Sea Otter Advisors LLC Acquires Stake in KnightSwan Acquisition Corp

Sea Otter Advisors LLC (Trades, Portfolio), a New York-based investment firm, recently made a significant acquisition in KnightSwan Acquisition Corp (NYSE:KNSW.U). This article provides an in-depth analysis of the transaction, the profiles of the involved parties, and the potential implications for both the stock and the guru's portfolio.

Transaction Details

On July 19, 2023, Sea Otter Advisors LLC (Trades, Portfolio) purchased 409,675 shares of KnightSwan Acquisition Corp at a price of $10.58 per share. This transaction had a 2.17% impact on the firm's portfolio, increasing their total holdings in the company to 409,675 shares, which now represent 2.17% of their portfolio. The firm now holds 8.82% of KnightSwan Acquisition Corp's total shares. This significant acquisition indicates the firm's confidence in the future performance of the stock.

Profile of Sea Otter Advisors LLC (Trades, Portfolio)

Sea Otter Advisors LLC (Trades, Portfolio) is an investment firm located at 107 Grand Street, New York. The firm manages a portfolio of 259 stocks, with a total equity of $196 million. Their top holdings include Tesla Inc (NASDAQ:TSLA), Occidental Petroleum Corp (NYSE:OXY.WS), OCA Acquisition Corp (NASDAQ:OCAX), Talon 1 Acquisition Corp (NASDAQ:TOAC), and Investcorp Europe Acquisition Corp I (NASDAQ:IVCB). The firm's investments are primarily concentrated in the Financial Services and Energy sectors.

Profile of KnightSwan Acquisition Corp

KnightSwan Acquisition Corp (NYSE:KNSW.U) is a US-based company that was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company went public on January 21, 2022. As of July 27, 2023, the company's stock is trading at $10.42 per share.

Stock Performance and Valuation

Since its IPO, KnightSwan Acquisition Corp's stock has gained 4.72%. Year-to-date, the stock has increased by 2.26%. However, since Sea Otter Advisors LLC (Trades, Portfolio)'s acquisition, the stock has declined by 1.51%. The company's PE ratio is 148.14, indicating that it may be overvalued. Unfortunately, due to insufficient data, the GF Valuation and GF Value cannot be evaluated.

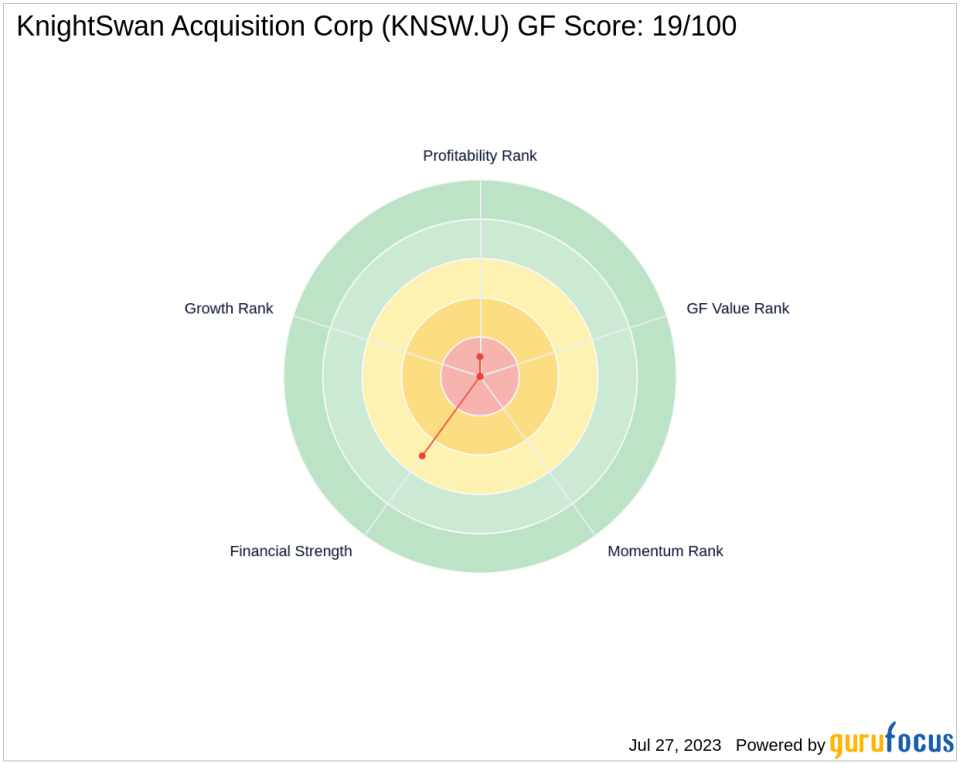

Stock Rankings and Scores

KnightSwan Acquisition Corp's GF Score is 19/100, suggesting poor future performance potential. The company's balance sheet, profitability, growth, GF Value, and momentum ranks are 5/10, 1/10, 0/10, 0/10, and 0/10 respectively. The company's Z Score is 0.00, and its cash to debt rank is 2. The company operates in the Diversified Financial Services industry.

Stock Financials and Growth

KnightSwan Acquisition Corp's interest coverage is not applicable due to insufficient data. The company's ROE and ROA are 0.73 and 0.70 respectively. The company's gross margin growth, operating margin growth, and 3-year revenue, EBITDA, and earning growth are also not applicable due to insufficient data.

Stock Momentum and Predictability

KnightSwan Acquisition Corp's RSI 5 day, RSI 9 day, and RSI 14 day are 3.51, 12.08, and 21.38 respectively. The company's momentum index 6 - 1 month and momentum index 12 - 1 month are 3.00 and 5.88 respectively. The company's predictability rank is not available due to insufficient data.

Transaction Analysis

Sea Otter Advisors LLC (Trades, Portfolio)'s acquisition of KnightSwan Acquisition Corp shares represents a significant addition to their portfolio. Despite the stock's recent decline and poor GF Score, the firm's investment suggests confidence in the stock's future performance. However, given the stock's current valuation and rankings, investors should exercise caution and conduct thorough research before making investment decisions.

All data and rankings are accurate as of July 27, 2023.

This article first appeared on GuruFocus.