Seagate (STX) Q1 Loss Wider Than Expected, Revenues Miss

Seagate Technology Holdings plc STX reported first-quarter fiscal 2024 non-GAAP loss of 22 cents per share, wider than the Zacks Consensus Estimate of a loss of 20 cents. The company reported non-GAAP earnings of 48 cents in the year-ago quarter.

Management anticipated first-quarter fiscal 2024 non-GAAP loss to be 16 cents per share (+/- 20 cents).

Non-GAAP revenues of $1.454 billion missed the Zacks Consensus Estimate by 2.1%. The figure declined 29% on a year-over-year basis and 9% sequentially. Management projected revenues to be $1.55 billion (+/- $150 million) for the fiscal first quarter.

Seagate noted that weak economic trends in China, soft demand in the legacy markets and continued inventory digestion by clients affected the top-line performance. The company added that cautious IT spending trends remain concerning, especially for the Enterprise Systems market.

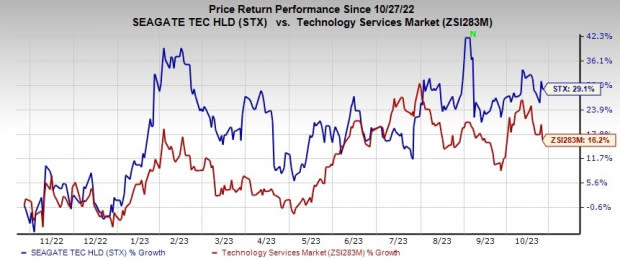

In the past year, STX has increased 29.1% compared with the sub-industry’s gain of 16.2%.

Image Source: Zacks Investment Research

Exabyte Shipments in Detail

In the reported quarter, Seagate shipped 89.6 exabytes of HDD storage. This marked a dip of 24% on a year-over-year basis and 2% sequentially.

Average mass capacity decreased 1% year over year. Nonetheless, it improved 17% sequentially to 7.5TB.

The company shipped 79.2 exabytes for the mass-capacity storage market (including nearline, video and image applications, and network-attached storage). This recorded a year-over-year plunge of 24% in exabytes shipments. However, exabyte shipments rose 5% sequentially. Average mass capacity per drive jumped sequentially to 10.3 TB from 9.6 TB.

Seagate Technology Holdings PLC Price, Consensus and EPS Surprise

Seagate Technology Holdings PLC price-consensus-eps-surprise-chart | Seagate Technology Holdings PLC Quote

In the nearline market, it shipped 56 exabytes of HDD, down 34% year over year but up 2% sequentially.

Seagate shipped 10.4 exabytes for the legacy market (which includes mission-critical notebooks, desktops, gaming consoles, digital video recorders or DVR and external consumer devices), down 27% year over year and 35% sequentially. Average capacity improved by 15% year over year to 2.4 TB.

Revenues by Product Group

Total revenues of HDD (89.1% of revenues) tumbled 27% year over year to $1.295 billion in the reported quarter. On a sequential basis, revenues were down 6%.

Non-HDD segment’s revenues (10.9%) including enterprise data solutions, cloud systems and solid-state drives were $159 million, down 40% on a year-over-year basis and 27% sequentially.

Our estimates for revenues from HDD and non-HDD segments were $1.301 million and $215 million, respectively.

Margin Details

Non-GAAP gross margin fell to 19.8% from 24.5% in the prior-year quarter.

Non-GAAP operating expenses were down 21% on a year-over-year basis to $248 million.

Non-GAAP income from operations totaled $40 million, down from $184 million a year ago. Non-GAAP operating margin dipped to 2.8% from 9% in the year-earlier quarter.

Balance Sheet and Cash Flow

As of Sep 29, 2023, cash and cash equivalents were $795 million compared with $786 million as of Jun 30, 2023.

As of Sep 29, 2023, long-term debt (including the current portion) was $5.666 billion compared with $5.451 billion as of Jun 30, 2023.

Cash flow from operations was $127 million compared with $218 million reported in the previous quarter. Free cash flow amounted to $57 million compared with $168 million in the previous quarter.

STX paid $145 million as dividends in the fiscal fourth quarter. It exited the quarter with 209 million shares outstanding.

Seagate announced a quarterly cash dividend of 70 cents per share. The dividend will be paid out on Jan 9, 2024, to shareholders of record as of the close of business on Dec 21, 2023.

Outlook

Management anticipates second-quarter fiscal 2024 revenues to be $1.55 billion (+/- $150 million).

Non-GAAP loss for the fiscal second quarter is expected to be 10 cents per share (+/- 20 cents).

Zacks Rank

Currently, Seagate carries a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Asure Software ASUR, Synopsys SNPS and VMware VMW. Each stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 676.4%. Shares of ASUR have climbed 41.6% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has gained 0.4% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.7%. Shares of SNPS have gained 57.4% in the past year.

The Zacks Consensus Estimate for VMware’s fiscal 2024 EPS has improved 5.9% in the past 60 days to $7.23.

VMware’s earnings outpaced the Zacks Consensus Estimate in two of the last four quarters while missing twice. The average earnings surprise is 1.2%. Shares of VMW have jumped 33.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report