Seaboard (SEB): An Underappreciated Gem in the Stock Market

Seaboard Corp (SEB) recently reported a daily gain of 5.21% and a 3-month gain of 4.12%. With an Earnings Per Share (EPS) (EPS) of 348.91, the question arises: is Seaboard (SEB) modestly undervalued? This article aims to provide an in-depth valuation analysis of Seaboard, offering valuable insights for potential investors. We invite you to delve into our comprehensive analysis below.

Company Overview

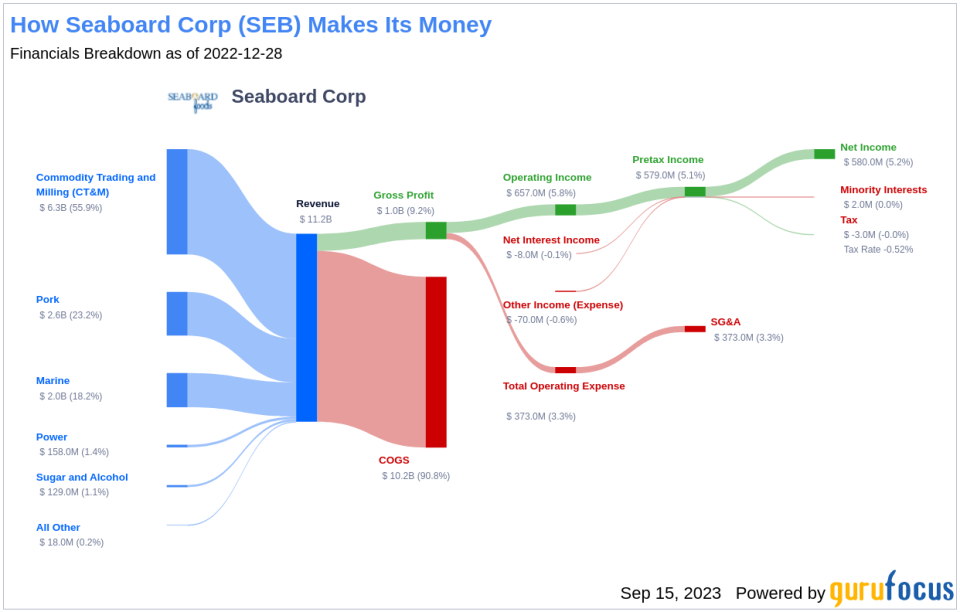

Seaboard Corp (SEB) is a diversified conglomerate operating in agricultural and ocean transport businesses. With a strong presence in the U.S., Central and South America, and Africa, Seaboard's operations span across six business segments: pork, commodity trading and milling, marine, sugar and alcohol, power, and turkey. The company's stock price is currently $3850, while its fair value, according to our proprietary GF Value, stands at $4614.19, indicating potential undervaluation. The following income breakdown provides further details:

Understanding GF Value

The GF Value is a unique valuation model that estimates the intrinsic value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This value, represented by the GF Value Line, provides an overview of the fair value that the stock should ideally be traded at.

Seaboard (SEB) is estimated to be modestly undervalued according to the GF Value. This suggests that the long-term return of its stock is likely to be higher than its business growth. The GF Value chart below provides a clearer picture:

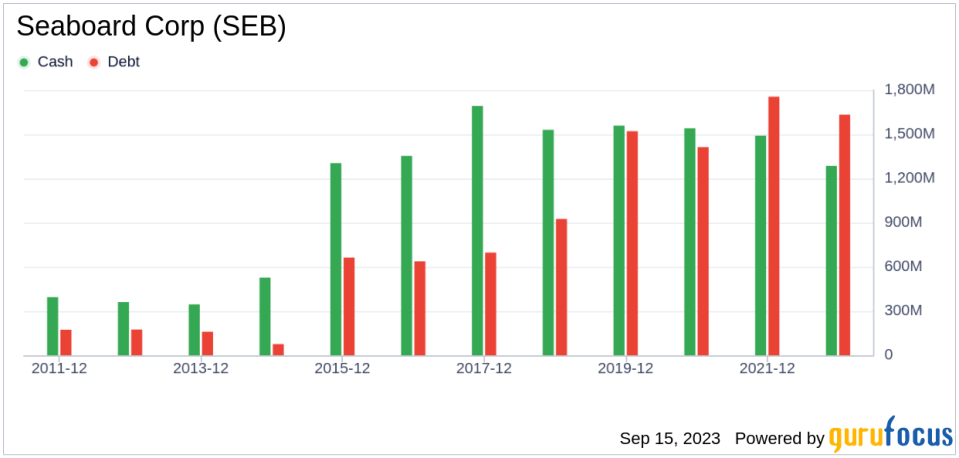

Seaboard's Financial Strength

Understanding the financial strength of a company is crucial before investing. Seaboard's cash-to-debt ratio of 0.82 is better than 62.02% of 495 companies in the Conglomerates industry. This, along with an overall financial strength score of 8 out of 10, indicates that Seaboard's financial strength is robust.

Profitability and Growth

Seaboard's profitability and growth are key factors contributing to its valuation. The company has been profitable 10 times over the past 10 years, with an operating margin of 2.41%. Seaboard's average annual revenue growth is 18.2%, and its 3-year average EBITDA growth is 22.7%.

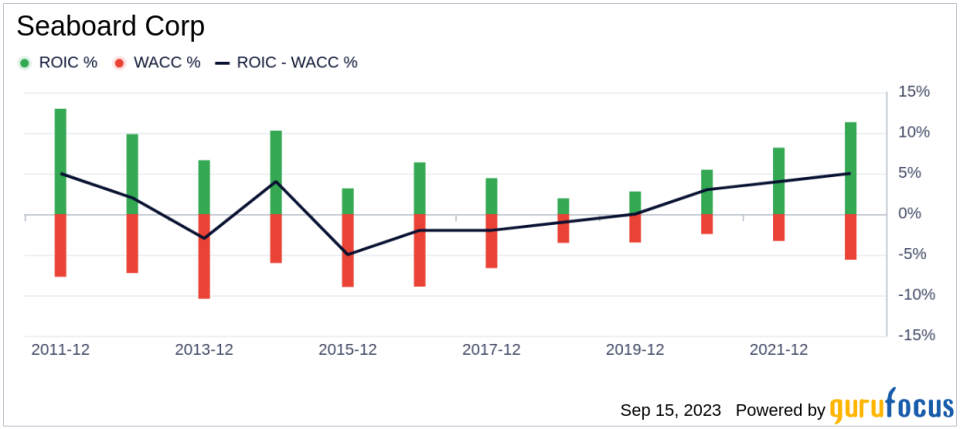

ROIC vs WACC

Comparing Seaboard's Return on Invested Capital (ROIC) of 3.84 to its Weighted Average Cost of Capital (WACC) of 4.73 provides further insight into the company's profitability. The historical ROIC vs WACC comparison of Seaboard is shown below:

Conclusion

In conclusion, Seaboard (SEB) appears to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 64.86% of 407 companies in the Conglomerates industry. For more information about Seaboard stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.