Seagate (STX) Unveils PS5-Optimized PCIe Gen4 NVMe SSDs

Seagate Technology Holdings plc STX announced that it has officially received licensing for the PlayStation Seagate Game Drive PS5 NVMe SSD. This will enable PlayStation users to leverage the high-speed performance of Seagate's PCIe Gen4 NVMe solid state drives (SSD) on their gaming consoles.

The drive incorporates the latest PCIe Gen4 NVMe SSD technology, which offers high speed and capacity for PlayStation 5. Also, it significantly outpaces PCIe Gen3 SSDs by having sequential read speeds of up to 7300 MB/s, added Seagate.

The Seagate-validated E18 controller and 3D TLC NAND ensure high speed and durability for console gaming. Also, the SSD is available in capacities up to 2TB and has an endurance of 1.8 million MTBF and up to 2550 TBW, added Seagate.

Seagate Technology Holdings PLC Price and Consensus

Seagate Technology Holdings PLC price-consensus-chart | Seagate Technology Holdings PLC Quote

Overall, the SSD will maximize gaming performance and reliability. The officially licensed Seagate Game Drive PS5 NVMe SSD is now available for purchase at $99.99 for 1TB and $149.99 for 2TB.

Per Mordor Intelligence report, the SSD market is expected to witness a CAGR of 17.6% between 2023 and 2028 and reach $125.05 billion. The secular growth of digital data, modest growth in the total addressable market and higher demand for storage will drive growth for storage in general, especially for SSDs.

The emergence of thinner laptops and tablets over the past few years has created an ideal market for SSDs, which are entering the higher end of the market. SSDs are used in servers due to lower latency, facilitating faster response to real-time applications.

In July, the company launched the next generation FireCuda SSDs — FireCuda 540. The new SSD technology is designed to deliver vastly improved speed performance for gamers, creators, and tech enthusiasts, noted the company

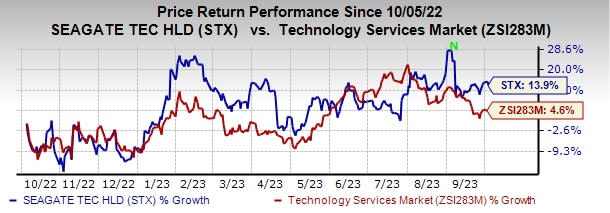

Seagate currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 13.9% compared with the sub-industry’s growth of 4.6% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Woodward WWD and Watts Water Technologies WTS. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 68.4% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2023 EPS has increased 5.6% in the past 60 days to $4.15.

WWD’s long-term earnings growth rate is 18.8%. Shares of WWD have gained 42.1% in the past year.

The Zacks Consensus Estimate for Watts Water’s 2023 EPS has increased 4.8% in the past 60 days to $7.78. The company’s long-term earnings growth rate is 7.5%.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 12.5%. Shares of WTS have rallied 30% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report