SEACOR Marine Holdings' (NYSE:SMHI) investors will be pleased with their incredible 504% return over the last three years

SEACOR Marine Holdings Inc. (NYSE:SMHI) shareholders might be concerned after seeing the share price drop 12% in the last month. But over the last three years the stock has shone bright like a diamond. The longer term view reveals that the share price is up 504% in that period. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. Only time will tell if there is still too much optimism currently reflected in the share price. Anyone who held for that rewarding ride would probably be keen to talk about it.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for SEACOR Marine Holdings

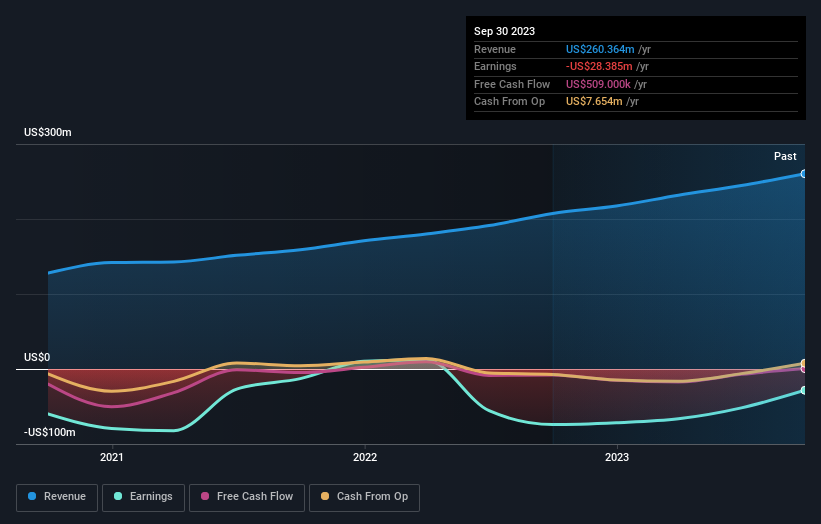

SEACOR Marine Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years SEACOR Marine Holdings saw its revenue grow at 23% per year. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 82% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like SEACOR Marine Holdings can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling SEACOR Marine Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that SEACOR Marine Holdings has rewarded shareholders with a total shareholder return of 56% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for SEACOR Marine Holdings that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.