

Total Revenue: Grew by 19.7% to $216.7 million in full-year 2023.

Software Revenue: Increased by 17.4% to $159.1 million for the full year.

Net Income: Reported at $40.7 million for the full year, a significant turnaround from a loss of $149.2 million in 2022.

Software Gross Margin: Improved to 81% for the full year from 78% in 2022.

Operating Expenses: Rose to $318.1 million for the full year, up 28.4% from 2022.

Cash Position: Ended the year with $468.8 million in cash, cash equivalents, restricted cash, and marketable securities.

2024 Outlook: Software revenue growth expected to range from 6% to 13%.

On February 28, 2024, Schrodinger Inc (NASDAQ:SDGR) released its 8-K filing, announcing its financial results for the fourth quarter and full-year ended December 31, 2023. The company, known for its computational platform used in drug discovery and materials science, reported a robust 44% increase in fourth-quarter software revenue, reaching $68.7 million, and a 20% growth in total revenue for the year, amounting to $216.7 million.

Schrodinger Inc (NASDAQ:SDGR) operates in two segments: Software and Drug Discovery. The Software segment focuses on selling transformative drug discovery software to the life sciences industry and materials science customers. The Drug Discovery segment generates revenue through a portfolio of preclinical and clinical programs, both internally and through collaborations.

Financial Performance and Challenges

The company's performance in 2023 was marked by significant achievements, including the largest quarter for software revenue in its history and a total annual revenue growth of 20%. However, the Drug Discovery segment faced a decline, with revenue dropping to $5.5 million in the fourth quarter from $9.0 million in the same period of 2022. This decrease was attributed to collaboration milestones that positively impacted the previous year's fourth quarter.

Despite the overall revenue growth, Schrodinger Inc (NASDAQ:SDGR) reported a net loss of $30.7 million in the fourth quarter, a 12.7% increase from the $27.2 million loss in the fourth quarter of 2022. Operating expenses also rose by 29.6% to $87.2 million for the quarter. These challenges highlight the need for the company to manage its expenses and continue to innovate to maintain its growth trajectory.

Financial Achievements and Importance

The improvement in software gross margin to 87% in the fourth quarter from 83% in the same period of the previous year is a testament to the company's efficiency and the scalability of its software business. This is particularly important in the Healthcare Providers & Services industry, where margins can significantly impact profitability.

For the full year, the company's net income stood at $40.7 million, a remarkable recovery from the $149.2 million loss in 2022. This turnaround was largely due to other income, which included gains on equity investments and changes in the fair value of such investments, amounting to $220.4 million for the year.

Key Financial Metrics

Important metrics for Schrodinger Inc (NASDAQ:SDGR) include the total annual contract value (ACV) for its software segment, which increased by 9.7% to $154.2 million. The ACV of its top 10 customers also grew by 9.7% to $51.0 million. The company's customer retention rate among customers with an ACV of at least $500,000 was an impressive 98%, indicating strong customer loyalty and satisfaction.

At the end of 2023, Schrodinger Inc (NASDAQ:SDGR) had a solid cash position, with approximately $468.8 million in cash, cash equivalents, restricted cash, and marketable securities. This financial stability is crucial for the company's ongoing research and development efforts and potential future investments.

2024 Financial Outlook and Commentary

Looking ahead to 2024, Schrodinger Inc (NASDAQ:SDGR) anticipates software revenue growth ranging from 6% to 13%, with drug discovery revenue expected to be between $30 million and $35 million. The company plans to maintain a similar software gross margin to that of 2023 and expects operating expense growth to range from 8% to 12%.

"We had a very strong year in 2023, with significant growth in our software and drug discovery revenue and substantial progress in our proprietary pipeline and at our co-founded companies," stated Geoff Porges, MBBS, chief financial officer of Schrodinger. "We see many opportunities to drive continuing software revenue growth in 2024 and beyond, and are very excited by the value we are building in our proprietary portfolio, and in our ventures and partnerships."

The company's focus on investing in the science underlying its platform and increasing customer adoption is expected to drive further growth and advance its proprietary pipeline, which now includes two clinical-stage programs.

For value investors and potential GuruFocus.com members, Schrodinger Inc (NASDAQ:SDGR)'s strong financial performance, particularly in its software segment, and its promising outlook for 2024, make it a company worth watching in the Healthcare Providers & Services industry.

Explore the complete 8-K earnings release (here) from Schrodinger Inc for further details.

This article first appeared on GuruFocus.