Scott Black's Q2 2023 13F Filing: Key Trades and Portfolio Overview

Scott Black (Trades, Portfolio), the president and founder of Delphi Management, Inc., recently filed the firm's 13F report for the second quarter of 2023, which ended on June 30, 2023. Black, a seasoned investor with a background in Applied Mathematics and Economics, has a reputation for strategic equity management and corporate diversification activities. His investment philosophy is reflected in the firm's portfolio, which contained 82 stocks with a total value of $96 million.

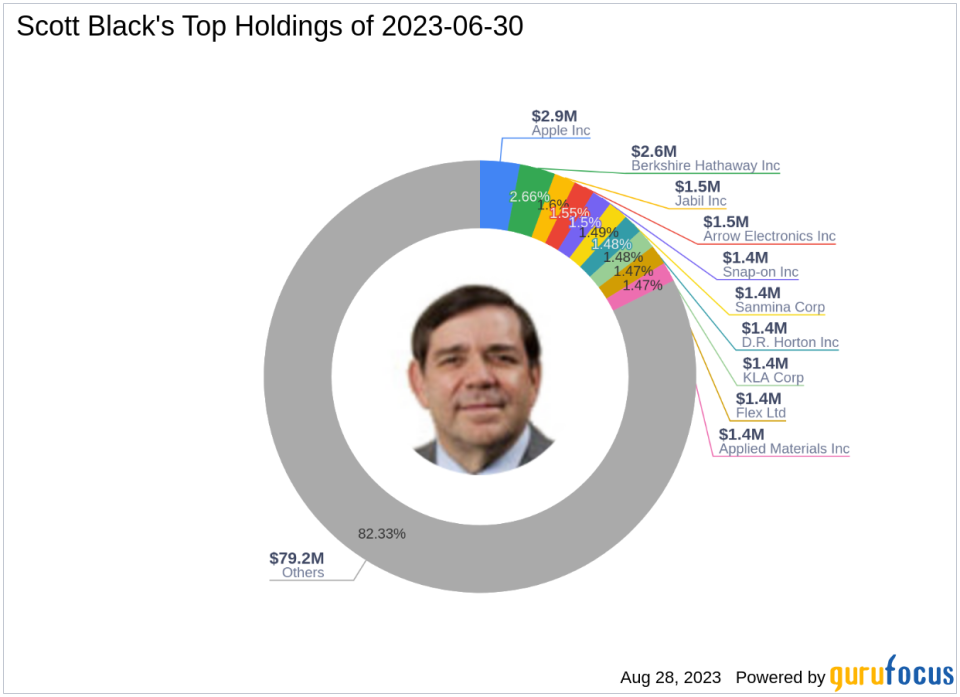

Top Holdings

The firm's top holdings for the quarter were AAPL (2.97%), BRK.B (2.66%), and JBL (1.60%). These stocks represent a significant portion of the portfolio, indicating Black's confidence in these companies.

Key Trades of the Quarter

Among the notable trades of the quarter, the firm established a new position in Sanmina Corp (NASDAQ:SANM), purchasing 23,661 shares. This investment gave SANM a 1.49% weight in the equity portfolio. The shares were traded at an average price of $54.91 during the quarter. As of August 28, 2023, SANM had a market cap of $3.19 billion and a stock price of $55.79. The company has shown a return of 11.68% over the past year and boasts a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10 according to GuruFocus.

Another significant move was the complete sell-off of the firm's 15,846-share investment in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM). The shares were traded at an average price of $93.07 during the quarter. As of August 28, 2023, TSM had a market cap of $484.31 billion and a stock price of $93.38. The company has shown a return of 12.34% over the past year and has a financial strength rating of 8 out of 10 and a profitability rating of 10 out of 10 according to GuruFocus.

The firm also established a new position in AGCO Corp (NYSE:AGCO), purchasing 10,369 shares. This investment gave AGCO a 1.41% weight in the equity portfolio. The shares were traded at an average price of $124.17 during the quarter. As of August 28, 2023, AGCO had a market cap of $9.12 billion and a stock price of $121.75. The company has shown a return of 15.78% over the past year and has a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10 according to GuruFocus.

In conclusion, Scott Black (Trades, Portfolio)'s Q2 2023 13F filing reveals a strategic approach to portfolio management, with significant investments in companies showing strong financial strength and profitability. The firm's top holdings and key trades reflect a balanced mix of established and emerging companies, demonstrating Black's commitment to diversification and value creation.

This article first appeared on GuruFocus.