Seagate (STX) Improves Exos CORVAULT 4U106 With 2.5PB Capacity

Seagate Technology Holdings plc STX unveiled its latest high-performance block storage system, the Seagate Exos CORVAULT 4U106, boasting a substantial 2.5PB capacity. It utilizes the company’s high-capacity Exos hard drives with self-healing technology to provide an efficient petabyte storage solution for scale-out data center architecture.

The system offers increased rack density, extended lifecycles, and improved power efficiency per petabyte, thereby reducing the total cost of ownership, added the company. It also reduces storage networking resources by up to 50% and enhances total rack power efficiency by up to 30%.

The Autonomous Drive Regeneration and Advanced Distributed Autonomic Protection Technology contribute to minimizing downtime and optimizing data center resources, which in turn reduces the carbon footprint and e-waste.

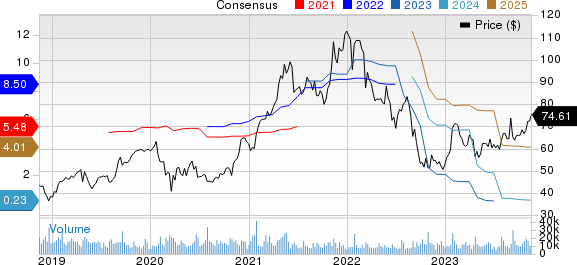

Seagate Technology Holdings PLC Price and Consensus

Seagate Technology Holdings PLC price-consensus-chart | Seagate Technology Holdings PLC Quote

The Seagate Exos CORVAULT 4U106 was initially available in a 2PB conventional magnetic recording-based configuration. It will now offer additional 2PB and 2.5PB Heat-Assisted Magnetic Recording-based configurations. These configurations will be accessible through storage resellers globally in November, with product availability expected at the end of December, added the company.

Seagate is the leading manufacturer of hard disk drives (HDDs) in the United States. The company’s HDD products are designed for mission-critical and nearline applications in enterprise servers and storage systems.

The company reported first-quarter fiscal 2024 non-GAAP loss of 22 cents per share, wider than the Zacks Consensus Estimate of a loss of 20 cents. The company reported non-GAAP earnings per share (EPS) of 48 cents in the year-ago quarter.

Non-GAAP revenues of $1.454 billion missed the Zacks Consensus Estimate by 2.1%. The figure declined 29% on a year-over-year basis and 9% sequentially. The company noted that weak economic trends in China, soft demand in the legacy markets and continued inventory digestion by clients affected the top-line performance.

Seagate currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 38.4% compared with the sub-industry’s growth of 19.5% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Guidewire Software GWRE, Flex FLEX and Badger Meter BMI. Flex and Badger Meter presently sport a Zacks Rank #1 (Strong Buy) whereas Guidewire carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Guidewire Software’s fiscal 2024 EPS has increased 10.5% in the past 60 days to 74 cents. Shares of GWRE have soared 47.1% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has gained 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%. Shares of FLEX have gained 29.5% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has improved 7.3% in the past 60 days to $3.07.

Badger Meter’s earnings outpaced the Zacks Consensus Estimate in all the last four quarters, the average surprise being 10.3%. Shares of BMI have rallied 24.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report