Seacoast Banking Corp of Florida Reports Mixed Results for Q4 and Full Year 2023

Net Income: Q4 net income of $29.5 million, or $0.35 per diluted share; Full year net income of $104.0 million, or $1.23 per diluted share.

Adjusted Net Income: Q4 adjusted net income of $36.5 million, or $0.43 per diluted share; Full year adjusted net income of $154.7 million, or $1.83 per diluted share.

Net Interest Margin: Decreased to 3.36% in Q4 from 3.57% in the previous quarter.

Efficiency Ratio: Improved to 60.32% in Q4 from 62.60% in the previous quarter.

Asset Quality: Nonperforming loans increased to 0.65% of total loans at the end of Q4, up from 0.41% at the end of the previous quarter.

Capital and Liquidity: Tangible common equity to tangible assets ratio improved to 9.31% at the end of Q4.

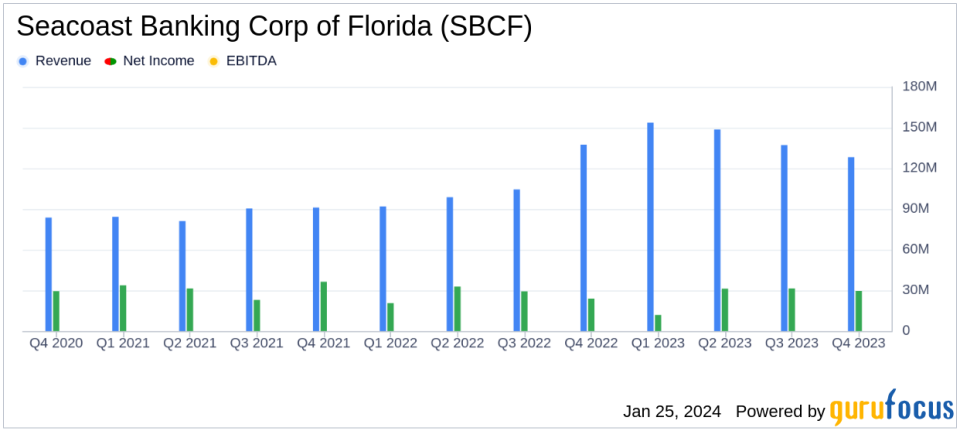

On January 25, 2024, Seacoast Banking Corp of Florida (NASDAQ:SBCF) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a financial services provider with a focus on commercial and consumer banking, wealth management, and mortgage services, reported a mixed set of results with a year-over-year increase in adjusted net income but a decrease in net income compared to the previous quarter.

Financial Performance Overview

For Q4 2023, SBCF reported net income of $29.5 million, or $0.35 per diluted share, a decrease from $31.4 million, or $0.37 per diluted share in Q3 2023, but an increase from $23.9 million, or $0.34 per diluted share in Q4 2022. The full year net income stood at $104.0 million, or $1.23 per diluted share, compared to $106.5 million, or $1.66 per diluted share for the previous year.

Adjusted net income for Q4 2023 was $36.5 million, or $0.43 per diluted share, compared to $39.7 million, or $0.46 per diluted share in the previous quarter. The adjusted net income for the full year was $154.7 million, or $1.83 per diluted share, showing an improvement from $136.1 million, or $2.12 per diluted share in the previous year.

Net interest margin, a key metric for banks, decreased to 3.36% in Q4 from 3.57% in Q3 2023, reflecting margin compression challenges. The efficiency ratio, which measures noninterest expense as a percentage of revenue, improved to 60.32% in Q4 from 62.60% in the previous quarter, indicating better cost management.

Asset Quality and Balance Sheet Strength

Asset quality showed some signs of stress with nonperforming loans increasing to 0.65% of total loans at the end of Q4, up from 0.41% at the end of Q3. However, the company's capital and liquidity positions remained strong, with the tangible common equity to tangible assets ratio improving to 9.31% at the end of Q4.

Strategic Initiatives and Market Positioning

Charles M. Shaffer, Seacoast's Chairman and CEO, commented on the company's strategic expense measures and robust capital position. He highlighted the company's disciplined expense management and commitment to driving growth in shareholder value. Shaffer also mentioned the repurchase of 546,200 shares of common stock and the anticipated reduction in annual expenses of approximately $15 million due to the execution of the second phase of their expense initiative.

Shaffer stated, "As we embark on 2024, we remain diligently focused on maintaining our conservative balance sheet principles and carefully managing our expense base while investing to drive low-cost deposit growth."

Conclusion

While Seacoast Banking Corp of Florida faces margin compression and asset quality concerns, its adjusted net income growth and strong capital position suggest a resilient business model. The company's strategic initiatives, including share repurchases and expense management, are aimed at enhancing shareholder value and positioning the company for future growth.

For a detailed analysis of Seacoast Banking Corp of Florida's financial results, including income statements, balance sheets, and cash flow statements, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Seacoast Banking Corp of Florida for further details.

This article first appeared on GuruFocus.